Three Affiliated Tribes Motor Vehicle Fuel Tax Report and Schedules Form

What is the Three Affiliated Tribes Motor Vehicle Fuel Tax Report and Schedules

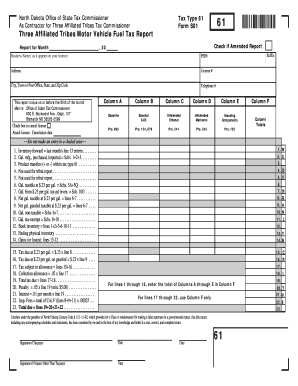

The Three Affiliated Tribes Motor Vehicle Fuel Tax Report and Schedules is a specific form used for reporting fuel tax obligations by individuals and businesses operating within the jurisdiction of the Three Affiliated Tribes. This report is essential for ensuring compliance with local tax regulations concerning fuel sales and usage. It typically includes details about fuel purchases, sales, and any applicable exemptions. Understanding this form is crucial for maintaining proper tax records and fulfilling legal obligations.

How to use the Three Affiliated Tribes Motor Vehicle Fuel Tax Report and Schedules

Using the Three Affiliated Tribes Motor Vehicle Fuel Tax Report and Schedules involves several steps. First, gather all necessary documentation related to fuel transactions, including invoices and receipts. Next, fill out the report accurately, ensuring that all required fields are completed. It is important to review the information for accuracy before submission. Finally, submit the completed report according to the specified guidelines, which may include electronic submission or mailing it to the appropriate office.

Steps to complete the Three Affiliated Tribes Motor Vehicle Fuel Tax Report and Schedules

Completing the Three Affiliated Tribes Motor Vehicle Fuel Tax Report and Schedules requires careful attention to detail. Follow these steps:

- Collect all relevant fuel transaction records.

- Obtain the latest version of the report form.

- Fill in the required information, including personal or business details and fuel transaction data.

- Double-check all entries for accuracy.

- Submit the form by the designated deadline, either electronically or by mail.

Key elements of the Three Affiliated Tribes Motor Vehicle Fuel Tax Report and Schedules

The key elements of the Three Affiliated Tribes Motor Vehicle Fuel Tax Report and Schedules include the following:

- Taxpayer Information: Name, address, and identification number of the taxpayer.

- Fuel Sales Data: Detailed records of fuel purchases and sales, including quantities and types of fuel.

- Exemptions: Any applicable exemptions that may reduce tax liabilities.

- Signatures: Required signatures to validate the report.

Filing Deadlines / Important Dates

Filing deadlines for the Three Affiliated Tribes Motor Vehicle Fuel Tax Report and Schedules are critical for compliance. Typically, reports must be submitted quarterly or annually, depending on the specific regulations set by the Three Affiliated Tribes. It is essential to stay informed about these deadlines to avoid penalties and ensure timely processing of the report.

Penalties for Non-Compliance

Failure to comply with the requirements of the Three Affiliated Tribes Motor Vehicle Fuel Tax Report and Schedules can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is important for taxpayers to understand their obligations and ensure timely and accurate submissions to avoid these consequences.

Quick guide on how to complete three affiliated tribes motor vehicle fuel tax report and schedules

Effortlessly Prepare [SKS] on Any Device

Web-based document management has become increasingly favored by businesses and individuals alike. It offers a superb eco-friendly substitute for conventional printed and signed documents, allowing you to locate the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to Edit and eSign [SKS] with Ease

- Obtain [SKS] and select Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your edits.

- Select your preferred method for sharing your form, either via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you choose. Edit and eSign [SKS] and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Three Affiliated Tribes Motor Vehicle Fuel Tax Report And Schedules

Create this form in 5 minutes!

How to create an eSignature for the three affiliated tribes motor vehicle fuel tax report and schedules

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Three Affiliated Tribes Motor Vehicle Fuel Tax Report And Schedules?

The Three Affiliated Tribes Motor Vehicle Fuel Tax Report And Schedules is a document required for reporting fuel tax obligations specific to the Three Affiliated Tribes. It outlines the necessary information regarding fuel sales and usage, ensuring compliance with tribal regulations. Understanding this report is crucial for businesses operating within the jurisdiction.

-

How can airSlate SignNow help with the Three Affiliated Tribes Motor Vehicle Fuel Tax Report And Schedules?

airSlate SignNow simplifies the process of preparing and submitting the Three Affiliated Tribes Motor Vehicle Fuel Tax Report And Schedules. Our platform allows users to easily eSign and send documents, ensuring that all necessary paperwork is completed accurately and efficiently. This reduces the risk of errors and helps maintain compliance.

-

What are the pricing options for using airSlate SignNow for the Three Affiliated Tribes Motor Vehicle Fuel Tax Report And Schedules?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including those focused on the Three Affiliated Tribes Motor Vehicle Fuel Tax Report And Schedules. Our plans are designed to be cost-effective, ensuring that businesses can access essential features without breaking the bank. You can choose a plan that best fits your volume of document management.

-

What features does airSlate SignNow provide for managing the Three Affiliated Tribes Motor Vehicle Fuel Tax Report And Schedules?

airSlate SignNow provides a range of features tailored for managing the Three Affiliated Tribes Motor Vehicle Fuel Tax Report And Schedules, including customizable templates, automated workflows, and secure eSigning. These features streamline the document preparation process, making it easier to gather necessary information and ensure timely submissions.

-

Are there any integrations available with airSlate SignNow for the Three Affiliated Tribes Motor Vehicle Fuel Tax Report And Schedules?

Yes, airSlate SignNow offers various integrations that can enhance your experience with the Three Affiliated Tribes Motor Vehicle Fuel Tax Report And Schedules. You can connect with popular applications such as Google Drive, Dropbox, and CRM systems to streamline your document management process. This ensures that all relevant data is easily accessible and organized.

-

What are the benefits of using airSlate SignNow for the Three Affiliated Tribes Motor Vehicle Fuel Tax Report And Schedules?

Using airSlate SignNow for the Three Affiliated Tribes Motor Vehicle Fuel Tax Report And Schedules provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance. Our platform allows for quick eSigning and document sharing, which saves time and minimizes the risk of delays. This ultimately helps businesses stay on top of their tax obligations.

-

Is airSlate SignNow secure for handling the Three Affiliated Tribes Motor Vehicle Fuel Tax Report And Schedules?

Absolutely! airSlate SignNow prioritizes security, ensuring that all documents, including the Three Affiliated Tribes Motor Vehicle Fuel Tax Report And Schedules, are protected with advanced encryption and secure access controls. We comply with industry standards to safeguard sensitive information, giving you peace of mind while managing your tax reports.

Get more for Three Affiliated Tribes Motor Vehicle Fuel Tax Report And Schedules

- During which hours are you available for volunteer assignments and which location form

- Liss form 2014 2019

- Mid america transaction routing form 2015 2019

- What does a daycare reimburstment form look like

- Rx form

- Instructions statement of health form association

- Functional assessment form 2010 2019

- Manual de operacionalizao do sistema no usurio tcerj form

Find out other Three Affiliated Tribes Motor Vehicle Fuel Tax Report And Schedules

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist