Schedule 3 Full Year Nonresident or Part Year Resident Using Form Nd

Understanding the Schedule 3 Full Year Nonresident or Part Year Resident Using Form Nd

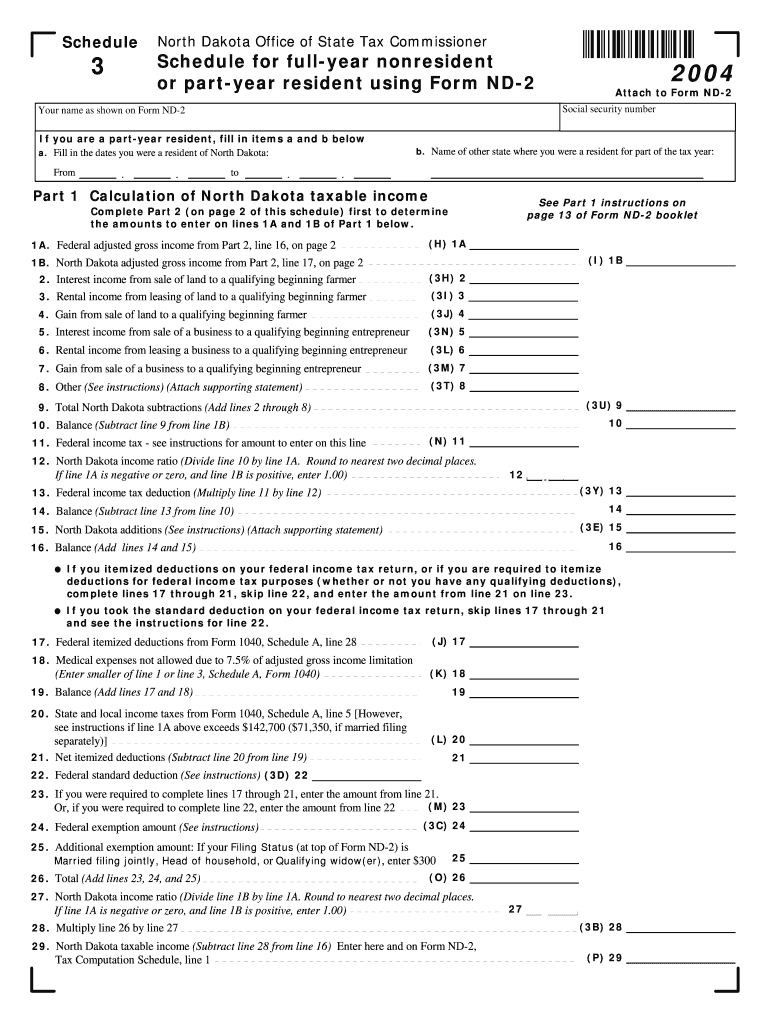

The Schedule 3 Full Year Nonresident or Part Year Resident Using Form Nd is a tax document used by individuals who do not reside in the state for the entire year or are not residents at all. This form helps determine the tax obligations for individuals who earn income in a state where they do not maintain a permanent residence. It is essential for accurately reporting income and calculating any tax liability owed to the state.

Steps to Complete the Schedule 3 Full Year Nonresident or Part Year Resident Using Form Nd

Completing the Schedule 3 form involves several key steps. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, accurately report your income earned during the period of residency and non-residency. Be sure to include any deductions or credits applicable to your situation. After filling out the form, review it for accuracy before submission. Finally, ensure you file the form by the deadline to avoid any penalties.

Eligibility Criteria for Using the Schedule 3 Full Year Nonresident or Part Year Resident Using Form Nd

This form is specifically designed for individuals who qualify as nonresidents or part-year residents of a state. Eligibility typically includes those who have earned income in the state but do not maintain a permanent residence there. Additionally, part-year residents are those who have moved into or out of the state during the tax year. Understanding your residency status is crucial for proper form usage.

Key Elements of the Schedule 3 Full Year Nonresident or Part Year Resident Using Form Nd

Key elements of the Schedule 3 form include sections for reporting various types of income, deductions, and credits. It typically requires information regarding the taxpayer's residency status, income earned in the state, and any taxes already paid. The form may also ask for additional details to support claims for deductions or credits, ensuring a comprehensive overview of the individual's financial situation during the tax year.

Filing Deadlines for the Schedule 3 Full Year Nonresident or Part Year Resident Using Form Nd

Filing deadlines for the Schedule 3 form align with the general tax filing deadlines set by the IRS. Typically, individual tax returns are due on April fifteenth of each year. However, if you are filing for an extension, ensure you complete the Schedule 3 form by the extended deadline to avoid penalties. It is important to check for any state-specific deadlines that may differ from federal deadlines.

Form Submission Methods for the Schedule 3 Full Year Nonresident or Part Year Resident Using Form Nd

The Schedule 3 form can be submitted through various methods. Taxpayers have the option to file electronically using tax preparation software, which often simplifies the process. Alternatively, individuals may choose to print the completed form and mail it to the appropriate state tax office. In some cases, in-person submission may also be available, depending on the state’s regulations.

Quick guide on how to complete schedule 3 full year nonresident or part year resident using form nd

Execute [SKS] effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can acquire the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, alter, and electronically sign your documents swiftly without interruptions. Handle [SKS] on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest method to modify and electronically sign [SKS] effortlessly

- Find [SKS] and then click Get Form to commence.

- Utilize the tools we provide to fill out your document.

- Select important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tiresome form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and electronically sign [SKS] to ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule 3 Full year Nonresident Or Part year Resident Using Form Nd

Create this form in 5 minutes!

How to create an eSignature for the schedule 3 full year nonresident or part year resident using form nd

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Schedule 3 Full year Nonresident Or Part year Resident Using Form Nd?

Schedule 3 Full year Nonresident Or Part year Resident Using Form Nd is a tax form used by individuals who are either nonresidents or part-year residents of North Dakota. This form helps in reporting income and calculating tax obligations accurately. Understanding this form is crucial for compliance and to ensure you are paying the correct amount of taxes.

-

How can airSlate SignNow assist with Schedule 3 Full year Nonresident Or Part year Resident Using Form Nd?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending documents, including tax forms like Schedule 3 Full year Nonresident Or Part year Resident Using Form Nd. Our solution streamlines the process, making it faster and more efficient to handle your tax documentation.

-

What are the pricing options for using airSlate SignNow for Schedule 3 Full year Nonresident Or Part year Resident Using Form Nd?

airSlate SignNow offers various pricing plans to suit different needs, including options for individuals and businesses. Our plans are designed to be cost-effective, ensuring you can manage your Schedule 3 Full year Nonresident Or Part year Resident Using Form Nd without breaking the bank. You can choose a plan that fits your usage and budget.

-

What features does airSlate SignNow offer for managing Schedule 3 Full year Nonresident Or Part year Resident Using Form Nd?

With airSlate SignNow, you can easily create, edit, and send Schedule 3 Full year Nonresident Or Part year Resident Using Form Nd. Our platform includes features like templates, document tracking, and secure storage, ensuring that your tax documents are handled efficiently and securely.

-

Is airSlate SignNow secure for handling sensitive tax documents like Schedule 3 Full year Nonresident Or Part year Resident Using Form Nd?

Yes, airSlate SignNow prioritizes security and compliance. We use advanced encryption and security protocols to protect your sensitive information, including Schedule 3 Full year Nonresident Or Part year Resident Using Form Nd. You can trust that your documents are safe with us.

-

Can I integrate airSlate SignNow with other software for managing Schedule 3 Full year Nonresident Or Part year Resident Using Form Nd?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to streamline your workflow when managing Schedule 3 Full year Nonresident Or Part year Resident Using Form Nd. This means you can connect with your existing tools for a more efficient document management process.

-

What are the benefits of using airSlate SignNow for Schedule 3 Full year Nonresident Or Part year Resident Using Form Nd?

Using airSlate SignNow for Schedule 3 Full year Nonresident Or Part year Resident Using Form Nd offers numerous benefits, including time savings, increased efficiency, and enhanced accuracy in document handling. Our platform simplifies the eSigning process, making it easier for you to focus on your tax obligations.

Get more for Schedule 3 Full year Nonresident Or Part year Resident Using Form Nd

Find out other Schedule 3 Full year Nonresident Or Part year Resident Using Form Nd

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online

- eSign Michigan Car Insurance Quotation Form Mobile

- eSignature Massachusetts Mechanic's Lien Online

- eSignature Massachusetts Mechanic's Lien Free

- eSign Ohio Car Insurance Quotation Form Mobile

- eSign North Dakota Car Insurance Quotation Form Online

- eSign Pennsylvania Car Insurance Quotation Form Mobile

- eSignature Nevada Mechanic's Lien Myself

- eSign California Life-Insurance Quote Form Online

- How To eSignature Ohio Mechanic's Lien

- eSign Florida Life-Insurance Quote Form Online

- eSign Louisiana Life-Insurance Quote Form Online

- How To eSign Michigan Life-Insurance Quote Form

- Can I eSign Colorado Business Insurance Quotation Form

- Can I eSign Hawaii Certeficate of Insurance Request