ND 1 CR Calculation of Credit for Income Tax Paid to Another State ND 1 CR Calculation of Credit for Income Tax Paid to Another Form

Understanding the ND 1 CR Calculation of Credit for Income Tax Paid to Another State

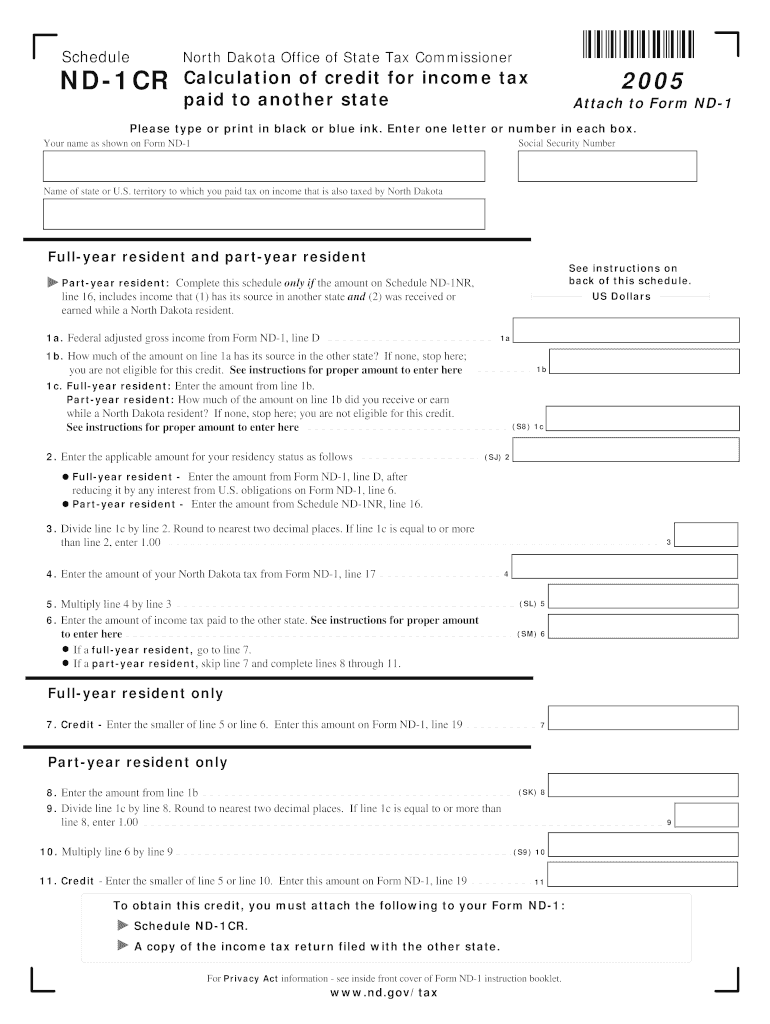

The ND 1 CR form is designed for taxpayers in North Dakota who have paid income tax to another state and wish to claim a credit for that tax. This credit helps to alleviate the burden of double taxation, ensuring that individuals do not pay taxes on the same income in multiple jurisdictions. The form requires detailed information regarding the income earned in the other state, the amount of tax paid, and the corresponding tax rates. Understanding the purpose and function of the ND 1 CR form is essential for accurate tax filing and maximizing potential credits.

Steps to Complete the ND 1 CR Calculation of Credit for Income Tax Paid to Another State

Completing the ND 1 CR form involves several key steps:

- Gather Documentation: Collect all relevant documents, including the tax return from the other state and proof of tax payments.

- Fill Out Personal Information: Enter your name, address, and Social Security number on the form.

- Report Income: Detail the income earned in the other state and the corresponding tax paid.

- Calculate the Credit: Use the provided instructions to determine the amount of credit you are eligible for based on the tax paid.

- Review and Sign: Ensure all information is accurate before signing and dating the form.

Required Documents for ND 1 CR Calculation of Credit for Income Tax Paid to Another State

To successfully complete the ND 1 CR form, you will need to provide specific documentation, including:

- Tax Returns: A copy of your tax return from the other state where income tax was paid.

- Payment Records: Receipts or statements showing the tax payments made to the other state.

- W-2 Forms: Any W-2 forms that report income earned in the other state.

- Other Income Documentation: Additional forms or statements that detail income sources, if applicable.

Eligibility Criteria for ND 1 CR Calculation of Credit for Income Tax Paid to Another State

To qualify for the credit on the ND 1 CR form, taxpayers must meet certain eligibility criteria:

- Residency: You must be a resident of North Dakota during the tax year in question.

- Income Source: The income for which you are claiming the credit must have been earned in a state that imposes income tax.

- Tax Payment: You must have actually paid income tax to the other state on the income reported.

- Filing Status: Ensure your filing status aligns with the requirements set forth by North Dakota tax regulations.

Examples of Using the ND 1 CR Calculation of Credit for Income Tax Paid to Another State

Here are a few scenarios illustrating how the ND 1 CR form can be utilized:

- Scenario One: A North Dakota resident works remotely for a company based in California and pays California state income tax. They can use the ND 1 CR form to claim a credit for the taxes paid to California.

- Scenario Two: A North Dakota resident who travels frequently for work and earns income in Minnesota can file the ND 1 CR to receive a credit for the taxes paid to Minnesota.

- Scenario Three: A retiree living in North Dakota who receives pension income from another state can also claim a credit for any state taxes withheld from that pension income.

Quick guide on how to complete nd 1 cr calculation of credit for income tax paid to another state nd 1 cr calculation of credit for income tax paid to another

Prepare [SKS] effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely archive it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest method to alter and electronically sign [SKS] seamlessly

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or obscure sensitive information with features that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require reprinting new copies. airSlate SignNow streamlines all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign [SKS] and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to ND 1 CR Calculation Of Credit For Income Tax Paid To Another State ND 1 CR Calculation Of Credit For Income Tax Paid To Another

Create this form in 5 minutes!

How to create an eSignature for the nd 1 cr calculation of credit for income tax paid to another state nd 1 cr calculation of credit for income tax paid to another

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ND 1 CR Calculation Of Credit For Income Tax Paid To Another State?

The ND 1 CR Calculation Of Credit For Income Tax Paid To Another State is a process that allows taxpayers to claim a credit for income taxes paid to another state. This calculation helps reduce the overall tax burden for individuals who earn income in multiple states. Understanding this credit is essential for accurate tax filing and maximizing potential refunds.

-

How can airSlate SignNow assist with the ND 1 CR Calculation Of Credit For Income Tax Paid To Another State?

airSlate SignNow provides a streamlined platform for managing documents related to the ND 1 CR Calculation Of Credit For Income Tax Paid To Another State. With our eSigning capabilities, you can easily sign and send necessary tax documents securely. This simplifies the process, ensuring you stay compliant and organized.

-

What are the pricing options for using airSlate SignNow for tax-related documents?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including those focused on the ND 1 CR Calculation Of Credit For Income Tax Paid To Another State. Our plans are designed to be cost-effective, ensuring you get the best value for your document management and eSigning needs. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which are beneficial for the ND 1 CR Calculation Of Credit For Income Tax Paid To Another State. These features enhance efficiency and ensure that all necessary documents are handled correctly and securely. You can manage your tax documents with ease and confidence.

-

Can airSlate SignNow integrate with other accounting software for tax calculations?

Yes, airSlate SignNow can seamlessly integrate with various accounting software, making it easier to manage the ND 1 CR Calculation Of Credit For Income Tax Paid To Another State. This integration allows for automatic data transfer and reduces the risk of errors in your tax calculations. You can streamline your workflow and enhance productivity.

-

What are the benefits of using airSlate SignNow for tax-related eSigning?

Using airSlate SignNow for tax-related eSigning offers numerous benefits, especially for the ND 1 CR Calculation Of Credit For Income Tax Paid To Another State. It provides a secure and efficient way to sign documents, reducing turnaround time and improving compliance. Additionally, our platform is user-friendly, making it accessible for all users.

-

Is airSlate SignNow suitable for both individuals and businesses handling tax documents?

Absolutely! airSlate SignNow is designed to cater to both individuals and businesses managing tax documents, including the ND 1 CR Calculation Of Credit For Income Tax Paid To Another State. Our platform is versatile and can accommodate various user needs, ensuring that everyone can benefit from our eSigning and document management solutions.

Get more for ND 1 CR Calculation Of Credit For Income Tax Paid To Another State ND 1 CR Calculation Of Credit For Income Tax Paid To Another

- Fis 1028 form 6962899

- Name change authorization name change authorization form

- Hampr block express ira distribution form

- International wire transfer form template 2015 2019

- Borrower financial 2006 2019 form

- Payers request for taxpayer identification number and certification form

- Text 1 evolution secretaria de estado da educa o do paran form

- Minist rio do desenvolvimento ind stria e com rcio mdic gov form

Find out other ND 1 CR Calculation Of Credit For Income Tax Paid To Another State ND 1 CR Calculation Of Credit For Income Tax Paid To Another

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation