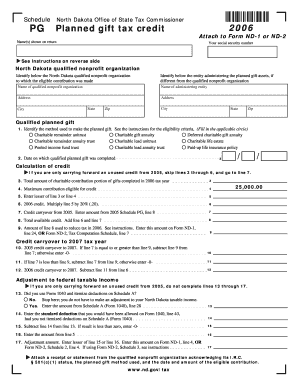

Schedule PG Planned Gift Tax Credit Fillable Schedule PG Planned Gift Tax Credit Fillable Nd Form

What is the Schedule PG Planned Gift Tax Credit?

The Schedule PG Planned Gift Tax Credit is a form used by taxpayers in the United States to claim a tax credit for planned gifts made to qualified charitable organizations. This form is essential for individuals who wish to receive tax benefits for their charitable contributions, particularly those that involve future donations or bequests. By completing this form, taxpayers can ensure that their planned gifts are recognized and credited appropriately during the tax filing process.

How to use the Schedule PG Planned Gift Tax Credit

Using the Schedule PG Planned Gift Tax Credit involves accurately filling out the form to reflect your planned charitable contributions. Taxpayers should gather all necessary information regarding the gifts they intend to make, including the value of the gifts and the details of the charitable organizations involved. Once the form is completed, it should be submitted along with your tax return to ensure that the credit is applied to your overall tax liability.

Steps to complete the Schedule PG Planned Gift Tax Credit

Completing the Schedule PG Planned Gift Tax Credit requires several steps:

- Gather documentation related to your planned gifts, including appraisals and letters from charitable organizations.

- Fill out the form with accurate information, including your personal details and specifics about each planned gift.

- Calculate the total value of your planned gifts and ensure that they meet the eligibility criteria for the tax credit.

- Review the completed form for accuracy before submitting it with your tax return.

Legal use of the Schedule PG Planned Gift Tax Credit

The Schedule PG Planned Gift Tax Credit is legally recognized by the Internal Revenue Service (IRS) as a valid means for taxpayers to claim credits for charitable contributions. It is important to comply with IRS guidelines and state-specific regulations when using this form. Taxpayers should ensure that all planned gifts meet the necessary legal requirements to qualify for the credit, including being made to eligible charitable organizations.

Eligibility Criteria

To qualify for the Schedule PG Planned Gift Tax Credit, taxpayers must meet certain eligibility criteria. These include:

- The planned gifts must be made to recognized 501(c)(3) charitable organizations.

- Taxpayers must have documentation proving the value of the planned gifts.

- The gifts must be irrevocable and intended for charitable purposes.

Form Submission Methods

The Schedule PG Planned Gift Tax Credit can be submitted in various ways. Taxpayers can file the form electronically through tax preparation software, which often integrates the form into the overall tax return process. Alternatively, it can be printed and mailed to the appropriate tax authority along with the completed tax return. In-person submission may also be an option depending on local tax office protocols.

Quick guide on how to complete schedule pg planned gift tax credit fillable schedule pg planned gift tax credit fillable nd

Effortlessly Prepare [SKS] on Any Device

Managing documents online has become increasingly popular among organizations and individuals alike. It offers an ideal environmentally friendly option to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources you need to create, modify, and electronically sign your documents quickly and efficiently. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

The Optimal Method to Modify and Electronically Sign [SKS] with Ease

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with the tools specifically provided by airSlate SignNow.

- Generate your electronic signature using the Sign feature, which only takes moments and carries the same legal validity as a conventional wet signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for sharing your form, whether via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and electronically sign [SKS] to ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule PG Planned Gift Tax Credit Fillable Schedule PG Planned Gift Tax Credit Fillable Nd

Create this form in 5 minutes!

How to create an eSignature for the schedule pg planned gift tax credit fillable schedule pg planned gift tax credit fillable nd

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule PG Planned Gift Tax Credit Fillable Schedule PG Planned Gift Tax Credit Fillable Nd?

The Schedule PG Planned Gift Tax Credit Fillable Schedule PG Planned Gift Tax Credit Fillable Nd is a form designed to help individuals and organizations report planned gifts for tax credit purposes. This fillable form simplifies the process of documenting planned gifts, ensuring compliance with tax regulations while maximizing potential benefits.

-

How can I access the Schedule PG Planned Gift Tax Credit Fillable Schedule PG Planned Gift Tax Credit Fillable Nd?

You can easily access the Schedule PG Planned Gift Tax Credit Fillable Schedule PG Planned Gift Tax Credit Fillable Nd through our website. Simply navigate to the forms section, and you will find the fillable version available for download and online completion.

-

Is there a cost associated with using the Schedule PG Planned Gift Tax Credit Fillable Schedule PG Planned Gift Tax Credit Fillable Nd?

The Schedule PG Planned Gift Tax Credit Fillable Schedule PG Planned Gift Tax Credit Fillable Nd is available at no cost. Our goal is to provide accessible resources to help you manage your planned gifts effectively without incurring additional expenses.

-

What features does the Schedule PG Planned Gift Tax Credit Fillable Schedule PG Planned Gift Tax Credit Fillable Nd offer?

This fillable schedule includes user-friendly features such as editable fields, automatic calculations, and easy navigation. These features streamline the process of filling out the form, making it easier for users to complete and submit their planned gift documentation.

-

How does the Schedule PG Planned Gift Tax Credit Fillable Schedule PG Planned Gift Tax Credit Fillable Nd benefit users?

Using the Schedule PG Planned Gift Tax Credit Fillable Schedule PG Planned Gift Tax Credit Fillable Nd allows users to efficiently document their planned gifts, ensuring they receive the appropriate tax credits. This can lead to signNow financial benefits while also promoting charitable giving.

-

Can I integrate the Schedule PG Planned Gift Tax Credit Fillable Schedule PG Planned Gift Tax Credit Fillable Nd with other software?

Yes, the Schedule PG Planned Gift Tax Credit Fillable Schedule PG Planned Gift Tax Credit Fillable Nd can be integrated with various document management and accounting software. This integration helps streamline your workflow and ensures that all your planned gift documentation is organized and easily accessible.

-

What support is available for users of the Schedule PG Planned Gift Tax Credit Fillable Schedule PG Planned Gift Tax Credit Fillable Nd?

We offer comprehensive support for users of the Schedule PG Planned Gift Tax Credit Fillable Schedule PG Planned Gift Tax Credit Fillable Nd. Our customer service team is available to assist with any questions or issues you may encounter while using the form.

Get more for Schedule PG Planned Gift Tax Credit Fillable Schedule PG Planned Gift Tax Credit Fillable Nd

Find out other Schedule PG Planned Gift Tax Credit Fillable Schedule PG Planned Gift Tax Credit Fillable Nd

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document