Form 400 UT Calculation of Interest on Underpayment or Late Payment of Estimated Income Tax for Individuals Form 400 UT Calculat

Understanding Form 400 UT

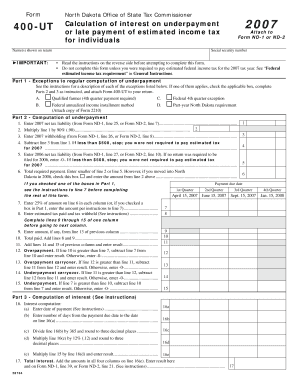

The Form 400 UT is essential for individuals who need to calculate interest on underpayment or late payment of estimated income tax. This form is specifically designed for taxpayers in the United States who may have underpaid their estimated income taxes throughout the year. By using Form 400 UT, individuals can determine the amount of interest owed due to these underpayments or late payments. This ensures compliance with tax regulations and helps avoid potential penalties.

How to Use Form 400 UT

To effectively use Form 400 UT, individuals should first gather all relevant financial information, including income details and previous estimated tax payments. The form guides users through the calculation process, detailing how to compute the interest owed based on the amount underpaid and the duration of the underpayment. It is crucial to follow the instructions closely to ensure accurate calculations and compliance with IRS guidelines.

Steps to Complete Form 400 UT

Completing Form 400 UT involves several key steps:

- Gather necessary documents, such as income statements and previous tax returns.

- Identify the total estimated tax payments made during the year.

- Calculate the underpayment amount by comparing the estimated payments to the actual tax liability.

- Use the provided formula on the form to determine the interest on the underpayment.

- Complete the form by entering all calculated figures accurately.

Key Elements of Form 400 UT

Form 400 UT includes several important sections that taxpayers must complete:

- Taxpayer Information: Personal details such as name, address, and Social Security number.

- Payment Details: Information regarding estimated tax payments made and the due dates.

- Interest Calculation: A section dedicated to calculating the interest owed on any underpayments.

Filing Deadlines for Form 400 UT

Timely submission of Form 400 UT is crucial to avoid additional penalties. The form should be filed by the tax return due date, which is typically April 15 for most individuals. If you miss this deadline, it is advisable to file as soon as possible to minimize any potential interest or penalties that may accrue.

Penalties for Non-Compliance

Failing to file Form 400 UT or underpaying estimated income tax can result in significant penalties. The IRS may impose interest on the unpaid amount, and additional fines may apply if the underpayment is substantial. It is important to address any underpayment promptly to avoid escalating financial consequences.

Quick guide on how to complete form 400 ut calculation of interest on underpayment or late payment of estimated income tax for individuals form 400 ut

Complete [SKS] effortlessly on any gadget

Digital document management has gained traction among organizations and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork, allowing you to easily locate the appropriate form and securely save it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents rapidly without delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and eSign [SKS] without difficulty

- Find [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Select your preferred delivery method for your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new copies of documents. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] and ensure exceptional communication at any point in the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 400 UT Calculation Of Interest On Underpayment Or Late Payment Of Estimated Income Tax For Individuals Form 400 UT Calculat

Create this form in 5 minutes!

How to create an eSignature for the form 400 ut calculation of interest on underpayment or late payment of estimated income tax for individuals form 400 ut

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 400 UT Calculation Of Interest On Underpayment Or Late Payment Of Estimated Income Tax For Individuals?

The Form 400 UT Calculation Of Interest On Underpayment Or Late Payment Of Estimated Income Tax For Individuals is a tax form used by individuals to calculate interest owed on underpayments or late payments of estimated income tax. This form helps ensure compliance with tax regulations and assists in accurate tax reporting.

-

How can airSlate SignNow assist with the Form 400 UT Calculation Of Interest On Underpayment Or Late Payment Of Estimated Income Tax For Individuals?

airSlate SignNow provides a streamlined platform for electronically signing and sending the Form 400 UT Calculation Of Interest On Underpayment Or Late Payment Of Estimated Income Tax For Individuals. Our solution simplifies the process, making it easy to manage your tax documents efficiently.

-

What are the pricing options for using airSlate SignNow for the Form 400 UT Calculation Of Interest On Underpayment Or Late Payment Of Estimated Income Tax For Individuals?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of individuals and businesses. You can choose a plan that best fits your requirements for managing the Form 400 UT Calculation Of Interest On Underpayment Or Late Payment Of Estimated Income Tax For Individuals, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for managing the Form 400 UT Calculation Of Interest On Underpayment Or Late Payment Of Estimated Income Tax For Individuals?

Our platform includes features such as customizable templates, secure eSigning, and document tracking, all designed to enhance your experience with the Form 400 UT Calculation Of Interest On Underpayment Or Late Payment Of Estimated Income Tax For Individuals. These tools help you stay organized and compliant with tax regulations.

-

Is airSlate SignNow compliant with tax regulations for the Form 400 UT Calculation Of Interest On Underpayment Or Late Payment Of Estimated Income Tax For Individuals?

Yes, airSlate SignNow is designed to comply with all relevant tax regulations, ensuring that your use of the Form 400 UT Calculation Of Interest On Underpayment Or Late Payment Of Estimated Income Tax For Individuals meets legal requirements. Our platform prioritizes security and compliance for all users.

-

Can I integrate airSlate SignNow with other software for the Form 400 UT Calculation Of Interest On Underpayment Or Late Payment Of Estimated Income Tax For Individuals?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to seamlessly manage the Form 400 UT Calculation Of Interest On Underpayment Or Late Payment Of Estimated Income Tax For Individuals alongside your existing tools. This enhances your workflow and efficiency.

-

What are the benefits of using airSlate SignNow for the Form 400 UT Calculation Of Interest On Underpayment Or Late Payment Of Estimated Income Tax For Individuals?

Using airSlate SignNow for the Form 400 UT Calculation Of Interest On Underpayment Or Late Payment Of Estimated Income Tax For Individuals provides numerous benefits, including time savings, improved accuracy, and enhanced security. Our platform simplifies the document management process, allowing you to focus on your core tasks.

Get more for Form 400 UT Calculation Of Interest On Underpayment Or Late Payment Of Estimated Income Tax For Individuals Form 400 UT Calculat

Find out other Form 400 UT Calculation Of Interest On Underpayment Or Late Payment Of Estimated Income Tax For Individuals Form 400 UT Calculat

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free