Schedule PG Planned Gift Tax Credit State of North Dakota Nd Form

What is the Schedule PG Planned Gift Tax Credit in North Dakota?

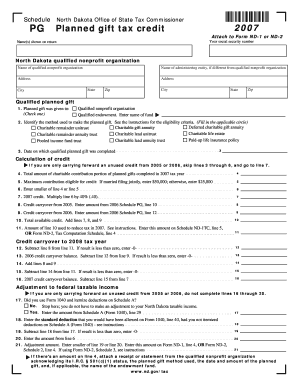

The Schedule PG Planned Gift Tax Credit is a specific tax form used in North Dakota that allows taxpayers to claim a credit for planned gifts made to qualified charitable organizations. This credit is designed to encourage philanthropy by reducing the overall tax burden for individuals who contribute to eligible charities. The credit applies to gifts made during the tax year and can significantly impact the taxpayer's state tax liability.

Key Elements of the Schedule PG Planned Gift Tax Credit

Several key elements define the Schedule PG Planned Gift Tax Credit:

- Eligibility Criteria: Taxpayers must ensure that their gifts are made to qualified charitable organizations recognized by the state.

- Credit Amount: The credit amount may vary based on the size of the gift and the taxpayer's overall tax liability.

- Documentation: Proper documentation of the gifts is required, including receipts and acknowledgment letters from the charitable organizations.

Steps to Complete the Schedule PG Planned Gift Tax Credit

Completing the Schedule PG involves several straightforward steps:

- Gather all necessary documentation for your planned gifts, including receipts and letters from charities.

- Fill out the Schedule PG form, providing details about the gifts made during the tax year.

- Calculate the credit based on the guidelines provided in the form instructions.

- Attach the completed Schedule PG to your state tax return when filing.

How to Obtain the Schedule PG Planned Gift Tax Credit

The Schedule PG form can be obtained through the North Dakota Office of State Tax Commissioner. It is typically available online as a downloadable PDF. Taxpayers can also request a physical copy by contacting the tax office directly. Ensure you have the latest version of the form to avoid any issues during filing.

Filing Deadlines for the Schedule PG Planned Gift Tax Credit

Filing deadlines for the Schedule PG align with the general state tax filing deadlines in North Dakota. Typically, individual taxpayers must file their state tax returns by April fifteenth of each year. If you are unable to meet this deadline, consider filing for an extension, but be aware that this may not extend the deadline for any taxes owed.

Legal Use of the Schedule PG Planned Gift Tax Credit

The Schedule PG is legally recognized as a valid method for claiming tax credits for planned gifts in North Dakota. Taxpayers must adhere to the guidelines set forth by the state tax authority to ensure compliance. Misuse or fraudulent claims can result in penalties or disqualification from future credits.

Quick guide on how to complete schedule pg planned gift tax credit state of north dakota nd

Easily Prepare [SKS] on Any Device

Digital document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents quickly and efficiently. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify your document-based tasks today.

The Easiest Way to Modify and eSign [SKS] Seamlessly

- Locate [SKS] and click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your signature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to finalize your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management requirements with just a few clicks from any device you prefer. Modify and eSign [SKS] while ensuring effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule PG Planned Gift Tax Credit State Of North Dakota Nd

Create this form in 5 minutes!

How to create an eSignature for the schedule pg planned gift tax credit state of north dakota nd

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule PG Planned Gift Tax Credit in the State of North Dakota?

The Schedule PG Planned Gift Tax Credit in the State of North Dakota allows taxpayers to receive a credit for planned gifts made to qualified charitable organizations. This credit can signNowly reduce your state tax liability, making it an attractive option for those looking to support charitable causes while benefiting financially.

-

How can airSlate SignNow help with the Schedule PG Planned Gift Tax Credit process?

airSlate SignNow streamlines the documentation process for the Schedule PG Planned Gift Tax Credit in the State of North Dakota. With our easy-to-use eSigning features, you can quickly prepare, send, and sign necessary documents, ensuring compliance and efficiency in your planned giving efforts.

-

What are the costs associated with using airSlate SignNow for Schedule PG Planned Gift Tax Credit documentation?

airSlate SignNow offers a cost-effective solution for managing your Schedule PG Planned Gift Tax Credit documentation. Our pricing plans are designed to fit various budgets, providing you with the tools needed to efficiently handle your planned giving paperwork without breaking the bank.

-

What features does airSlate SignNow offer for managing planned gifts?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which are essential for managing planned gifts and the Schedule PG Planned Gift Tax Credit in the State of North Dakota. These tools help ensure that your documentation is accurate and compliant with state regulations.

-

Can I integrate airSlate SignNow with other software for planned giving?

Yes, airSlate SignNow offers seamless integrations with various software platforms, enhancing your ability to manage the Schedule PG Planned Gift Tax Credit in the State of North Dakota. This allows you to connect with CRM systems, accounting software, and other tools to streamline your planned giving processes.

-

What are the benefits of using airSlate SignNow for planned giving?

Using airSlate SignNow for planned giving provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security for your documents. By simplifying the process of managing the Schedule PG Planned Gift Tax Credit in the State of North Dakota, you can focus more on your charitable goals.

-

Is airSlate SignNow compliant with North Dakota state regulations for planned gifts?

Absolutely! airSlate SignNow is designed to comply with North Dakota state regulations, including those related to the Schedule PG Planned Gift Tax Credit. Our platform ensures that all your documents meet legal requirements, providing peace of mind as you navigate the planned giving landscape.

Get more for Schedule PG Planned Gift Tax Credit State Of North Dakota Nd

- Twin arrows casino resort launches reach engaged nation form

- Spllc application for employment squarespace form

- 610 east 4th street duluth mn 55805 form

- Plaid pantries inc employment application plaid pantry form

- 90 day form human resources cornell university

- Bapplicationb for bemploymentb solicitud de empleo form

- Big lots careers 2012 2019 form

- Httpswwwtxcaorgimagesconferencescc14powerpoints6pdf form

Find out other Schedule PG Planned Gift Tax Credit State Of North Dakota Nd

- How Do I Sign Minnesota Legal Residential Lease Agreement

- Sign South Carolina Insurance Lease Agreement Template Computer

- Sign Missouri Legal Last Will And Testament Online

- Sign Montana Legal Resignation Letter Easy

- How Do I Sign Montana Legal IOU

- How Do I Sign Montana Legal Quitclaim Deed

- Sign Missouri Legal Separation Agreement Myself

- How Do I Sign Nevada Legal Contract

- Sign New Jersey Legal Memorandum Of Understanding Online

- How To Sign New Jersey Legal Stock Certificate

- Sign New Mexico Legal Cease And Desist Letter Mobile

- Sign Texas Insurance Business Plan Template Later

- Sign Ohio Legal Last Will And Testament Mobile

- Sign Ohio Legal LLC Operating Agreement Mobile

- Sign Oklahoma Legal Cease And Desist Letter Fast

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy