Schedule ND 1FC Family Member Care Income Tax Credit Schedule ND 1FC Family Member Care Income Tax Credit Form

Understanding the Schedule ND 1FC Family Member Care Income Tax Credit

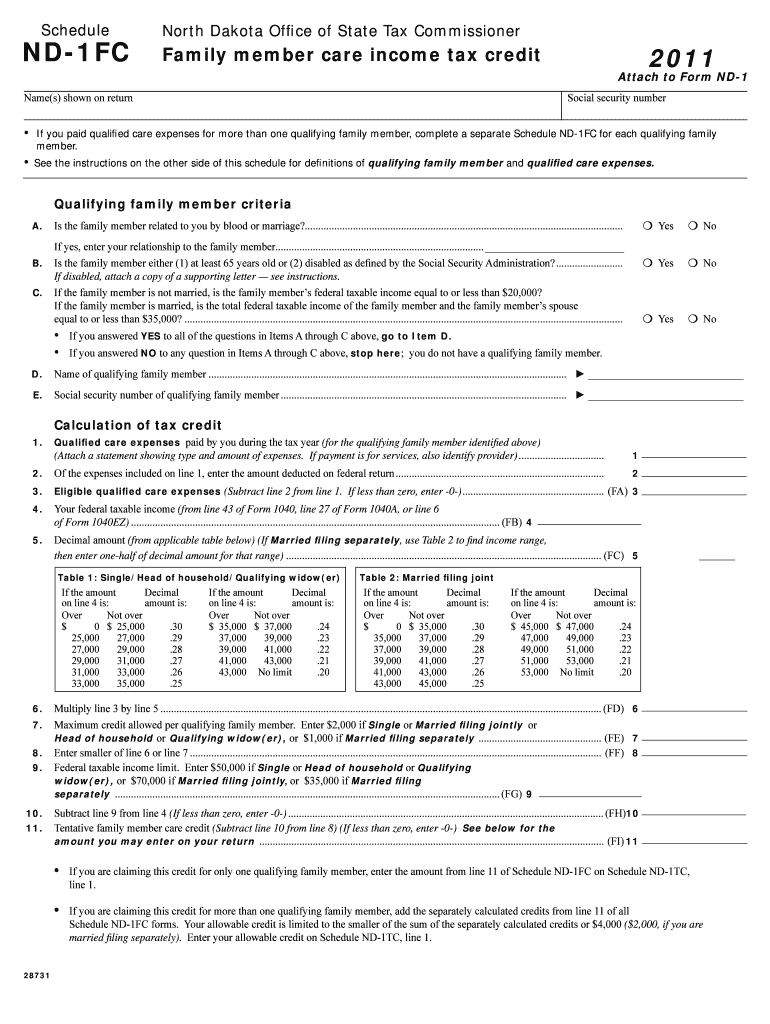

The Schedule ND 1FC Family Member Care Income Tax Credit is a tax benefit designed to assist individuals who provide care for family members with disabilities or chronic illnesses. This credit aims to alleviate some of the financial burdens associated with caregiving, allowing caregivers to claim a credit based on the expenses incurred while providing necessary care. Eligible expenses may include medical costs, transportation, and other related expenditures that support the well-being of the care recipient.

Steps to Complete the Schedule ND 1FC Family Member Care Income Tax Credit

Completing the Schedule ND 1FC involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including receipts for qualifying expenses and information about the care recipient's condition. Next, fill out the form by providing your personal information, details about the care recipient, and a breakdown of the expenses incurred. It is important to double-check all entries for accuracy before submission. Finally, submit the completed schedule along with your state tax return, either electronically or by mail, depending on your filing method.

Eligibility Criteria for the Schedule ND 1FC Family Member Care Income Tax Credit

To qualify for the Schedule ND 1FC Family Member Care Income Tax Credit, certain eligibility criteria must be met. Caregivers must be providing care to a family member who is a qualifying individual, typically defined as someone with a disability or chronic illness. Additionally, the caregiver must have incurred eligible expenses directly related to the care provided. Income limits may also apply, so it is essential to review the specific guidelines to determine if you meet the necessary qualifications.

Required Documents for the Schedule ND 1FC Family Member Care Income Tax Credit

When preparing to file the Schedule ND 1FC, it is crucial to gather all required documents to support your claim. This includes receipts for medical expenses, proof of the care recipient's condition, and any other documentation that verifies the expenses incurred. Additionally, personal identification information for both the caregiver and the care recipient should be readily available. Having these documents organized will facilitate a smoother filing process and help ensure that your claim is processed without delays.

Filing Deadlines for the Schedule ND 1FC Family Member Care Income Tax Credit

Filing deadlines for the Schedule ND 1FC typically align with the standard state tax return deadlines. It is essential to be aware of these dates to avoid penalties or interest charges. Generally, state tax returns are due by April 15 of each year, but it is advisable to check for any specific extensions or changes that may apply. Timely submission of the Schedule ND 1FC along with your tax return is crucial to ensure you receive the credit for which you are eligible.

How to Obtain the Schedule ND 1FC Family Member Care Income Tax Credit

The Schedule ND 1FC Family Member Care Income Tax Credit can be obtained through your state’s tax authority website or office. Many states provide downloadable forms that can be printed and filled out by hand. Additionally, electronic versions of the form may be available for those who prefer to file online. It is important to ensure that you are using the most current version of the form to avoid any issues during the filing process.

Quick guide on how to complete schedule nd 1fc family member care income tax credit schedule nd 1fc family member care income tax credit

Complete [SKS] seamlessly on any device

Digital document management has gained increased popularity among organizations and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your files quickly and efficiently. Manage [SKS] on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to edit and eSign [SKS] effortlessly

- Find [SKS] and click on Get Form to begin.

- Utilize the features we provide to finalize your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Edit and eSign [SKS] while ensuring excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule ND 1FC Family Member Care Income Tax Credit Schedule ND 1FC Family Member Care Income Tax Credit

Create this form in 5 minutes!

How to create an eSignature for the schedule nd 1fc family member care income tax credit schedule nd 1fc family member care income tax credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule ND 1FC Family Member Care Income Tax Credit?

The Schedule ND 1FC Family Member Care Income Tax Credit is a tax credit designed to assist individuals who provide care for family members. This credit can help reduce your tax liability, making it easier to manage the financial aspects of caregiving. Understanding this credit is essential for maximizing your tax benefits.

-

How can I apply for the Schedule ND 1FC Family Member Care Income Tax Credit?

To apply for the Schedule ND 1FC Family Member Care Income Tax Credit, you need to complete the appropriate tax forms during your tax filing process. Ensure that you have all necessary documentation regarding your caregiving situation. Consulting with a tax professional can also help streamline your application.

-

What are the eligibility requirements for the Schedule ND 1FC Family Member Care Income Tax Credit?

Eligibility for the Schedule ND 1FC Family Member Care Income Tax Credit typically includes being a caregiver for a qualifying family member. You must also meet specific income thresholds and provide necessary documentation to support your claim. It's important to review the guidelines to ensure you qualify.

-

What benefits does the Schedule ND 1FC Family Member Care Income Tax Credit offer?

The Schedule ND 1FC Family Member Care Income Tax Credit offers signNow financial relief for caregivers by reducing their overall tax burden. This credit can help offset the costs associated with caregiving, making it a valuable resource for families. Utilizing this credit can enhance your financial stability while providing care.

-

Are there any costs associated with filing for the Schedule ND 1FC Family Member Care Income Tax Credit?

While there are no direct costs to file for the Schedule ND 1FC Family Member Care Income Tax Credit, you may incur expenses related to tax preparation services. If you choose to use software or hire a professional, those costs can vary. It's advisable to weigh these costs against the potential tax savings.

-

Can I use airSlate SignNow to manage documents related to the Schedule ND 1FC Family Member Care Income Tax Credit?

Yes, airSlate SignNow provides an efficient platform for managing documents related to the Schedule ND 1FC Family Member Care Income Tax Credit. You can easily send, sign, and store important documents securely. This streamlines the process and ensures you have all necessary paperwork organized.

-

What features does airSlate SignNow offer that can assist with the Schedule ND 1FC Family Member Care Income Tax Credit?

airSlate SignNow offers features such as eSigning, document templates, and secure storage that can assist with the Schedule ND 1FC Family Member Care Income Tax Credit. These tools simplify the documentation process, making it easier to manage your tax-related paperwork. This efficiency can save you time and reduce stress during tax season.

Get more for Schedule ND 1FC Family Member Care Income Tax Credit Schedule ND 1FC Family Member Care Income Tax Credit

- 2015 georgia 500 tax form 2018 2019

- 500es 2019 form

- 500es 2017 form

- Ga form 500ez short individual income tax return

- Form hw 4 rev 2018 employees withholding allowance and status certificate forms 2018

- Marital statusif you are legally separated from your spouse form

- Hawaii form bb1 2017 2019

- Hawaii divorce decree 2013 2019 form

Find out other Schedule ND 1FC Family Member Care Income Tax Credit Schedule ND 1FC Family Member Care Income Tax Credit

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template

- eSignature Alaska Bill of Sale Immovable Property Online

- Can I Electronic signature Delaware General Power of Attorney Template

- Can I Electronic signature Michigan General Power of Attorney Template

- Can I Electronic signature Minnesota General Power of Attorney Template

- How Do I Electronic signature California Distributor Agreement Template

- eSignature Michigan Escrow Agreement Simple

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement