Form 58 Partnership Income Tax Return State of North Dakota Nd

What is the Form 58 Partnership Income Tax Return State Of North Dakota Nd

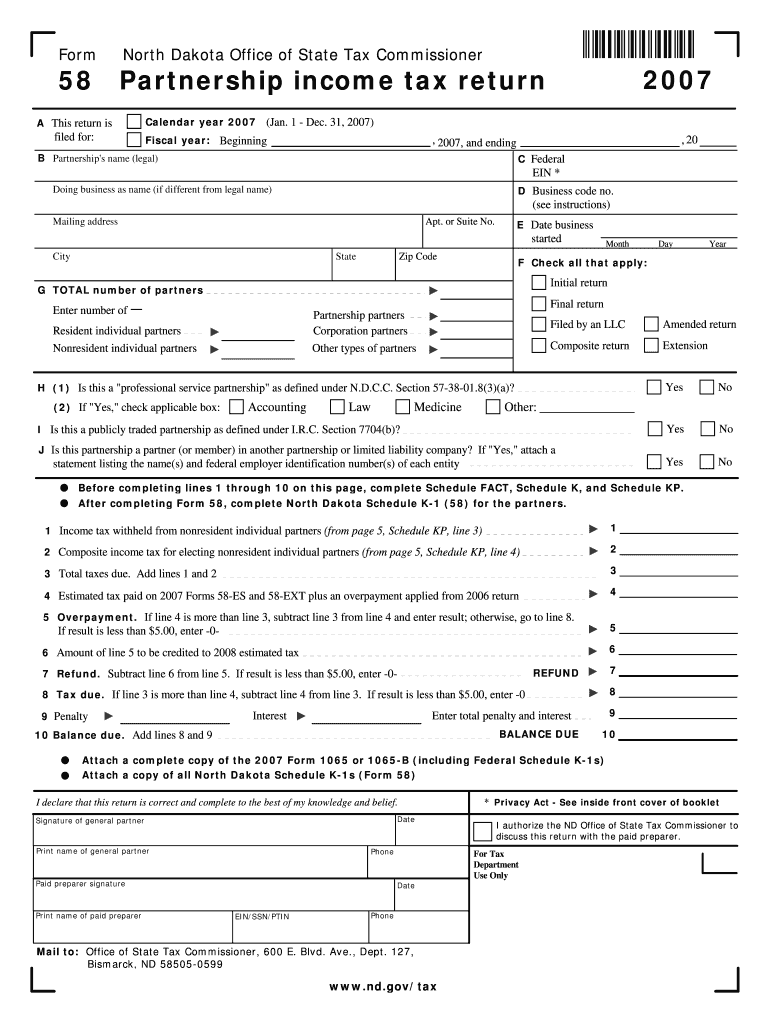

The Form 58 Partnership Income Tax Return is a specific tax document required by the State of North Dakota for partnerships to report their income, deductions, and credits. This form is essential for partnerships operating within the state, as it ensures compliance with state tax laws. It captures various financial details that reflect the partnership's operations during the tax year, including income earned and expenses incurred.

How to use the Form 58 Partnership Income Tax Return State Of North Dakota Nd

Using the Form 58 involves several steps that require careful attention to detail. Partnerships must gather all necessary financial information, including income statements, expense reports, and any relevant documentation that supports the figures reported on the form. Once completed, the form must be filed with the North Dakota Office of State Tax Commissioner by the designated deadline to avoid penalties.

Steps to complete the Form 58 Partnership Income Tax Return State Of North Dakota Nd

Completing the Form 58 requires a systematic approach. Start by collecting all financial records related to the partnership's income and expenses. Follow these steps:

- Enter the partnership's identifying information, including the name and address.

- Report total income earned during the tax year.

- Detail all allowable deductions and credits.

- Calculate the net income or loss.

- Review the completed form for accuracy before submission.

Filing Deadlines / Important Dates

Partnerships must adhere to specific filing deadlines for the Form 58. Typically, the form is due on the fifteenth day of the fourth month following the end of the partnership's tax year. For partnerships operating on a calendar year, this means the form is due by April 15. It is crucial to mark these dates to ensure timely filing and avoid any associated penalties.

Required Documents

To successfully complete the Form 58, partnerships need to gather several key documents. These include:

- Income statements detailing all sources of revenue.

- Expense records that substantiate all claimed deductions.

- Previous year’s tax returns for reference.

- Any supporting documentation for credits claimed.

Penalties for Non-Compliance

Failure to file the Form 58 by the deadline can result in significant penalties. The North Dakota Office of State Tax Commissioner may impose fines based on the amount of tax owed and the duration of the delay. Additionally, non-compliance may lead to interest accruing on unpaid taxes, further increasing the financial burden on the partnership.

Quick guide on how to complete form 58 partnership income tax return state of north dakota nd

Prepare [SKS] effortlessly on any device

Digital document management has gained traction with companies and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow provides all the tools required to generate, adjust, and eSign your documents quickly without any delays. Manage [SKS] on any gadget with airSlate SignNow Android or iOS applications and streamline your document-related tasks today.

How to edit and eSign [SKS] effortlessly

- Find [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or erase sensitive details with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you want to share your form—via email, SMS, or invitation link, or download it to your computer.

Forget about misplaced or lost documents, tedious form searching, or mistakes that require reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 58 Partnership Income Tax Return State Of North Dakota Nd

Create this form in 5 minutes!

How to create an eSignature for the form 58 partnership income tax return state of north dakota nd

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 58 Partnership Income Tax Return State Of North Dakota Nd?

The Form 58 Partnership Income Tax Return State Of North Dakota Nd is a tax form used by partnerships to report income, deductions, and credits to the state of North Dakota. It is essential for compliance with state tax laws and ensures that partnerships fulfill their tax obligations accurately.

-

How can airSlate SignNow help with the Form 58 Partnership Income Tax Return State Of North Dakota Nd?

airSlate SignNow simplifies the process of preparing and submitting the Form 58 Partnership Income Tax Return State Of North Dakota Nd by providing an easy-to-use platform for document management and eSigning. This streamlines the workflow, making it easier for businesses to handle their tax returns efficiently.

-

What are the pricing options for using airSlate SignNow for Form 58 Partnership Income Tax Return State Of North Dakota Nd?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for small businesses and larger enterprises. Each plan provides access to features that facilitate the completion of the Form 58 Partnership Income Tax Return State Of North Dakota Nd, ensuring cost-effectiveness.

-

What features does airSlate SignNow offer for managing the Form 58 Partnership Income Tax Return State Of North Dakota Nd?

airSlate SignNow includes features such as document templates, eSignature capabilities, and secure cloud storage, all of which are beneficial for managing the Form 58 Partnership Income Tax Return State Of North Dakota Nd. These tools enhance collaboration and ensure that all necessary documents are easily accessible.

-

Are there any benefits to using airSlate SignNow for the Form 58 Partnership Income Tax Return State Of North Dakota Nd?

Using airSlate SignNow for the Form 58 Partnership Income Tax Return State Of North Dakota Nd offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows for quick document turnaround, which is crucial during tax season.

-

Can airSlate SignNow integrate with other software for the Form 58 Partnership Income Tax Return State Of North Dakota Nd?

Yes, airSlate SignNow can integrate with various accounting and tax software, making it easier to manage the Form 58 Partnership Income Tax Return State Of North Dakota Nd. This integration helps streamline data transfer and reduces the risk of errors during the filing process.

-

Is airSlate SignNow user-friendly for completing the Form 58 Partnership Income Tax Return State Of North Dakota Nd?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to navigate and complete the Form 58 Partnership Income Tax Return State Of North Dakota Nd. The intuitive interface ensures that users can quickly find the tools they need.

Get more for Form 58 Partnership Income Tax Return State Of North Dakota Nd

Find out other Form 58 Partnership Income Tax Return State Of North Dakota Nd

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document