Partnership Estimated Tax Payment Nd Form

What is the Partnership Estimated Tax Payment Nd

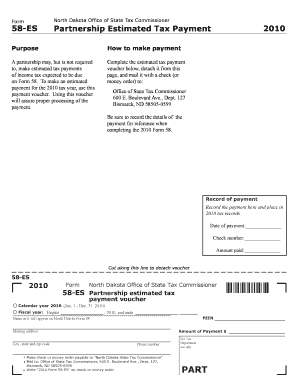

The Partnership Estimated Tax Payment Nd is a tax form used by partnerships to report and remit estimated tax payments to the state of North Dakota. This form is essential for partnerships that expect to owe tax on their income throughout the year. It helps ensure that the partnership meets its tax obligations and avoids penalties for underpayment. The estimated tax payments are typically based on the partnership's expected income, deductions, and credits for the year.

Steps to complete the Partnership Estimated Tax Payment Nd

Completing the Partnership Estimated Tax Payment Nd involves several key steps:

- Gather necessary financial information, including estimated income, deductions, and credits.

- Calculate the estimated tax liability using the current tax rates applicable to partnerships in North Dakota.

- Fill out the form accurately, ensuring all sections are completed as required.

- Review the form for any errors or omissions before submission.

- Submit the completed form along with the payment by the specified deadlines.

Filing Deadlines / Important Dates

Partnerships must be aware of specific deadlines for submitting the Partnership Estimated Tax Payment Nd. Generally, estimated tax payments are due quarterly, with deadlines typically falling on the 15th day of April, June, September, and January of the following year. It is crucial for partnerships to adhere to these deadlines to avoid penalties and interest on late payments.

Required Documents

To complete the Partnership Estimated Tax Payment Nd, partnerships should prepare several documents, including:

- Previous year’s tax return for reference on income and deductions.

- Current year financial statements to estimate income accurately.

- Any supporting documents for deductions and credits being claimed.

Legal use of the Partnership Estimated Tax Payment Nd

The Partnership Estimated Tax Payment Nd is legally required for partnerships that anticipate owing state taxes. Failure to file this form can result in penalties and interest charges. It is important for partnerships to understand their legal obligations regarding estimated tax payments to maintain compliance with state tax laws.

Who Issues the Form

The Partnership Estimated Tax Payment Nd is issued by the North Dakota Office of State Tax Commissioner. This office is responsible for tax administration and ensures that partnerships comply with state tax regulations. Partnerships can obtain the form directly from the state tax office or through authorized channels.

Quick guide on how to complete partnership estimated tax payment nd

Accomplish [SKS] effortlessly on any device

Digital document administration has gained signNow traction among businesses and individuals. It offers a superb eco-friendly substitute for conventional printed and signed documents, as you can obtain the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly and without delays. Manage [SKS] on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign [SKS] effortlessly

- Acquire [SKS] and then click Get Form to initiate.

- Utilize the tools we provide to finish your document.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to store your adjustments.

- Select your delivery method for your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from your preferred device. Modify and eSign [SKS] and guarantee outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Partnership Estimated Tax Payment Nd

Create this form in 5 minutes!

How to create an eSignature for the partnership estimated tax payment nd

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Partnership Estimated Tax Payment Nd?

A Partnership Estimated Tax Payment Nd refers to the advance tax payments that partnerships in North Dakota must make to meet their tax obligations. These payments help ensure that partnerships do not face penalties for underpayment at the end of the tax year. Understanding this process is crucial for maintaining compliance and avoiding unexpected tax liabilities.

-

How can airSlate SignNow assist with Partnership Estimated Tax Payment Nd?

airSlate SignNow provides a streamlined solution for managing documents related to Partnership Estimated Tax Payment Nd. With our eSigning capabilities, you can easily send, sign, and store tax documents securely. This simplifies the process, ensuring that all necessary paperwork is completed accurately and on time.

-

What are the pricing options for using airSlate SignNow for tax documents?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses handling Partnership Estimated Tax Payment Nd. Our plans are designed to be cost-effective, providing access to essential features without breaking the bank. You can choose from monthly or annual subscriptions based on your usage requirements.

-

Are there any features specifically designed for tax document management?

Yes, airSlate SignNow includes features specifically designed for managing tax documents, including templates for Partnership Estimated Tax Payment Nd. You can create, edit, and store documents efficiently, ensuring that all necessary forms are readily available. Additionally, our audit trail feature helps track changes and signatures for compliance purposes.

-

Can I integrate airSlate SignNow with my accounting software?

Absolutely! airSlate SignNow offers seamless integrations with various accounting software, making it easier to manage Partnership Estimated Tax Payment Nd. This integration allows for automatic syncing of documents and data, reducing manual entry and minimizing errors. Check our integration options to find the best fit for your business.

-

What benefits does airSlate SignNow provide for businesses handling tax payments?

Using airSlate SignNow for Partnership Estimated Tax Payment Nd offers numerous benefits, including increased efficiency and reduced paperwork. Our platform allows for quick document turnaround times, ensuring that you meet tax deadlines without hassle. Additionally, the secure eSigning process enhances the overall security of your sensitive tax information.

-

Is airSlate SignNow user-friendly for those unfamiliar with eSigning?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it accessible even for those unfamiliar with eSigning. The intuitive interface guides users through the process of sending and signing documents related to Partnership Estimated Tax Payment Nd. Our customer support team is also available to assist with any questions or concerns.

Get more for Partnership Estimated Tax Payment Nd

Find out other Partnership Estimated Tax Payment Nd

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement