S Corporation Estimated Tax Payment Nd Form

What is the S Corporation Estimated Tax Payment Nd

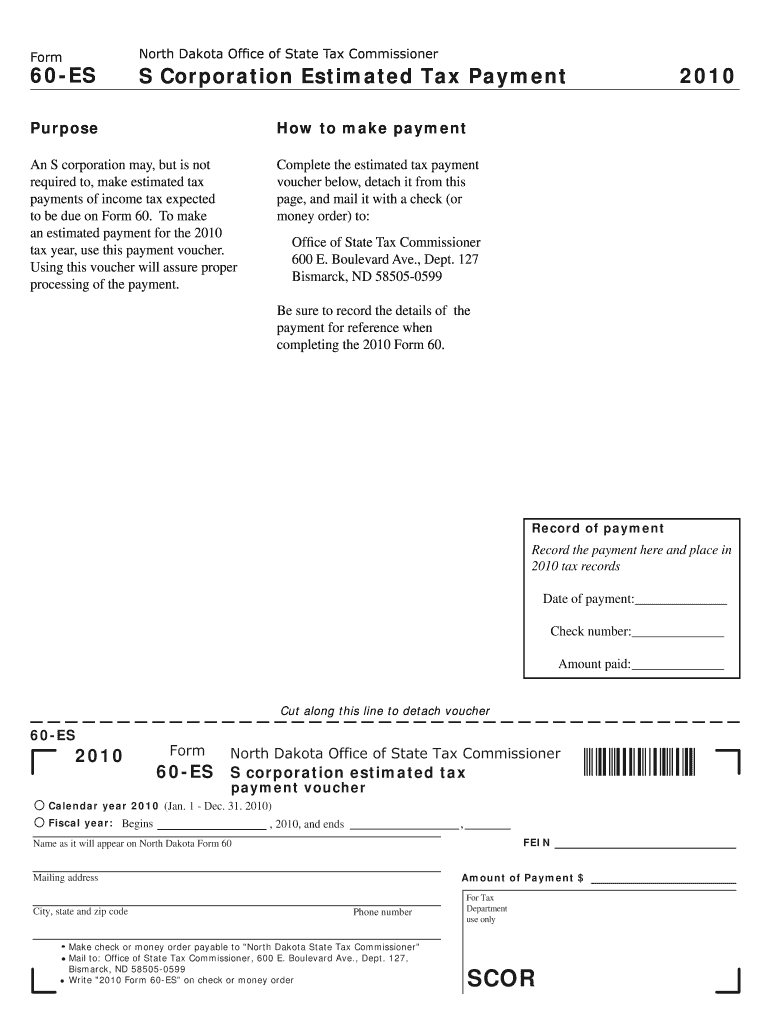

The S Corporation Estimated Tax Payment Nd is a tax form used by S corporations in North Dakota to report and pay estimated income taxes. This form is essential for S corporations, which are pass-through entities, meaning that the income is passed to shareholders who then report it on their personal tax returns. The estimated tax payments help ensure that the corporation meets its tax obligations throughout the year, rather than facing a large tax bill at the end of the fiscal year.

How to use the S Corporation Estimated Tax Payment Nd

To use the S Corporation Estimated Tax Payment Nd, businesses must first calculate their expected income for the year. This involves estimating total revenue and allowable deductions. Once the estimated taxable income is determined, the corporation can calculate the estimated tax due using the current tax rates. The completed form should be submitted according to the state's guidelines, typically on a quarterly basis, to avoid penalties for underpayment.

Steps to complete the S Corporation Estimated Tax Payment Nd

Completing the S Corporation Estimated Tax Payment Nd involves several key steps:

- Estimate your corporation's taxable income for the year.

- Calculate the estimated tax liability based on the applicable tax rates.

- Fill out the form accurately, including all required information such as the corporation's name, address, and tax identification number.

- Submit the form by the specified deadlines, typically on a quarterly schedule.

Filing Deadlines / Important Dates

Filing deadlines for the S Corporation Estimated Tax Payment Nd are crucial to avoid penalties. Generally, estimated tax payments are due on the fifteenth day of the fourth, sixth, ninth, and twelfth months of the corporation's tax year. It is important to keep track of these dates to ensure timely submission and compliance with state tax laws.

Penalties for Non-Compliance

Failure to submit the S Corporation Estimated Tax Payment Nd on time can result in penalties. These may include interest on unpaid taxes and additional fines for late payments. It is essential for corporations to adhere to the filing schedule to avoid these financial repercussions, which can add up significantly over time.

IRS Guidelines

The IRS provides specific guidelines for S corporations regarding estimated tax payments. These guidelines outline how to determine estimated tax liabilities, the necessary forms to file, and the payment methods available. Understanding these guidelines can help corporations navigate their tax responsibilities effectively and ensure compliance with federal regulations.

Quick guide on how to complete s corporation estimated tax payment nd

Easily Prepare [SKS] on Any Device

Managing documents online has gained popularity among both businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Handle [SKS] on any device using airSlate SignNow Android or iOS applications and enhance any document-related process today.

The Simplest Way to Edit and Electronically Sign [SKS] Effortlessly

- Obtain [SKS] and then click Get Form to commence.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the information and then click the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Edit and eSign [SKS] to ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to S Corporation Estimated Tax Payment Nd

Create this form in 5 minutes!

How to create an eSignature for the s corporation estimated tax payment nd

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an S Corporation Estimated Tax Payment Nd?

An S Corporation Estimated Tax Payment Nd refers to the advance tax payments that S Corporations in North Dakota must make to meet their tax obligations. These payments are typically made quarterly and help ensure that the corporation does not face penalties for underpayment at the end of the tax year.

-

How can airSlate SignNow assist with S Corporation Estimated Tax Payment Nd?

airSlate SignNow provides a streamlined platform for managing and signing documents related to S Corporation Estimated Tax Payment Nd. With our easy-to-use interface, businesses can quickly prepare, send, and eSign tax documents, ensuring compliance and timely submissions.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses handling S Corporation Estimated Tax Payment Nd. Our plans are designed to be cost-effective, providing essential features without breaking the bank, making it accessible for all types of businesses.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, which are essential for managing S Corporation Estimated Tax Payment Nd. These tools help streamline the process, reduce errors, and ensure that all documents are handled efficiently.

-

Are there any integrations available with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to manage S Corporation Estimated Tax Payment Nd. These integrations allow for automatic data transfer and synchronization, enhancing productivity and reducing manual entry.

-

How does airSlate SignNow ensure the security of my tax documents?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure cloud storage to protect your documents related to S Corporation Estimated Tax Payment Nd, ensuring that sensitive information remains confidential and safe from unauthorized access.

-

Can I access airSlate SignNow on mobile devices?

Absolutely! airSlate SignNow is accessible on mobile devices, allowing you to manage your S Corporation Estimated Tax Payment Nd documents on the go. This flexibility ensures that you can send, sign, and track documents anytime, anywhere.

Get more for S Corporation Estimated Tax Payment Nd

- Hawaii change form 2017 2019

- State of hawaii tax form g 45 2016

- Forms individual income taxiowa department of revenue

- Deduction iowa department of revenue iowagov form

- Iowa rent rebate 2016 form

- Iowa workforce form 68 019204 12 2018 2019

- Iowa workforce form 68 019204 12 2016

- Iowa corporation short form income tax return state of iowa iowa

Find out other S Corporation Estimated Tax Payment Nd

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple