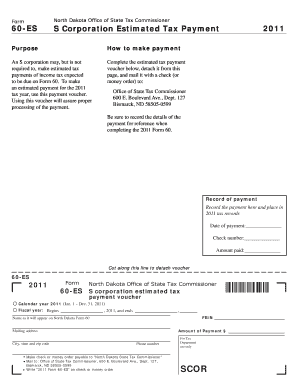

Complete the Estimated Tax Payment Voucher Below, Detach it from This Page, and Mail it with a Check or Money Order to Office of Form

What is the Complete The Estimated Tax Payment Voucher Below, Detach It From This Page, And Mail It With A Check or Money Order To Office Of State Tax Commissioner 600 E

The Complete The Estimated Tax Payment Voucher Below, Detach It From This Page, And Mail It With A Check or Money Order To Office Of State Tax Commissioner 600 E is a specific form used by taxpayers in the United States to submit estimated tax payments. This voucher serves as a formal request to the Office of State Tax Commissioner, allowing individuals and businesses to fulfill their tax obligations in a timely manner. By using this voucher, taxpayers can ensure that their payments are properly recorded and allocated to their tax accounts.

Steps to complete the Complete The Estimated Tax Payment Voucher Below, Detach It From This Page, And Mail It With A Check or Money Order To Office Of State Tax Commissioner 600 E

Completing the estimated tax payment voucher involves several straightforward steps:

- Obtain the voucher form from the appropriate source, ensuring it is the current version.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Indicate the amount of estimated tax you are submitting with the payment.

- Detach the completed voucher from the page, ensuring it is intact for mailing.

- Prepare a check or money order for the specified amount, payable to the Office of State Tax Commissioner.

- Mail the voucher along with the payment to the designated address.

How to use the Complete The Estimated Tax Payment Voucher Below, Detach It From This Page, And Mail It With A Check or Money Order To Office Of State Tax Commissioner 600 E

Using the estimated tax payment voucher is a simple process. First, ensure you have the correct form. After filling out the necessary information, detach the voucher from the rest of the document. It is important to keep a copy of the voucher and payment for your records. Mail the voucher along with your check or money order to the specified address. This ensures that your payment is processed correctly and on time, helping you avoid any potential penalties for late payment.

Filing Deadlines / Important Dates

Filing deadlines for estimated tax payments vary based on individual circumstances, such as your income and filing status. Generally, estimated tax payments are due quarterly. It is crucial to be aware of these deadlines to ensure compliance with state tax regulations. Missing a deadline may result in penalties or interest charges, so keeping track of these important dates is essential for maintaining good standing with tax authorities.

Key elements of the Complete The Estimated Tax Payment Voucher Below, Detach It From This Page, And Mail It With A Check or Money Order To Office Of State Tax Commissioner 600 E

The key elements of the estimated tax payment voucher include:

- Taxpayer Information: Name, address, and taxpayer identification number.

- Payment Amount: The total amount of estimated tax being submitted.

- Submission Instructions: Clear guidance on how to detach and mail the voucher.

- Contact Information: Details for reaching the Office of State Tax Commissioner for any questions.

Who Issues the Form

The estimated tax payment voucher is issued by the Office of State Tax Commissioner in each state. This office is responsible for managing tax collections and ensuring compliance with state tax laws. It is advisable to check your specific state's tax commissioner's website for the most accurate and updated forms, as they may vary by state.

Quick guide on how to complete complete the estimated tax payment voucher below detach it from this page and mail it with a check or money order to office of

Complete [SKS] seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers a perfect eco-friendly substitute to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and electronically sign your documents quickly without interruptions. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to edit and electronically sign [SKS] with ease

- Find [SKS] and then click Get Form to begin.

- Use the tools available to fill out your document.

- Highlight important sections of the documents or obscure sensitive information using tools specifically provided by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select your preferred method for submitting your form, whether by email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, frustrating form searches, or mistakes that compel you to print new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and electronically sign [SKS] to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Complete The Estimated Tax Payment Voucher Below, Detach It From This Page, And Mail It With A Check or Money Order To Office Of

Create this form in 5 minutes!

How to create an eSignature for the complete the estimated tax payment voucher below detach it from this page and mail it with a check or money order to office of

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process to complete the estimated tax payment voucher?

To complete the estimated tax payment voucher, simply fill out the required fields on the form. Once you have filled it out, detach it from this page and mail it with a check or money order to the Office of State Tax Commissioner at 600 E.

-

How can airSlate SignNow help me with my tax payment vouchers?

airSlate SignNow provides an easy-to-use platform to create and manage your tax payment vouchers. You can complete the estimated tax payment voucher below, detach it from this page, and mail it with a check or money order to the Office of State Tax Commissioner 600 E, all while ensuring your documents are securely signed.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing plans to fit different business needs. You can choose a plan that allows you to complete the estimated tax payment voucher below, detach it from this page, and mail it with a check or money order to the Office of State Tax Commissioner 600 E, all while staying within your budget.

-

Are there any features that simplify the tax payment process?

Yes, airSlate SignNow includes features like templates and automated reminders that simplify the tax payment process. You can easily complete the estimated tax payment voucher below, detach it from this page, and mail it with a check or money order to the Office of State Tax Commissioner 600 E, ensuring you never miss a deadline.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, enhancing your workflow. This allows you to complete the estimated tax payment voucher below, detach it from this page, and mail it with a check or money order to the Office of State Tax Commissioner 600 E, all while using your preferred tools.

-

What benefits does airSlate SignNow offer for businesses?

airSlate SignNow empowers businesses by providing a cost-effective solution for document management. You can complete the estimated tax payment voucher below, detach it from this page, and mail it with a check or money order to the Office of State Tax Commissioner 600 E, streamlining your operations and saving time.

-

Is airSlate SignNow secure for handling sensitive documents?

Yes, airSlate SignNow prioritizes security and compliance, ensuring your sensitive documents are protected. You can confidently complete the estimated tax payment voucher below, detach it from this page, and mail it with a check or money order to the Office of State Tax Commissioner 600 E, knowing your information is safe.

Get more for Complete The Estimated Tax Payment Voucher Below, Detach It From This Page, And Mail It With A Check or Money Order To Office Of

Find out other Complete The Estimated Tax Payment Voucher Below, Detach It From This Page, And Mail It With A Check or Money Order To Office Of

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form