Illinois Department of Revenue PTAX 300 HA Affidavit for Co Stephenson Il Form

Understanding the PTAX 300 HA Affidavit

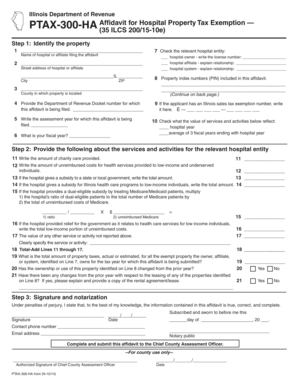

The Illinois Department of Revenue PTAX 300 HA Affidavit is a crucial document for property owners in Co Stephenson, Illinois. This affidavit is primarily used to claim a property tax exemption for certain types of property, including those owned by charitable organizations or other qualifying entities. Understanding the purpose and requirements of this form is essential for ensuring compliance with state tax laws and for securing potential tax benefits.

Steps to Complete the PTAX 300 HA Affidavit

Completing the PTAX 300 HA Affidavit involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information about the property and the owner. This includes the property address, ownership details, and the specific exemption being claimed. Next, fill out the affidavit form carefully, ensuring that all required fields are completed. It is important to review the form for any errors before submission. Finally, submit the completed affidavit to the appropriate local authority by the specified deadline.

Legal Use of the PTAX 300 HA Affidavit

The PTAX 300 HA Affidavit serves a legal purpose in the context of property taxation in Illinois. It is designed to provide a formal declaration that the property meets the criteria for exemption under state law. Using this affidavit correctly can help property owners avoid unnecessary tax liabilities. Failure to use the form appropriately or submit it on time may result in penalties or the denial of the exemption claim.

Eligibility Criteria for the PTAX 300 HA Affidavit

To qualify for the PTAX 300 HA Affidavit, the property must meet specific eligibility criteria set forth by the Illinois Department of Revenue. Generally, the property must be owned by a qualifying organization, such as a nonprofit or charitable entity, and must be used for purposes that align with the exemption criteria. Property owners should review these criteria carefully to determine their eligibility before completing the affidavit.

Required Documents for the PTAX 300 HA Affidavit

When filing the PTAX 300 HA Affidavit, certain documents may be required to support the exemption claim. These documents typically include proof of ownership, such as a deed or title, and any relevant documentation that demonstrates the property’s use in accordance with the exemption criteria. It is advisable to compile these documents in advance to facilitate a smooth filing process.

Form Submission Methods for the PTAX 300 HA Affidavit

The PTAX 300 HA Affidavit can be submitted through various methods, including online, by mail, or in person at the local tax assessor's office. Each submission method has its own guidelines and requirements, so it is important for property owners to choose the method that best suits their needs. Ensure that the submission is completed by the deadline to avoid complications with the exemption claim.

Quick guide on how to complete illinois department of revenue ptax 300 ha affidavit for co stephenson il

Accomplish Illinois Department Of Revenue PTAX 300 HA Affidavit For Co Stephenson Il effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely preserve it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly without delays. Manage Illinois Department Of Revenue PTAX 300 HA Affidavit For Co Stephenson Il on any platform using airSlate SignNow Android or iOS applications and enhance any document-related process today.

The most efficient way to modify and electronically sign Illinois Department Of Revenue PTAX 300 HA Affidavit For Co Stephenson Il with ease

- Find Illinois Department Of Revenue PTAX 300 HA Affidavit For Co Stephenson Il and click Get Form to begin.

- Utilize the tools provided to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow specifically provides for those tasks.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to finalize your changes.

- Select how you prefer to send your form—via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in a few clicks from any device you choose. Modify and electronically sign Illinois Department Of Revenue PTAX 300 HA Affidavit For Co Stephenson Il and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the illinois department of revenue ptax 300 ha affidavit for co stephenson il

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ptax 300 ha and how does it work?

The ptax 300 ha is a powerful tool designed to streamline document signing and management. It allows users to send, receive, and eSign documents efficiently, ensuring a smooth workflow. With its user-friendly interface, businesses can easily integrate the ptax 300 ha into their existing processes.

-

What are the key features of the ptax 300 ha?

The ptax 300 ha offers a range of features including customizable templates, real-time tracking, and secure cloud storage. These features enhance the document signing experience, making it faster and more reliable. Additionally, the ptax 300 ha supports multiple file formats, catering to diverse business needs.

-

How much does the ptax 300 ha cost?

Pricing for the ptax 300 ha is competitive and designed to fit various budgets. airSlate SignNow offers flexible subscription plans that cater to businesses of all sizes. You can choose a plan that best suits your needs and take advantage of the cost-effective solutions provided by the ptax 300 ha.

-

What are the benefits of using the ptax 300 ha?

Using the ptax 300 ha can signNowly improve your document workflow by reducing turnaround times and minimizing errors. It enhances collaboration among team members and clients, making the signing process seamless. Overall, the ptax 300 ha empowers businesses to operate more efficiently.

-

Can the ptax 300 ha integrate with other software?

Yes, the ptax 300 ha is designed to integrate seamlessly with various software applications. This includes popular CRM systems, project management tools, and cloud storage services. These integrations enhance the functionality of the ptax 300 ha, allowing for a more cohesive workflow.

-

Is the ptax 300 ha secure for sensitive documents?

Absolutely, the ptax 300 ha prioritizes security with advanced encryption and compliance with industry standards. Your sensitive documents are protected throughout the signing process, ensuring confidentiality and integrity. Trust the ptax 300 ha to handle your important documents safely.

-

How can I get started with the ptax 300 ha?

Getting started with the ptax 300 ha is simple. You can sign up for a free trial on the airSlate SignNow website to explore its features. Once you're ready, choose a subscription plan that fits your needs and start leveraging the benefits of the ptax 300 ha.

Get more for Illinois Department Of Revenue PTAX 300 HA Affidavit For Co Stephenson Il

- Lotta lara lesson plan template form

- Waiver of liability form 100073706

- Printable acknowledgement form

- Please complete this estate planning client intake form to the best of your knowledge

- Ia 1065 form

- Percent error is the blank of an blank to a blank form

- Cbp form 29 pdf

- Room rental contract template form

Find out other Illinois Department Of Revenue PTAX 300 HA Affidavit For Co Stephenson Il

- eSignature California Commercial Lease Agreement Template Myself

- eSignature California Commercial Lease Agreement Template Easy

- eSignature Florida Commercial Lease Agreement Template Easy

- eSignature Texas Roommate Contract Easy

- eSignature Arizona Sublease Agreement Template Free

- eSignature Georgia Sublease Agreement Template Online

- eSignature Arkansas Roommate Rental Agreement Template Mobile

- eSignature Maryland Roommate Rental Agreement Template Free

- How Do I eSignature California Lodger Agreement Template

- eSignature Kentucky Lodger Agreement Template Online

- eSignature North Carolina Lodger Agreement Template Myself

- eSignature Alabama Storage Rental Agreement Free

- eSignature Oregon Housekeeping Contract Computer

- eSignature Montana Home Loan Application Online

- eSignature New Hampshire Home Loan Application Online

- eSignature Minnesota Mortgage Quote Request Simple

- eSignature New Jersey Mortgage Quote Request Online

- Can I eSignature Kentucky Temporary Employment Contract Template

- eSignature Minnesota Email Cover Letter Template Fast

- How To eSignature New York Job Applicant Rejection Letter