#10 Comm Office Alabama Department of Revenue Form

What is the #10 Comm Office Alabama Department of Revenue?

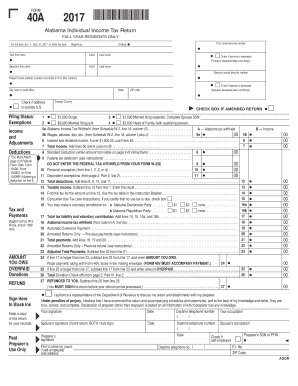

The #10 Comm Office refers to a specific form used by the Alabama Department of Revenue for various tax-related purposes. This form is crucial for individuals and businesses that need to report specific financial information accurately. It is designed to ensure compliance with state tax regulations and to facilitate proper processing by the Alabama Department of Revenue. Understanding the purpose of this form is essential for anyone engaged in financial activities that fall under its jurisdiction.

How to use the #10 Comm Office Alabama Department of Revenue

Using the #10 Comm Office form involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents that pertain to the information required on the form. This may include income statements, expense records, and any other relevant financial data. Next, carefully fill out the form, ensuring that all information is accurate and complete. Once completed, the form can be submitted either electronically or via traditional mail, depending on the preferences outlined by the Alabama Department of Revenue.

Steps to complete the #10 Comm Office Alabama Department of Revenue

Completing the #10 Comm Office form requires attention to detail. Follow these steps for a smooth process:

- Review the form instructions thoroughly to understand what information is required.

- Collect all relevant documentation, including financial records and identification numbers.

- Fill out the form accurately, ensuring that all fields are completed as required.

- Double-check all entries for accuracy and completeness before submission.

- Submit the form according to the preferred method, whether online or by mail.

Legal use of the #10 Comm Office Alabama Department of Revenue

The #10 Comm Office form must be used in accordance with Alabama state laws and regulations. This means that the information provided must be truthful and accurate to avoid any legal repercussions. The form serves as a legal document, and any discrepancies or false information can lead to penalties, including fines or audits by the Alabama Department of Revenue. Therefore, it is crucial to understand the legal implications of submitting this form and to ensure compliance with all applicable laws.

Filing Deadlines / Important Dates

Filing deadlines for the #10 Comm Office form are critical to ensure compliance with Alabama tax regulations. Generally, these deadlines align with the state’s tax filing schedule. It is essential to be aware of these dates to avoid late fees or penalties. Typically, forms must be submitted by the designated due date, which can vary based on the type of tax being reported. Keeping a calendar of important dates can help taxpayers stay organized and compliant.

Required Documents

To complete the #10 Comm Office form, several documents are typically required. These may include:

- Income statements that detail earnings for the reporting period.

- Expense records to substantiate deductions claimed.

- Identification numbers, such as Social Security or Employer Identification Numbers (EIN).

- Any previous tax returns that may be relevant to the current filing.

Having these documents ready will facilitate a smoother completion process and ensure that all necessary information is accurately reported.

Who Issues the Form

The #10 Comm Office form is issued by the Alabama Department of Revenue, which is responsible for administering state tax laws and ensuring compliance among taxpayers. This department oversees the processing of tax forms, the collection of taxes, and the enforcement of tax regulations within the state of Alabama. Understanding the role of the Alabama Department of Revenue is important for taxpayers as it provides context for the requirements and expectations associated with the #10 Comm Office form.

Quick guide on how to complete alabama department of revenue tax forms

Prepare alabama department of revenue tax forms seamlessly on any device

Digital document management has become favored by organizations and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the essentials to create, modify, and eSign your documents quickly without setbacks. Manage 10 comm on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to alter and eSign alabama department of revenue effortlessly

- Obtain alabama department of revenue forms and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of your documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or mislaid documents, tedious form searches, or errors that necessitate producing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you select. Modify and eSign alabama department of revenue income tax and ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs alabama revenue

-

If you left a survey for burglars to fill out the next time they ransacked your home, how would they rate the experience?

How did you learn about us?Rumors about rural houses having little Security.Location: 5/10Location was alright. Around 500 meters to the nearest neighbor. But unfortunately an hour away from any sizable population (20,000 plus being a sizable population.)Transportation: 10/10Transportation was top notch. The owners of the property never lock their Minivan or Pick-up truck. The keys are always left in the vehicles. Both are moderately new and somewhat non-descriptive so a perfect getaway vehicle. Not only did they provide vehicles they also kept trailers in a easily accessible unlocked shed.Security: 9/10Security was lax. There is a gate but it isn’t locked. Doors aren’t locked unless the house is left unoccupied for more than 2 weeks. No cameras made it really easy. They did have a dog which made it a bit of a pain. He was easily disposed of as he was just a Labrador Retriever puppy. Owners are very light sleepers don’t rob if they’re around.Products: 10/10No place has better selection. The place had 3 DSLR cameras, 3 Workstation class desktops, 3 tablets, 4 drones, 6 Smartphones, 9 external monitors and 11 laptops. All of the items were of premium design and value (aka Apples or equivalent). The freezers and shelves were well stocked the rest of the property was much more appealing though.They also had a shop on the property with many tools ranging from mechanics to carpentry to fabrication. The tools were of medium quality. The shop also stored 2 ATV for added convenience. The shop wasn’t the jackpot though.The shed was the real treasure trove. This drive in shed held heavy equipment all with the keys in the ignition for easy accessibility. The average equipment’s value was around $100,000, with a combined value of around $1.5 Million. Unfortunately the heavy equipment is hard to transport and the market is too small to get away with it.The products all seemed gift wrapped for the taking. Everything was easy to find as it looked organized.Laws in the area: 10/10Owners aren’t allowed to use lethal force or even have a premeditated weapon for self defense. A robber in the area once accidentally locked himself into the garage place he was robbing. As the owners did not come home for a couple days he resorted to eating dog food. The end result was the owners were charged for negligence of the robber. Laws almost protect us. Owners are not supposed to attack us in any way or they may be charged.Would you recommend to your friends?If everybody is gone a resounding yes. Unfortunately that’s not very often as the house is occupied by Home-schooling kids, a Writer and the owner is a farmer who mostly works on property. Also if you intend to use brute force, bring a weapon. All the occupants are big. The average height is around 6 feet.BTW bring friends to help loot. It really requires a team of people to loot the place.

-

What are some tips to fill out the kvpy self appraisal form?

You should not lie in the self-appraisal form. Professors generally do not ask anything from the self appraisal form. But if they find out some extraordinary stuffs in your form, they may ask you about those topics. And if you do not know those topics properly, you will have higher chance of NOT getting selected for the fellowship. So, DO NOT write anything that you are not sure about.If I remember properly, in the form they ask, “What is your favorite subject?” and I mentioned Biology there. Head of the interview panel saw that and asked me about my favorite field of biology. When I told genetics, two professors started asking question from genetics and did not ask anything from any other fields at all (except exactly 2 chemistry questions as I mentioned chemistry as my 2nd favorite subject). But they did not check other answers in self-appraisal form (at least in my presence).Do mention about science camps if you have attended any. Again, do not lie.All the best for interview round. :)

-

Can you give me some tips on how to fill out the OMR faster and correctly on the NEET?

There are few effective ways to do this . i will share my method herein India usually , exams like NEET, UPSC are held in government and private schools . sometimes you are lucky enough to get a proper sitting facilities . In most of the cases , you won’t feel much comfortable sitting for straight 3 hrs in those primary classrooms and coming to OMR sheet , we all have the fear of disqualification in case of tampering , folding . so , i suggest you to put the OMR sheet given to you in the desk or away from you on the bench so that it is not folded up in your hands while solving the questions .to start solving , divide the time and questions . explaning with an example , if there are 100 questions and 120 minutes .solve the first 50 questions in 60 minutes …dont touch your OMR sheet until you finish these 50 questions ( finish here means to solve if you only know them . dont waste your time solving new one’s which you have no idea) . start solving in your question paper itself . After solving grab your OMR and start bubbling the questions until 60 whichever is solved and keep OMR away from youNow, solve the half of the remaining questions i.e 25 questions in other 30 minutes and then repeat the same processNow you are left with 30 minutes and 25 questions . There is a danger of invigilator grabbing your OMR at end of the exam . so dont take any chance . you have to change the strategy here . you have to put the OMR sheet in front of you and after solving each question , bubble simultaneously .so even in the worst case , you will be able to solve maximum questions .after solving everything , if you are left with anytime , start solving the unsolved if there is no negative marking . i ahve no idea about NEET so i have answered in general prospective .thanks for A2A Sofikul Islam

-

How can I get more people to fill out my survey?

Make it compellingQuickly and clearly make these points:Who you are and why you are doing thisHow long it takesWhats in it for me -- why should someone help you by completing the surveyExample: "Please spend 3 minutes helping me make it easier to learn Mathematics. Answer 8 short questions for my eternal gratitude and (optional) credit on my research findings. Thank you SO MUCH for helping."Make it convenientKeep it shortShow up at the right place and time -- when people have the time and inclination to help. For example, when students are planning their schedules. Reward participationOffer gift cards, eBooks, study tips, or some other incentive for helping.Test and refineTest out different offers and even different question wording and ordering to learn which has the best response rate, then send more invitations to the offer with the highest response rate.Reward referralsIf offering a reward, increase it for referrals. Include a custom invite link that tracks referrals.

-

Musicians: How many songs do you think you'd need to perform to fill out a two-hour gig?

A two-hour gig? That's 120 minutes of on stage performance or setup inclusion? I'll go with stage time, and also assume you've negotiated appropriate setup, and such.Another assumption is genre. I'll assume it's pop structured (as most radio friendly music is these days), so average song time would be roughly 3 and a half minutes…give or take.You're looking at roughly 30 songs. Thats…over 2 hours. Now, that's a rough estimate, as song times vary, etc.Oh, but wait. You'll need to include breaks, for “personnel” i.e. the band members. Normally, the drummer will need the longest break, followed by others. The drummer is using all four limbs continuously, so…they need them.If you're headlining, and depending on what you've negotiated, you might not be allotted “dead air”, so someone's staying on stage on breaks. Usually, that means at least a guitar player and/or the singer. Maybe not a long guitar solo, but…maybe an acoustic filler/singalong for the crowd. Plus, in between banter, there's that too (paring that down was always a plus for us back in the day)So, practice 30ish and get them flawless, because you're only going to need 20ish. Why 30ish? Because…more is good for flexibility. Always. Plus, it allows you to keep your set list semi-”fresh”, while only putting in a little extra work.setlist.fm - the setlist wiki is a good resource for structuring a setlist in a professional way (I wish it was around during the “trial and error” days.)

-

How do you fill a money order?

How To Fill Out A Money Order sometimes makes the user confusing and irritating. You can easily figure out each and every step with full procedure by visiting on the link.

-

How do I fill a form which is PDF?

You can try out Fill which had a free forever plan and requires no download. You simply upload your PDF and then fill it in within the browser:UploadFillDownloadIf the fields are live, as in the example above, simply fill them in. If the fields are not live you can drag on the fields to complete it quickly. Once you have completed the form click the download icon in the toolbar to download a copy of the finished PDF. Or send it for signing.Open a free account on Fill here

-

How should one fill out the DAF form for the UPSC civil services?

1) Things to keep in mind while filling your DAF1. DAF is not like your resume, the more achievements the more you will score.Here DAF is only a way to know about you so that they can ask questions.2. Please do not try to fake or write for the sake of writing. If there is no achievement, then don’t create one, no hobby then don’t write fake one .3. Be specific. For you music might be a hobby (listening in free time), but they will expect you to know about music in detail. . You might like cooking but they will ask you anything related to cooking ( about preservatives, masalas, cooking recepies, types of cuisines etc).So better to avoid writing such open ended things. Write specific things which you know you can prepare.a4. Writing something and not able to answer basic questions related to those things sends a very wrong impression. When you are filling DAF ensure you write less but meaningful things you are confident about.2) Service Preference ListImportant : These are my personal views which can be biased. Detail about each service, growth opportunities can be found here http://persmin.gov.in/AIS1/Welco...Brief about Services1. IASGood work, Good Infrastructure and highly respectable. Issue is interference and work pressure. If you want a very peaceful life and tension free life then think about it.2. IFSWork as diplomats. Good services, especially for people who like to travel, pursue intellectual hobbies. You will have alternate terms in foreign country and India. Yes do give a consideration from family perspective and secondly from perspective that if you want paraphernalia you will not get it.3. IPSMostly work is in law and order domain. Lot of power, infra and Paraphernalia. However IPS is a very tough job and not everyone is made for it. It needs lot of patience, sacrifice in personal life and has maximum interference. So choose accordingly.4. IRS IT and CustomsMy personal advice would be to choose IT over customs ( stable cadre, timely promotions , decent infra and good places of postings) However work can appear to be boring due to a desk job restricted to taxation. Customs on the other hand is having more variety.5. IRTS vs IAASIRTS is IAS of railways. Lot of manpower under you. Good infra and facilities. However issue is very hectic life especially if you are in operations side as you have to manage timely running of trains. So don't opt it if you want a peaceful and tension free life.IAAS on the other hand is a totally different service. It audits almost everything in government. Remember it is not just auditing of accounts here but a larger purview. Also stable posting, normal working hours, postings in state capital and Delhi plus lot of foreign visits and yes timely promotions. Plus everyone fears an auditor. However you won't enjoy executive powers and perks like IRTS. So decide what kind of life you want.6. Accounting ServicesIRASBest among accounting services. Total financial power in railways. Good infrastructure, work life balance and good postings. Plus lot of opportunities for deputation due to finance.IDASThis is also a good service. Lot of financial power in defence sector. Good infrastructure, work life balance and good postings. Plus lot of opportunities for deputation due to financeICASThis is more of an accounting service. It has the responsibility to consolidate accounts of all the Dept except few. Posting in Delhi. However housing, car can be an issue.IPTAFSThis service has lost lot of ground due to BSNL and MTNL separating from DoT. So major work is collecting spectrum allocation and licence fee. Infrastructure issues are also there.7. Railway servicesRailway services have good infrastructure and facilities. Housing, car and manpower is not an issue.IRTS - IRAS - IRPSIRPSNot much work, dealing with unions and personnel management .RPFI would suggest to fill it among the bottom 5 services. Its like paramilitary force (Railway Protection Force)8. IPoSGood service. Administration of all post offices. Good infra and facilities. Plus post office's are getting modernized so new work is coming up.9. IDeSThis is a service where you work as CEO of cantonments/defence estates. There is huge infrastructure at your disposal, very good facilities. However growth is stagnant, work is not dynamic. Also you will not always be working in cantonments, HQ postings and other postings are there as well.10. ICLS and ITSBoth are new age services with postings in Capital cities and Delhi. ICLS are regulators of corporate sector. They implement company law and are involved in Registration, M&A, and Liquidation etc. Service seems to have a promising future but as of now it is not much preferred. Reasons include Infrastructure problem, desk work and stagnation as the top level.IT on the other hand deals with trade policy implementation. Officers working closely with traders and exporters. Also working in SEZ, policy work and some International exposure. So work is interesting and promising.Issue with both the services is similar. These are comparatively new service & do not have a huge infrastructure compared to postal, defence and railways. So Car, housing, other facilities might be a little problem. Also at senior level stagnation issue.11. IoFSNot much of an idea but their scope is more or less related to management of ordinance factories. Infra won’t be much of an issue. But usually filled among bottom few services12. Danics & DanipsThese are like State civil services(UT civil service) with a difference that promotions are better compared to most of the states. Many people prefer them at the bottom due to Group B. However in terms of power, work, infra these are better than many group A central services.13. Indian Information ServiceThis is like a PR Job. Most IIS officers work in various media units which are under Ministry of Information and Broadcasting such as DD News, All India Radio, Press Information Bureau etc. Even posted with various Ministries as spokespersons to handle the Ministry's information and communication needs and help in policy formulation. So work wise this is a nice service, plus majorly you stay in Delhi. Infrastructure, car housing is again an issue.14. AFHQ + Pondicherry civil serviceBottom services to be filled.Now how to fill service preference listSee this is a totally personal choice depending on what you want from your life. What matters to you : balanced life ? Quality work ? Power & Infrastructure? Delhi Posting? Decide accordingly. Here are some hints based on common choice1. Most preferred services (IAS – IFS –IPS – IRS IT –IRS Customs – IRTS /IAAS) .2. Less preffered services ( AFHQ , Pondicherry civil services , RPF, IoFS, IPTAFS ,ICLS )3. Middle Category ( IRAS, IDAS, ICAS, IPOS,IDES,ITS,IIS,IRPS)As per meIRTS >IRAS>IRPSIRAS>IDAS>ICASIPOS>IDESIDAS>IDESICAS, IIS, ITS (one is accounts, other is media/PR and one relates to Trade. Usual preference is ICAS – IIS-ITS)4. Adjust DANICS & DANIPS as per your convenience. Some people prefer them after Railway, Defence and Postal while majority put it at the end. Decide as per your own choice.Delhi Posting : ICAS , IISServices where Infrastructure won’t be an issue (Apart from Most preferred services ): IRAS,IRPS,IPOS,IDES,IDAS . I think infra will not be an issue even in IOFS and RPF.3) CADRE PreferenceP.S : Totally personal views. For details you can refer here http://www.iascoachingindelhi.or...UP: great work opportunities and infrastructure. But if you don't want an exciting and challenging life, it should not be high on your list.Bihar: Mostly like UP but more backward.MP, Rajasthan, Haryana: Good cadres. Balanced ones. Usually preferred by people.Punjab: Mixed reviews about the cadre.Jharkhand and Chattisgarh, Odisha: People carry lot of misconceptions. These are nice cadres to work plus good infra. Naxal problem is prevalent only in certain areas. Other issue is these are little backward areas. But I think these are highly underrated cadres .Uttarakhand and Himachal : Decent cadres to work but terrain issues. Not everyone likes hill posting so keep that in mind.Northeast cadres : Mostly people fill them lower in their preference due to factors like distance, culture, hills, personal life etc. Assam-Megahalya is the most preferred choice among north east cadres.J&K : considered a tough posting. Hills + security concerns etc.West Bengal and Kerala : Work wise normal but their political setup is different so many people don't prefer these cadres. So decide accordingly .Andra and Telangana : Good cadres to work. North Indians prefer them most among southern states.Karnataka: fineTamil Nadu : state services is very strong here so at times they hold important posts in the district .Maharashtra : Good cadreGujarat : Mixed reviews.Agmut: mixed reviews. Good thing is you get to stay for long in Delhi.Making choicesI can’t tell you what to opt. But I can share what people preferably fill at lower preference. Again as per my knowledge.- North eastern States- J&K- Kerala and WB ( some people prefer to fill them low)Also sharing some favoured cadres due to different reasons:- Rajasthan, Haryana, MP (Delhi proximity and balanced cadres )- UP & Bihar (Strong power centres for IAS)- AGMUT (Delhi posting, but not for those who like UP , Bihar work culture )- Sorry but I am not able to comment on south Indian cadres due to lack of in depth knowledgeCadres considered bad but are actually not- Chhattisgarh and JharkhandThat is all from my side. Hopefully this post can help you to some extent. All the best

Related searches to alabama revenue forms

Create this form in 5 minutes!

How to create an eSignature for the commoffice

How to generate an eSignature for your 10 Comm Office Alabama Department Of Revenue in the online mode

How to make an electronic signature for the 10 Comm Office Alabama Department Of Revenue in Google Chrome

How to make an electronic signature for signing the 10 Comm Office Alabama Department Of Revenue in Gmail

How to create an eSignature for the 10 Comm Office Alabama Department Of Revenue right from your smartphone

How to create an eSignature for the 10 Comm Office Alabama Department Of Revenue on iOS

How to generate an electronic signature for the 10 Comm Office Alabama Department Of Revenue on Android devices

People also ask 10 comm

-

What is the pricing structure for airSlate SignNow's 10 comm. solution?

The airSlate SignNow 10 comm. solution offers flexible pricing plans that cater to businesses of all sizes. With competitive rates, you can choose from monthly or annual subscriptions, which include essential features for efficient document signing and management. Explore pricing options tailored for your specific needs to get the most value out of your investment.

-

What features does airSlate SignNow provide in its 10 comm. offering?

The 10 comm. package from airSlate SignNow includes features such as document templates, audit trails, and customizable workflows. These tools help streamline the eSigning process, ensuring that your team can manage documents efficiently while maintaining compliance. Enhance productivity with these powerful features designed for modern businesses.

-

How does airSlate SignNow support remote work through its 10 comm. solution?

With the airSlate SignNow 10 comm. solution, remote teams can collaborate seamlessly on documents from anywhere. The platform allows users to eSign and manage documents online, reducing the need for physical paperwork. This flexibility not only saves time but also helps your organization maintain productivity regardless of location.

-

Are there integrations available with airSlate SignNow's 10 comm. solution?

Yes, airSlate SignNow's 10 comm. solution offers a variety of integrations with popular business applications. You can connect with tools like Google Drive, Salesforce, and Dropbox, enhancing your team’s workflow. These integrations make it easy to access and manage documents within the platforms you already use.

-

What are the benefits of using airSlate SignNow's 10 comm. solution?

The key benefits of using airSlate SignNow's 10 comm. solution include increased efficiency, enhanced security, and improved compliance. By digitizing your document workflows, you reduce turnaround times and minimize the risk of errors. Additionally, robust encryption and audit trails ensure that your documents remain secure and compliant with industry standards.

-

Can I try airSlate SignNow’s 10 comm. solution before committing?

Absolutely! airSlate SignNow offers a free trial for the 10 comm. solution, allowing prospective customers to explore its features risk-free. This trial period lets you test the functionality and determine how it fits your business needs before making a financial commitment. Take advantage of this opportunity to see the benefits firsthand.

-

Is airSlate SignNow’s 10 comm. solution suitable for small businesses?

Yes, airSlate SignNow's 10 comm. solution is designed to cater to businesses of all sizes, including small enterprises. Its cost-effective pricing and straightforward features make it accessible for small teams looking to streamline their document processes. By adopting this solution, small businesses can enhance their operational efficiency without breaking the bank.

Get more for alabama department of revenue

Find out other alabama department of revenue forms

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document