RI 4868PT Qxp Tax Ri Form

What is the RI 4868PT qxp Tax Ri

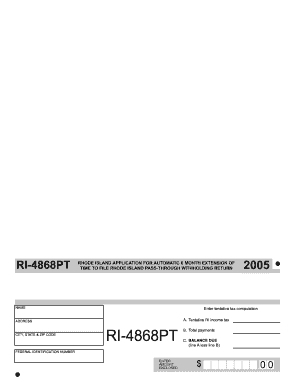

The RI 4868PT qxp Tax Ri is a state-specific tax form used in Rhode Island for requesting an extension of time to file personal income tax returns. This form is crucial for taxpayers who need additional time beyond the standard deadline to prepare their tax documents. By submitting the RI 4868PT qxp, individuals can avoid late filing penalties, provided they pay any estimated taxes owed by the original due date. It is important to note that this form does not extend the time to pay taxes due; it only extends the filing deadline.

Steps to complete the RI 4868PT qxp Tax Ri

Completing the RI 4868PT qxp Tax Ri involves several straightforward steps:

- Obtain the form: Download the RI 4868PT qxp from the Rhode Island Division of Taxation website or access it through authorized tax software.

- Fill in your personal information: Enter your name, address, and Social Security number accurately.

- Estimate your tax liability: Calculate the amount of tax you expect to owe for the year. This estimation is vital for avoiding underpayment penalties.

- Indicate payment: If you owe taxes, include the payment with your form submission to ensure compliance with state regulations.

- Review and sign: Double-check all entries for accuracy, then sign and date the form.

- Submit the form: File the completed RI 4868PT qxp by mail or electronically, depending on your preference and available options.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the RI 4868PT qxp is essential for compliance. The form must be submitted by the original due date of the personal income tax return, which is typically April 15. If this date falls on a weekend or holiday, the deadline is extended to the next business day. Additionally, if you anticipate owing taxes, payments should be made by this date to avoid penalties and interest charges. Keeping track of these deadlines helps ensure a smooth filing process.

Legal use of the RI 4868PT qxp Tax Ri

The RI 4868PT qxp Tax Ri is legally recognized by the Rhode Island Division of Taxation as a valid request for an extension to file personal income tax returns. It is important to use the form correctly to avoid potential legal issues. Taxpayers must ensure that they meet the eligibility criteria and adhere to the filing deadlines. Failure to comply with the legal requirements associated with this form can lead to penalties, including late fees and interest on unpaid taxes.

Required Documents

When filing the RI 4868PT qxp, certain documents may be necessary to support your request for an extension. These documents include:

- Your previous year’s tax return for reference.

- Any W-2 forms or 1099 forms that report income for the current tax year.

- Documentation of any estimated tax payments made for the current year.

Having these documents on hand ensures that you can accurately estimate your tax liability and complete the form correctly.

Examples of using the RI 4868PT qxp Tax Ri

There are various scenarios in which a taxpayer might find the RI 4868PT qxp useful. For instance:

- A self-employed individual may need extra time to gather income and expense records before filing their return.

- A taxpayer who has experienced a significant life event, such as a marriage or divorce, may require additional time to navigate the complexities of their new tax situation.

- Individuals who are waiting for important tax documents, such as K-1 forms from partnerships, can use this form to avoid penalties while they wait.

Quick guide on how to complete ri 4868pt qxp tax ri

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, alter, and eSign your documents promptly and without delays. Handle [SKS] on any device with the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The Easiest Way to Alter and eSign [SKS] Without Stress

- Locate [SKS] and click on Get Form to commence.

- Use the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to submit your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] and ensure excellent communication at every step of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to RI 4868PT qxp Tax Ri

Create this form in 5 minutes!

How to create an eSignature for the ri 4868pt qxp tax ri

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the RI 4868PT qxp Tax Ri form?

The RI 4868PT qxp Tax Ri form is an application for an extension of time to file your Rhode Island personal income tax return. This form allows taxpayers to request additional time to prepare their tax documents without incurring penalties. Understanding this form is crucial for timely tax compliance.

-

How can airSlate SignNow help with the RI 4868PT qxp Tax Ri form?

airSlate SignNow simplifies the process of completing and eSigning the RI 4868PT qxp Tax Ri form. Our platform allows users to fill out the form electronically, ensuring accuracy and efficiency. With our solution, you can easily manage your tax documents from anywhere.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. Our plans are designed to be cost-effective while providing access to essential features for managing documents like the RI 4868PT qxp Tax Ri form. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides a range of features including eSigning, document templates, and secure storage. These features streamline the process of handling important documents such as the RI 4868PT qxp Tax Ri form. Our user-friendly interface makes it easy for anyone to manage their documents efficiently.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your sensitive tax documents, including the RI 4868PT qxp Tax Ri form, are protected. We utilize advanced encryption and security protocols to safeguard your information. You can trust our platform for secure document management.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow offers integrations with various software applications to enhance your workflow. This includes popular tools that can help you manage your tax documents, such as accounting software, making it easier to handle forms like the RI 4868PT qxp Tax Ri.

-

What are the benefits of using airSlate SignNow for tax forms?

Using airSlate SignNow for tax forms like the RI 4868PT qxp Tax Ri provides numerous benefits, including time savings and improved accuracy. Our platform allows for quick eSigning and easy document sharing, which can signNowly streamline your tax preparation process. Experience hassle-free document management with us.

Get more for RI 4868PT qxp Tax Ri

Find out other RI 4868PT qxp Tax Ri

- eSign Montana Domain Name Registration Agreement Now

- eSign Nevada Affiliate Program Agreement Secure

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement

- How To eSign Hawaii Employee confidentiality agreement

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free