RI 8453 Tax Ri Form

What is the RI 8453 Tax Ri

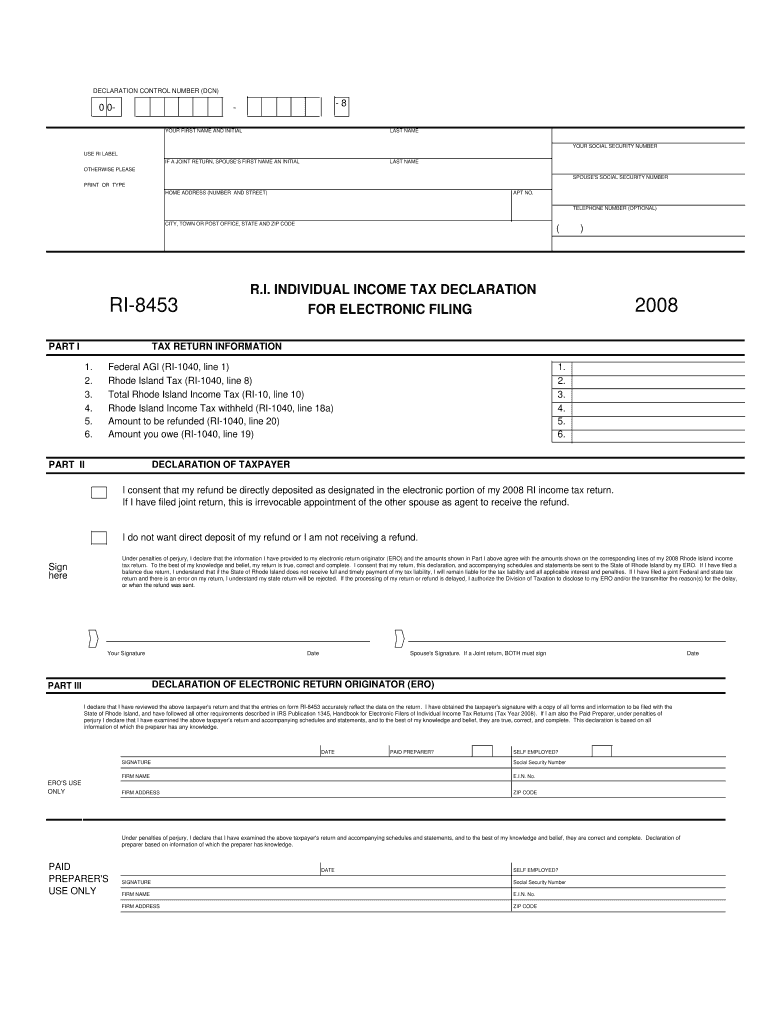

The RI 8453 Tax Ri is a form used by taxpayers in Rhode Island to authorize the electronic filing of their state tax returns. This form serves as a declaration of the taxpayer's intent to file electronically and provides necessary consent for the transmission of tax information to the Rhode Island Division of Taxation. It is essential for ensuring that the electronic submission complies with state regulations and that the taxpayer's identity is verified.

How to use the RI 8453 Tax Ri

Using the RI 8453 Tax Ri involves several straightforward steps. First, ensure you have all relevant tax information ready, including your Social Security number and any income documentation. Next, fill out the form accurately, providing all required details. After completing the form, you will need to sign it electronically. This signature confirms your consent for the electronic filing of your tax return. Finally, submit the form along with your electronic tax return to the appropriate tax authority.

Steps to complete the RI 8453 Tax Ri

Completing the RI 8453 Tax Ri requires careful attention to detail. Follow these steps for accurate completion:

- Gather all necessary personal and financial information.

- Access the RI 8453 Tax Ri form through the Rhode Island Division of Taxation website or your tax software.

- Fill in your name, Social Security number, and other required details.

- Review the information for accuracy and completeness.

- Electronically sign the form to validate your consent.

- Submit the form along with your electronic tax return.

Legal use of the RI 8453 Tax Ri

The RI 8453 Tax Ri is legally mandated for taxpayers who choose to file their state tax returns electronically. By submitting this form, taxpayers comply with state laws that require electronic filers to authenticate their identity and consent to the electronic submission of their tax information. Failure to use this form when required may result in delays in processing tax returns or potential penalties.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the RI 8453 Tax Ri. Typically, the deadline for filing state tax returns in Rhode Island aligns with the federal tax return deadline, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. Always check the Rhode Island Division of Taxation's announcements for any changes or specific dates relevant to the current tax year.

Required Documents

To complete the RI 8453 Tax Ri accurately, you will need several documents. These include:

- Your Social Security number or Individual Taxpayer Identification Number (ITIN).

- Income statements, such as W-2s or 1099s.

- Any relevant deductions or credits documentation.

- Previous tax returns for reference, if applicable.

Form Submission Methods

The RI 8453 Tax Ri can be submitted electronically through tax preparation software that supports Rhode Island tax filings. This method is the most efficient and ensures that your form is processed quickly. Additionally, if you prefer, you may also print the form and submit it via mail, though electronic submission is recommended for faster processing.

Quick guide on how to complete ri 8453 tax ri

Effortlessly Prepare RI 8453 Tax Ri on Any Device

Managing documents online has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the right form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without any hold-ups. Handle RI 8453 Tax Ri on any device using the airSlate SignNow apps for Android or iOS and enhance your document-related processes today.

The Easiest Way to Edit and Electronically Sign RI 8453 Tax Ri

- Obtain RI 8453 Tax Ri and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your updates.

- Choose your preferred method for sending your form—via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign RI 8453 Tax Ri to ensure seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ri 8453 tax ri

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the RI 8453 Tax Ri form and why is it important?

The RI 8453 Tax Ri form is a crucial document for taxpayers in Rhode Island, allowing for the electronic submission of tax returns. It serves as a declaration that the information provided is accurate and complete. Understanding its importance can help ensure compliance with state tax regulations.

-

How can airSlate SignNow help with the RI 8453 Tax Ri form?

airSlate SignNow simplifies the process of signing and submitting the RI 8453 Tax Ri form electronically. With our platform, users can easily eSign documents, ensuring a quick and secure submission. This streamlines the tax filing process, saving time and reducing errors.

-

What are the pricing options for using airSlate SignNow for RI 8453 Tax Ri?

airSlate SignNow offers flexible pricing plans to accommodate various business needs, including options for individuals and enterprises. Our cost-effective solutions ensure that you can manage your RI 8453 Tax Ri submissions without breaking the bank. Check our website for detailed pricing information.

-

Are there any features specifically designed for handling the RI 8453 Tax Ri?

Yes, airSlate SignNow includes features tailored for the RI 8453 Tax Ri, such as customizable templates and automated workflows. These tools help users efficiently manage their tax documents and ensure compliance with state requirements. Our platform is designed to enhance your document management experience.

-

What benefits does airSlate SignNow provide for eSigning the RI 8453 Tax Ri?

Using airSlate SignNow for eSigning the RI 8453 Tax Ri offers numerous benefits, including enhanced security and faster processing times. Our platform ensures that your documents are securely signed and stored, reducing the risk of fraud. Additionally, you can track the status of your submissions in real-time.

-

Can airSlate SignNow integrate with other software for RI 8453 Tax Ri management?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and tax software, making it easier to manage your RI 8453 Tax Ri submissions. This integration allows for a more streamlined workflow, reducing the need for manual data entry and improving overall efficiency.

-

Is airSlate SignNow user-friendly for those unfamiliar with the RI 8453 Tax Ri process?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it accessible even for those unfamiliar with the RI 8453 Tax Ri process. Our intuitive interface guides users through each step, ensuring a smooth experience. Comprehensive support resources are also available to assist you.

Get more for RI 8453 Tax Ri

Find out other RI 8453 Tax Ri

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament