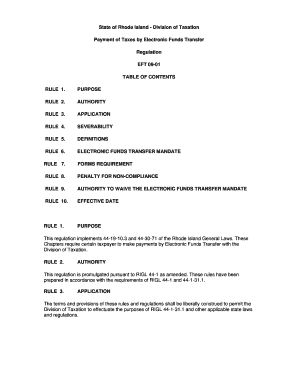

Division of Taxation Payment of Taxes by Electronic Funds Transfer Form

Understanding the Division Of Taxation Payment Of Taxes By Electronic Funds Transfer

The Division Of Taxation Payment Of Taxes By Electronic Funds Transfer (EFT) is a method that allows taxpayers to pay their taxes electronically. This system is designed to streamline the payment process, making it more efficient and secure. By using EFT, individuals and businesses can transfer funds directly from their bank accounts to the tax authority, reducing the need for paper checks and manual processing.

Taxpayers can benefit from this method as it offers immediate confirmation of payment, which can help in tracking and managing tax obligations. Additionally, using EFT can minimize the risk of late payments, as transactions are processed quickly and efficiently.

How to Use the Division Of Taxation Payment Of Taxes By Electronic Funds Transfer

To utilize the Division Of Taxation Payment Of Taxes By Electronic Funds Transfer, taxpayers must first ensure they are registered for EFT payments. This typically involves providing banking information and setting up an account with the tax authority. Once registered, taxpayers can initiate payments through the designated online portal or by using specific software that supports EFT transactions.

It is essential to verify that all information entered is accurate to avoid delays or errors in processing. Taxpayers should also keep records of their transactions for future reference and to ensure compliance with tax obligations.

Steps to Complete the Division Of Taxation Payment Of Taxes By Electronic Funds Transfer

Completing the Division Of Taxation Payment Of Taxes By Electronic Funds Transfer involves several key steps:

- Register for EFT payments with the tax authority, providing necessary banking details.

- Log into the online payment portal or use compatible software.

- Select the type of tax payment you wish to make.

- Enter the payment amount and confirm your banking information.

- Submit the payment and save the confirmation for your records.

Following these steps ensures a smooth and efficient payment process, helping taxpayers meet their obligations on time.

Required Documents for the Division Of Taxation Payment Of Taxes By Electronic Funds Transfer

When preparing to use the Division Of Taxation Payment Of Taxes By Electronic Funds Transfer, certain documents may be required. Taxpayers should have the following ready:

- Bank account information, including account number and routing number.

- Tax identification number (TIN) or Social Security number (SSN).

- Details of the tax period for which the payment is being made.

- Any relevant tax forms that may need to accompany the payment.

Having these documents on hand can facilitate a smoother transaction process and ensure compliance with tax regulations.

IRS Guidelines for Electronic Funds Transfer

The Internal Revenue Service (IRS) provides specific guidelines regarding the use of Electronic Funds Transfer for tax payments. Taxpayers should be aware that EFT payments must be initiated by the due date to avoid penalties. The IRS also recommends that taxpayers confirm their payment status to ensure that the transaction has been processed successfully.

Additionally, the IRS outlines the types of taxes that can be paid via EFT, which may include income taxes, estimated taxes, and employment taxes. Familiarity with these guidelines helps taxpayers navigate their obligations effectively.

Penalties for Non-Compliance with EFT Payments

Failure to comply with the requirements for the Division Of Taxation Payment Of Taxes By Electronic Funds Transfer can result in penalties. Taxpayers who do not make timely payments may face interest charges and late fees, which can accumulate over time. It is crucial to adhere to deadlines and ensure that payments are processed correctly to avoid these financial repercussions.

Understanding the potential penalties associated with non-compliance can motivate taxpayers to prioritize their tax obligations and utilize the EFT system effectively.

Quick guide on how to complete division of taxation payment of taxes by electronic funds transfer

Prepare Division Of Taxation Payment Of Taxes By Electronic Funds Transfer effortlessly on any device

Digital document management has become increasingly favored among companies and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Division Of Taxation Payment Of Taxes By Electronic Funds Transfer on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

The easiest way to modify and eSign Division Of Taxation Payment Of Taxes By Electronic Funds Transfer with ease

- Locate Division Of Taxation Payment Of Taxes By Electronic Funds Transfer and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Adjust and eSign Division Of Taxation Payment Of Taxes By Electronic Funds Transfer and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the division of taxation payment of taxes by electronic funds transfer

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Division Of Taxation Payment Of Taxes By Electronic Funds Transfer?

The Division Of Taxation Payment Of Taxes By Electronic Funds Transfer is a method that allows taxpayers to pay their taxes electronically, ensuring a secure and efficient transaction process. This system simplifies the payment process, reducing the need for paper checks and manual processing. By using electronic funds transfer, taxpayers can ensure timely payments and avoid late fees.

-

How does airSlate SignNow facilitate the Division Of Taxation Payment Of Taxes By Electronic Funds Transfer?

airSlate SignNow streamlines the process of the Division Of Taxation Payment Of Taxes By Electronic Funds Transfer by providing a user-friendly platform for document management and eSigning. Users can easily create, send, and sign documents related to tax payments electronically. This not only saves time but also enhances the accuracy of submissions.

-

What are the benefits of using airSlate SignNow for tax payments?

Using airSlate SignNow for the Division Of Taxation Payment Of Taxes By Electronic Funds Transfer offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows for quick document turnaround and ensures that all transactions are securely processed. Additionally, users can track their documents and payments in real-time.

-

Is there a cost associated with using airSlate SignNow for tax payments?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be a cost-effective solution for businesses. Pricing plans vary based on the features and number of users, ensuring that you can find a plan that fits your needs. The investment in airSlate SignNow can lead to signNow savings in time and resources when managing the Division Of Taxation Payment Of Taxes By Electronic Funds Transfer.

-

Can airSlate SignNow integrate with other financial software for tax payments?

Absolutely! airSlate SignNow offers integrations with various financial software, making it easier to manage the Division Of Taxation Payment Of Taxes By Electronic Funds Transfer. These integrations allow for seamless data transfer and help maintain accurate records across platforms. This ensures that your tax payment processes are efficient and well-coordinated.

-

How secure is the Division Of Taxation Payment Of Taxes By Electronic Funds Transfer with airSlate SignNow?

Security is a top priority for airSlate SignNow, especially when it comes to the Division Of Taxation Payment Of Taxes By Electronic Funds Transfer. The platform employs advanced encryption and security protocols to protect sensitive information during transactions. Users can have peace of mind knowing that their tax payment data is secure and confidential.

-

What types of documents can be managed through airSlate SignNow for tax payments?

airSlate SignNow allows users to manage a variety of documents related to the Division Of Taxation Payment Of Taxes By Electronic Funds Transfer, including payment authorizations, tax forms, and receipts. The platform supports various file formats, making it easy to upload and share necessary documents. This flexibility helps streamline the entire tax payment process.

Get more for Division Of Taxation Payment Of Taxes By Electronic Funds Transfer

- Motivation assessment scale 395300766 form

- Human form human function essentials of anatomy physiology pdf

- Frankenstein philip pullman read online form

- Certificate of embracing islam form

- Roofing invoice for insurance form

- Gmac atpi form

- Winemaking log template excel 479759062 form

- Language techniques list form

Find out other Division Of Taxation Payment Of Taxes By Electronic Funds Transfer

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation