Use This Form to Apply for Certification of Rehabilitation Work on a Certified Historic Residential Structure,' in Accordan

Understanding the Certification of Rehabilitation Work Form

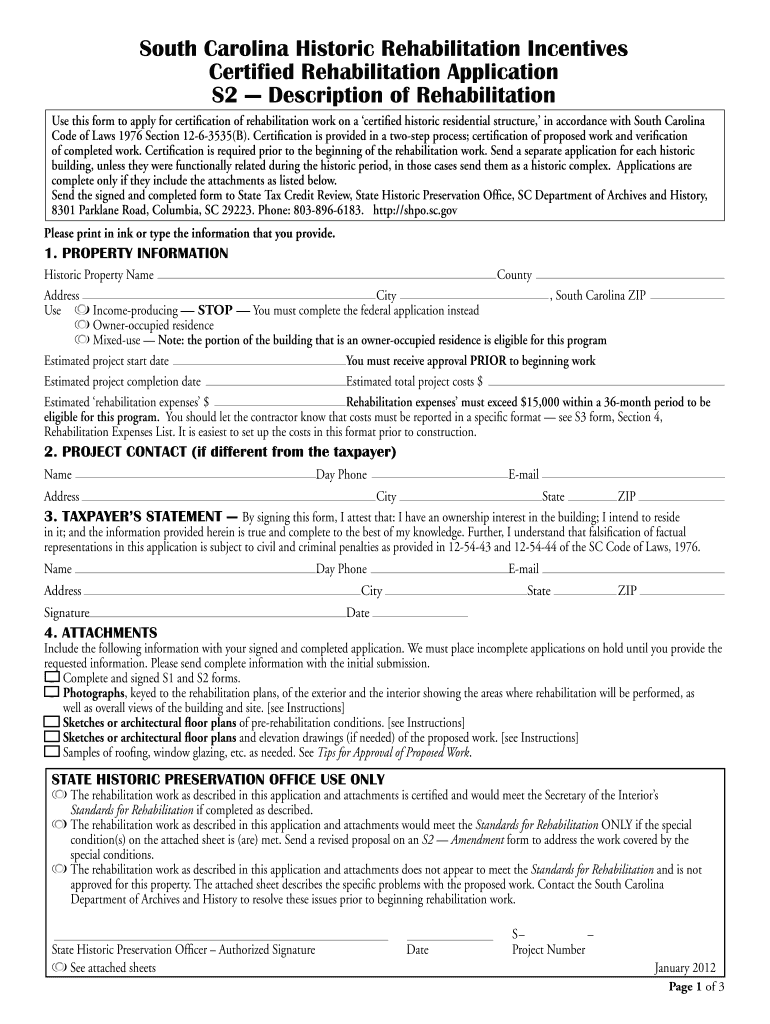

The form to apply for certification of rehabilitation work on a certified historic residential structure is a crucial document for property owners in South Carolina. This form is designed to comply with the South Carolina Code of Laws 1976, specifically Section 12-6-3535B, which outlines the requirements for obtaining tax credits related to the rehabilitation of historic properties. By completing this form, applicants can demonstrate that their rehabilitation work meets the necessary standards set forth by the State Historic Preservation Office (SHPO).

How to Complete the Rehabilitation Work Certification Form

Completing the form requires careful attention to detail. Applicants should begin by gathering all necessary information regarding the property, including its historic designation and the scope of rehabilitation work performed. The form typically requires details such as the property address, a description of the work completed, and supporting documentation, like photographs and receipts. It is essential to ensure that all information is accurate and complete to avoid delays in processing.

Key Elements of the Rehabilitation Work Certification Form

Several key elements must be included in the form to ensure compliance with state regulations. These include:

- Property Information: Full address and historic designation.

- Description of Work: Detailed account of the rehabilitation activities performed.

- Supporting Documentation: Photographs and financial records that validate the work completed.

- Signatures: Required signatures from property owners and possibly contractors involved in the work.

Eligibility Criteria for Certification

To be eligible for certification, the property must be a certified historic structure as defined by state law. Additionally, the rehabilitation work must adhere to the Secretary of the Interior's Standards for Rehabilitation. This means that the work should preserve the historic character of the property while allowing for necessary updates and improvements. Applicants should review these criteria carefully to ensure their project qualifies.

Submission Methods for the Rehabilitation Work Certification Form

The completed form can typically be submitted through various methods, including:

- Online Submission: Some jurisdictions may allow for digital submission through official state portals.

- Mail: Applicants can send the completed form and supporting documents via postal mail to the appropriate SHPO office.

- In-Person: Submitting the form in person may also be an option, allowing for direct communication with SHPO staff.

Important Dates and Filing Deadlines

It is crucial for applicants to be aware of any filing deadlines associated with the certification process. These dates can vary depending on the specific tax year and the nature of the rehabilitation work. Keeping track of these deadlines ensures that applicants do not miss out on potential tax credits or benefits.

Quick guide on how to complete use this form to apply for certification of rehabilitation work on a certified historic residential structure in accordance

Effortlessly prepare [SKS] on any gadget

Digital document management has become favored by organizations and individuals alike. It offers an excellent environmentally friendly alternative to conventional printed and signed paperwork, allowing you to find the appropriate template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, alter, and electronically sign your documents swiftly without holdups. Handle [SKS] on any device with airSlate SignNow apps for Android or iOS and simplify any document-related tasks today.

The simplest way to modify and electronically sign [SKS] effortlessly

- Find [SKS] and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Highlight important sections of the documents or obscure sensitive details using the tools that airSlate SignNow offers specifically for this purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, laborious form searching, or mistakes that require printing out new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you choose. Edit and electronically sign [SKS] and ensure outstanding communication at any stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Use This Form To Apply For Certification Of Rehabilitation Work On A Certified Historic Residential Structure,' In Accordan

Create this form in 5 minutes!

How to create an eSignature for the use this form to apply for certification of rehabilitation work on a certified historic residential structure in accordance

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the form for certification of rehabilitation work?

The form is designed to help property owners apply for certification of rehabilitation work on a certified historic residential structure. Use This Form To Apply For Certification Of Rehabilitation Work On A Certified Historic Residential Structure, In Accordance With South Carolina Code Of Laws 1976 Section 12 6 3535B Shpo Sc, to ensure compliance with state regulations and to potentially qualify for tax incentives.

-

How do I complete the application process?

To complete the application process, you must fill out the designated form accurately and provide all required documentation. Use This Form To Apply For Certification Of Rehabilitation Work On A Certified Historic Residential Structure, In Accordance With South Carolina Code Of Laws 1976 Section 12 6 3535B Shpo Sc, to ensure that you meet all necessary criteria for approval.

-

Are there any fees associated with the application?

Yes, there may be fees associated with the application for certification of rehabilitation work. It is important to review the specific costs outlined in the guidelines provided by the South Carolina SHPO. Use This Form To Apply For Certification Of Rehabilitation Work On A Certified Historic Residential Structure, In Accordance With South Carolina Code Of Laws 1976 Section 12 6 3535B Shpo Sc, to understand all financial obligations.

-

What are the benefits of obtaining certification?

Obtaining certification can provide signNow benefits, including eligibility for state tax credits and grants for rehabilitation projects. This can greatly reduce the financial burden of restoring a historic property. Use This Form To Apply For Certification Of Rehabilitation Work On A Certified Historic Residential Structure, In Accordance With South Carolina Code Of Laws 1976 Section 12 6 3535B Shpo Sc, to access these potential benefits.

-

How long does the certification process take?

The certification process duration can vary based on the completeness of your application and the volume of submissions being processed. Typically, it may take several weeks to a few months. Use This Form To Apply For Certification Of Rehabilitation Work On A Certified Historic Residential Structure, In Accordance With South Carolina Code Of Laws 1976 Section 12 6 3535B Shpo Sc, to ensure a smooth and timely review.

-

Can I track the status of my application?

Yes, applicants can often track the status of their application through the South Carolina SHPO website or by contacting their office directly. Keeping your application details handy will help in this process. Use This Form To Apply For Certification Of Rehabilitation Work On A Certified Historic Residential Structure, In Accordance With South Carolina Code Of Laws 1976 Section 12 6 3535B Shpo Sc, to facilitate any inquiries.

-

What types of structures are eligible for certification?

Eligible structures typically include residential properties that are recognized as historic by the state. The property must meet specific criteria outlined by the South Carolina SHPO. Use This Form To Apply For Certification Of Rehabilitation Work On A Certified Historic Residential Structure, In Accordance With South Carolina Code Of Laws 1976 Section 12 6 3535B Shpo Sc, to determine if your structure qualifies.

Get more for Use This Form To Apply For Certification Of Rehabilitation Work On A Certified Historic Residential Structure,' In Accordan

Find out other Use This Form To Apply For Certification Of Rehabilitation Work On A Certified Historic Residential Structure,' In Accordan

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF