Beneficiary's Share of Minnesota Taxable Income Revenue State Mn Form

What is the Beneficiary's Share of Minnesota Taxable Income?

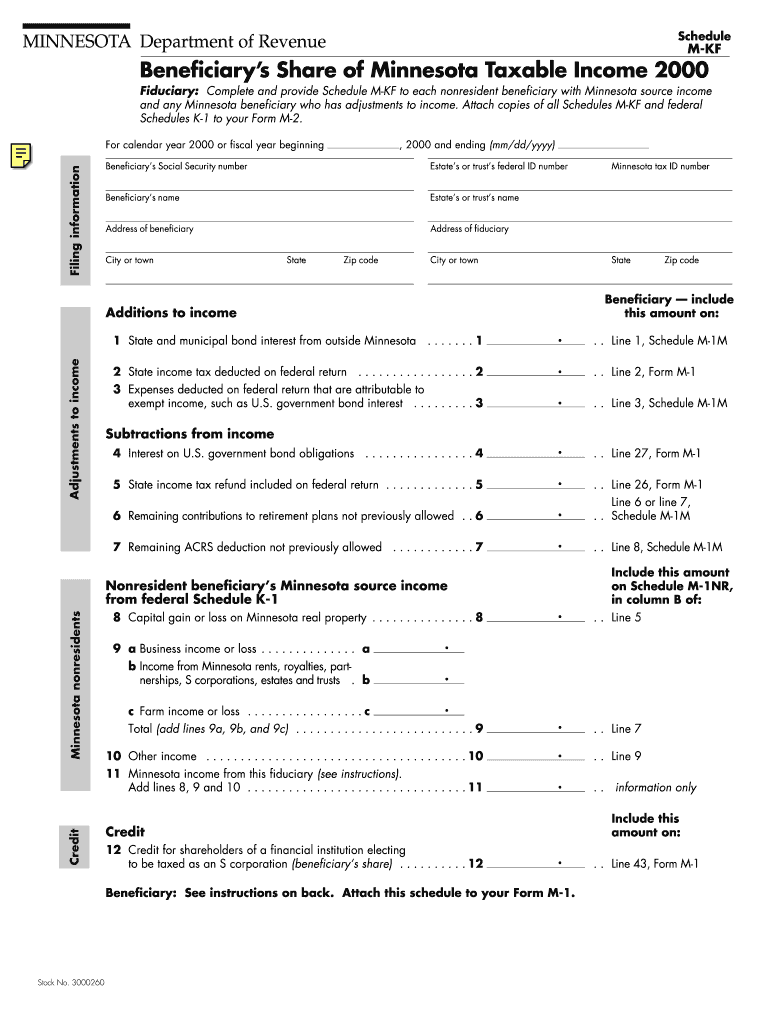

The Beneficiary's Share of Minnesota Taxable Income is a form used to report the income that beneficiaries receive from trusts or estates for tax purposes. This form is essential for ensuring that beneficiaries accurately report their share of income on their individual tax returns. In Minnesota, the taxability of this income is determined by state law, and the form helps clarify how much of the income is subject to state taxation.

How to Use the Beneficiary's Share of Minnesota Taxable Income

To use this form effectively, beneficiaries must first gather all relevant financial information regarding the trust or estate from which they are receiving income. This includes details about distributions, deductions, and any applicable credits. Once the necessary data is compiled, beneficiaries can fill out the form by entering their share of the taxable income as indicated in the trust or estate's accounting records. It is crucial to ensure that the information is accurate to avoid issues with the Minnesota Department of Revenue.

Steps to Complete the Beneficiary's Share of Minnesota Taxable Income

Completing the Beneficiary's Share of Minnesota Taxable Income involves several key steps:

- Gather all financial documents related to the trust or estate.

- Identify your share of the taxable income as provided by the trustee or estate administrator.

- Fill out the form, ensuring all entries are accurate and complete.

- Review the form for any errors before submission.

- Submit the completed form to the appropriate state tax authority by the designated deadline.

Key Elements of the Beneficiary's Share of Minnesota Taxable Income

Important elements of this form include the identification of the beneficiary, the amount of income received, and any deductions that may apply. Beneficiaries must also provide information about the trust or estate, including its name and taxpayer identification number. Understanding these elements is crucial for accurate reporting and compliance with Minnesota tax laws.

State-Specific Rules for the Beneficiary's Share of Minnesota Taxable Income

In Minnesota, specific rules govern how beneficiaries report their share of taxable income. These rules include guidelines on what constitutes taxable income, allowable deductions, and the treatment of distributions. Beneficiaries should be aware of any changes to state tax laws that may affect their reporting obligations, as these can vary from year to year.

Filing Deadlines / Important Dates

Beneficiaries must be mindful of filing deadlines associated with the Beneficiary's Share of Minnesota Taxable Income. Typically, the form must be submitted by the same deadline as individual state tax returns. It is advisable to check the Minnesota Department of Revenue's official calendar for specific dates and any potential extensions that may apply.

Quick guide on how to complete beneficiary39s share of minnesota taxable income revenue state mn

Effortlessly Prepare [SKS] on Any Device

Managing documents online has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, adjust, and electronically sign your documents swiftly without delays. Manage [SKS] on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to Alter and Electronically Sign [SKS] Smoothly

- Obtain [SKS] and then click Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive data with tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the worries of misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Alter and electronically sign [SKS] and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn

Create this form in 5 minutes!

How to create an eSignature for the beneficiary39s share of minnesota taxable income revenue state mn

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn?

The Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn refers to the portion of taxable income that beneficiaries must report for state tax purposes. Understanding this concept is crucial for accurate tax filing and compliance in Minnesota.

-

How can airSlate SignNow help with managing tax documents related to the Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn?

airSlate SignNow provides a streamlined platform for sending and eSigning tax documents, ensuring that all paperwork related to the Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn is handled efficiently. This reduces the risk of errors and enhances compliance with state regulations.

-

What are the pricing options for airSlate SignNow when dealing with tax-related documents?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Whether you need basic features or advanced functionalities for managing the Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn, there is a plan that fits your budget.

-

What features does airSlate SignNow offer for tax document management?

Key features of airSlate SignNow include customizable templates, secure eSigning, and document tracking. These tools are particularly useful for managing documents related to the Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn, ensuring that you stay organized and compliant.

-

Can airSlate SignNow integrate with other accounting software for tax purposes?

Yes, airSlate SignNow seamlessly integrates with various accounting and tax software. This integration is beneficial for managing the Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn, allowing for easy data transfer and improved workflow efficiency.

-

What are the benefits of using airSlate SignNow for tax document eSigning?

Using airSlate SignNow for eSigning tax documents offers numerous benefits, including enhanced security, reduced turnaround time, and improved accuracy. This is especially important when dealing with the Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn, as timely and correct submissions are crucial.

-

Is airSlate SignNow compliant with Minnesota tax regulations?

Absolutely, airSlate SignNow is designed to comply with various state regulations, including those pertaining to the Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn. This compliance ensures that your documents meet legal standards and reduces the risk of penalties.

Get more for Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn

- Management personnel plan mpp employee performance

- Application for admission lsu e j ourso college of business form

- Can a thesis chapter be coauthoredscientist sees squirrel form

- Incident report formstudentsvisitors nova

- Financial info form 14pmd international admissions

- Data sheet university of arkansas form

- Unrelated business income tax ampquotubitampquottax department form

- Official function form university of arkansas

Find out other Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn

- How Can I eSignature New Mexico Letter of Intent

- Can I eSign Colorado Startup Business Plan Template

- eSign Massachusetts Startup Business Plan Template Online

- eSign New Hampshire Startup Business Plan Template Online

- How To eSign New Jersey Startup Business Plan Template

- eSign New York Startup Business Plan Template Online

- eSign Colorado Income Statement Quarterly Mobile

- eSignature Nebraska Photo Licensing Agreement Online

- How To eSign Arizona Profit and Loss Statement

- How To eSign Hawaii Profit and Loss Statement

- How To eSign Illinois Profit and Loss Statement

- How To eSign New York Profit and Loss Statement

- How To eSign Ohio Profit and Loss Statement

- How Do I eSign Ohio Non-Compete Agreement

- eSign Utah Non-Compete Agreement Online

- eSign Tennessee General Partnership Agreement Mobile

- eSign Alaska LLC Operating Agreement Fast

- How Can I eSign Hawaii LLC Operating Agreement

- eSign Indiana LLC Operating Agreement Fast

- eSign Michigan LLC Operating Agreement Fast