Schedule M1lti Long Term Care Insurance Credit Form

What is the Schedule M1lti Long Term Care Insurance Credit

The Schedule M1lti Long Term Care Insurance Credit is a tax credit designed to assist taxpayers in offsetting the costs associated with long-term care insurance premiums. This credit is available to individuals who have purchased qualifying long-term care insurance policies. It aims to provide financial relief to those planning for potential long-term care needs, thereby encouraging the purchase of insurance that can help cover future healthcare expenses.

How to use the Schedule M1lti Long Term Care Insurance Credit

To utilize the Schedule M1lti Long Term Care Insurance Credit, taxpayers must first determine their eligibility based on the type of long-term care insurance they hold. After confirming eligibility, individuals can complete the necessary sections on their tax return, specifically the Schedule M1lti form, where they will report the premiums paid during the tax year. This information will then be used to calculate the credit amount that can be claimed against their tax liability.

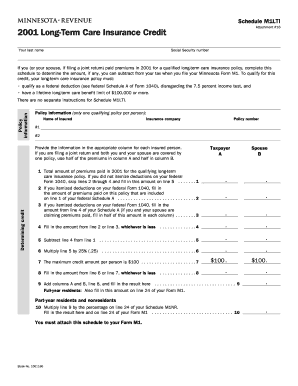

Steps to complete the Schedule M1lti Long Term Care Insurance Credit

Completing the Schedule M1lti Long Term Care Insurance Credit involves several key steps:

- Gather documentation of long-term care insurance premiums paid during the tax year.

- Review the eligibility criteria for the credit to ensure compliance.

- Fill out the Schedule M1lti form, providing accurate figures for the premiums.

- Calculate the credit amount based on the provided information.

- Attach the completed form to your tax return before submission.

Eligibility Criteria

Eligibility for the Schedule M1lti Long Term Care Insurance Credit typically includes individuals who have purchased long-term care insurance policies that meet specific state and federal guidelines. The policies must provide coverage for qualified long-term care services and must be in force during the tax year for which the credit is being claimed. Additionally, there may be age and income restrictions that affect eligibility, which should be reviewed carefully.

Required Documents

To successfully claim the Schedule M1lti Long Term Care Insurance Credit, taxpayers must provide certain documentation. This includes:

- Proof of premium payments for long-term care insurance, such as invoices or statements from the insurance provider.

- Completed Schedule M1lti form, accurately filled out with all necessary information.

- Any additional documentation required by the state tax authority to verify eligibility and premium amounts.

Filing Deadlines / Important Dates

Taxpayers should be aware of specific filing deadlines related to the Schedule M1lti Long Term Care Insurance Credit. Typically, the deadline for submitting tax returns, including any claims for credits, aligns with the federal tax filing deadline, which is usually April 15. However, it is essential to verify if there are any state-specific deadlines or extensions that may apply to the filing of the Schedule M1lti form.

Quick guide on how to complete schedule m1lti long term care insurance credit

Complete [SKS] effortlessly on any device

Web-based document management has become popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents swiftly without complications. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign [SKS] without breaking a sweat

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to submit your form, via email, SMS, invitation link, or download it onto your PC.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Alter and eSign [SKS] and guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule M1lti Long Term Care Insurance Credit

Create this form in 5 minutes!

How to create an eSignature for the schedule m1lti long term care insurance credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule M1lti Long Term Care Insurance Credit?

The Schedule M1lti Long Term Care Insurance Credit is a tax credit designed to help individuals offset the costs associated with long-term care insurance. This credit can signNowly reduce your tax liability, making it easier to manage the expenses of long-term care. Understanding this credit is essential for anyone considering long-term care insurance options.

-

How can I apply for the Schedule M1lti Long Term Care Insurance Credit?

To apply for the Schedule M1lti Long Term Care Insurance Credit, you need to complete the appropriate tax forms during your annual tax filing. Ensure that you have all necessary documentation regarding your long-term care insurance premiums. Consulting with a tax professional can also help streamline the application process.

-

What are the eligibility requirements for the Schedule M1lti Long Term Care Insurance Credit?

Eligibility for the Schedule M1lti Long Term Care Insurance Credit typically requires that you have a qualifying long-term care insurance policy. Additionally, there may be income limits and other criteria that must be met. It's important to review the specific requirements outlined by your tax authority to ensure you qualify.

-

What benefits does the Schedule M1lti Long Term Care Insurance Credit provide?

The Schedule M1lti Long Term Care Insurance Credit provides signNow financial relief by reducing your taxable income. This can lead to substantial savings on your overall tax bill. By utilizing this credit, you can make long-term care more affordable and accessible.

-

Are there any limitations on the Schedule M1lti Long Term Care Insurance Credit?

Yes, there are limitations on the Schedule M1lti Long Term Care Insurance Credit, including caps on the amount of premiums that can be claimed. Additionally, the credit may not be available for all types of long-term care insurance policies. It's crucial to understand these limitations to maximize your benefits.

-

How does the Schedule M1lti Long Term Care Insurance Credit integrate with other tax credits?

The Schedule M1lti Long Term Care Insurance Credit can often be combined with other tax credits to enhance your overall tax savings. However, it's important to check for any restrictions or interactions between credits. Consulting a tax advisor can help you navigate these integrations effectively.

-

What features should I look for in a long-term care insurance policy to qualify for the Schedule M1lti Long Term Care Insurance Credit?

When selecting a long-term care insurance policy, look for features such as comprehensive coverage, flexibility in benefits, and a reputable insurer. Policies that meet specific criteria set by tax authorities will qualify for the Schedule M1lti Long Term Care Insurance Credit. Always review the policy details carefully.

Get more for Schedule M1lti Long Term Care Insurance Credit

Find out other Schedule M1lti Long Term Care Insurance Credit

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word