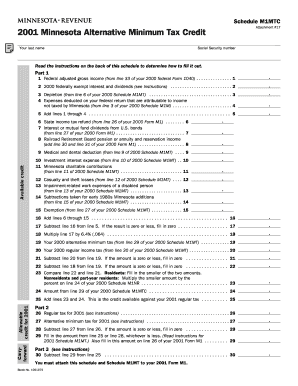

Schedule M1MTC Attachment #17 Minnesota Alternative Minimum Tax Credit Your Last Name Social Security Number Read the Instructio Form

Understanding the Schedule M1MTC Attachment #17

The Schedule M1MTC Attachment #17 is a crucial form for Minnesota taxpayers who are eligible for the Alternative Minimum Tax Credit. This form allows individuals to calculate and claim credits that reduce their overall tax liability. It is essential to fill out this form accurately, as it directly impacts the amount of tax owed. The form requires specific personal information, including your last name and Social Security number, to ensure proper identification and processing by the Minnesota Department of Revenue.

Steps to Complete the Schedule M1MTC Attachment #17

Completing the Schedule M1MTC Attachment #17 involves several key steps. First, gather all necessary documentation, including your tax returns and any supporting documents related to your income and deductions. Next, carefully read the instructions provided on the back of the schedule. This section offers detailed guidance on how to fill out each part of the form. As you complete the form, ensure that all information is accurate and consistent with your tax return. Finally, review the completed form for any errors before submission.

Eligibility Criteria for the Alternative Minimum Tax Credit

To qualify for the Alternative Minimum Tax Credit using the Schedule M1MTC Attachment #17, taxpayers must meet specific eligibility criteria. Generally, this includes having a taxable income that falls within certain limits and having paid alternative minimum tax in previous years. Additionally, taxpayers must be residents of Minnesota and have filed their state tax returns. It is advisable to consult the instructions on the back of the schedule for detailed eligibility requirements, as they may change annually.

Required Documents for Submission

When preparing to submit the Schedule M1MTC Attachment #17, ensure you have all required documents ready. This typically includes your completed Minnesota tax return, any W-2 forms, and documentation supporting your income and deductions. If you are claiming other credits or deductions, include relevant forms and schedules. Having these documents organized will facilitate a smoother filing process and help prevent delays in processing your credit claim.

Filing Deadlines for the Schedule M1MTC Attachment #17

Timely submission of the Schedule M1MTC Attachment #17 is essential to avoid penalties and ensure you receive your credit promptly. The filing deadline for this form generally aligns with the deadline for your Minnesota state tax return. Typically, this is April 15 for most taxpayers, but it may vary if the date falls on a weekend or holiday. It is important to verify the exact deadline each tax year to ensure compliance.

Form Submission Methods

Taxpayers have several options for submitting the Schedule M1MTC Attachment #17. You can file the form electronically through approved tax software, which often simplifies the process by automatically integrating necessary calculations. Alternatively, you may print the completed form and mail it to the Minnesota Department of Revenue. Ensure that you follow all mailing instructions, including using the correct address and any required postage. In-person submission is also an option at designated state tax offices.

Quick guide on how to complete schedule m1mtc attachment 17 minnesota alternative minimum tax credit your last name social security number read the

Complete [SKS] effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can easily access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents rapidly without any hold-ups. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign [SKS] without effort

- Find [SKS] and click Get Form to begin.

- Use the tools available to complete your document.

- Mark important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, or a sharing link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign [SKS] and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule M1MTC Attachment #17 Minnesota Alternative Minimum Tax Credit Your Last Name Social Security Number Read The Instructio

Create this form in 5 minutes!

How to create an eSignature for the schedule m1mtc attachment 17 minnesota alternative minimum tax credit your last name social security number read the

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule M1MTC Attachment #17 Minnesota Alternative Minimum Tax Credit?

The Schedule M1MTC Attachment #17 Minnesota Alternative Minimum Tax Credit is a form used to calculate your eligibility for the Minnesota Alternative Minimum Tax Credit. It requires your last name and Social Security number. Be sure to read the instructions on the back of this schedule to determine how to fill it out correctly.

-

How can airSlate SignNow help me with the Schedule M1MTC Attachment #17?

airSlate SignNow provides an easy-to-use platform for sending and eSigning documents, including tax forms like the Schedule M1MTC Attachment #17. Our solution streamlines the process, ensuring you can complete and submit your Minnesota Alternative Minimum Tax Credit application efficiently.

-

Is there a cost associated with using airSlate SignNow for tax documents?

Yes, airSlate SignNow offers various pricing plans to suit different needs, including options for individuals and businesses. Our cost-effective solution ensures you can manage documents like the Schedule M1MTC Attachment #17 without breaking the bank.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as eSigning, document templates, and secure cloud storage. These tools make it easy to manage your Schedule M1MTC Attachment #17 Minnesota Alternative Minimum Tax Credit forms and other important documents seamlessly.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow offers integrations with various software applications, enhancing your workflow. This means you can easily incorporate the Schedule M1MTC Attachment #17 into your existing systems for a more streamlined experience.

-

How secure is my information when using airSlate SignNow?

Security is a top priority at airSlate SignNow. We use advanced encryption and security protocols to protect your personal information, including your last name and Social Security number when filling out the Schedule M1MTC Attachment #17 Minnesota Alternative Minimum Tax Credit.

-

What if I need help filling out the Schedule M1MTC Attachment #17?

If you need assistance with the Schedule M1MTC Attachment #17, airSlate SignNow provides customer support to help guide you through the process. Our resources and support team can help you understand how to fill it out correctly by reading the instructions on the back of the schedule.

Get more for Schedule M1MTC Attachment #17 Minnesota Alternative Minimum Tax Credit Your Last Name Social Security Number Read The Instructio

Find out other Schedule M1MTC Attachment #17 Minnesota Alternative Minimum Tax Credit Your Last Name Social Security Number Read The Instructio

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online

- Sign Arkansas House rental lease agreement Free

- Sign Alaska Land lease agreement Computer

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free

- Sign Texas House rental lease Now

- How Can I Sign Arizona Lease agreement contract

- Help Me With Sign New Hampshire lease agreement

- How To Sign Kentucky Lease agreement form

- Can I Sign Michigan Lease agreement sample

- How Do I Sign Oregon Lease agreement sample

- How Can I Sign Oregon Lease agreement sample

- Can I Sign Oregon Lease agreement sample

- How To Sign West Virginia Lease agreement contract

- How Do I Sign Colorado Lease agreement template

- Sign Iowa Lease agreement template Free

- Sign Missouri Lease agreement template Later

- Sign West Virginia Lease agreement template Computer

- Sign Nevada Lease template Myself