Income Tax Return for Estates and Trusts M2 Income Tax Return for Estates and Trusts M2 Revenue State Mn Form

Understanding the Income Tax Return for Estates and Trusts M2

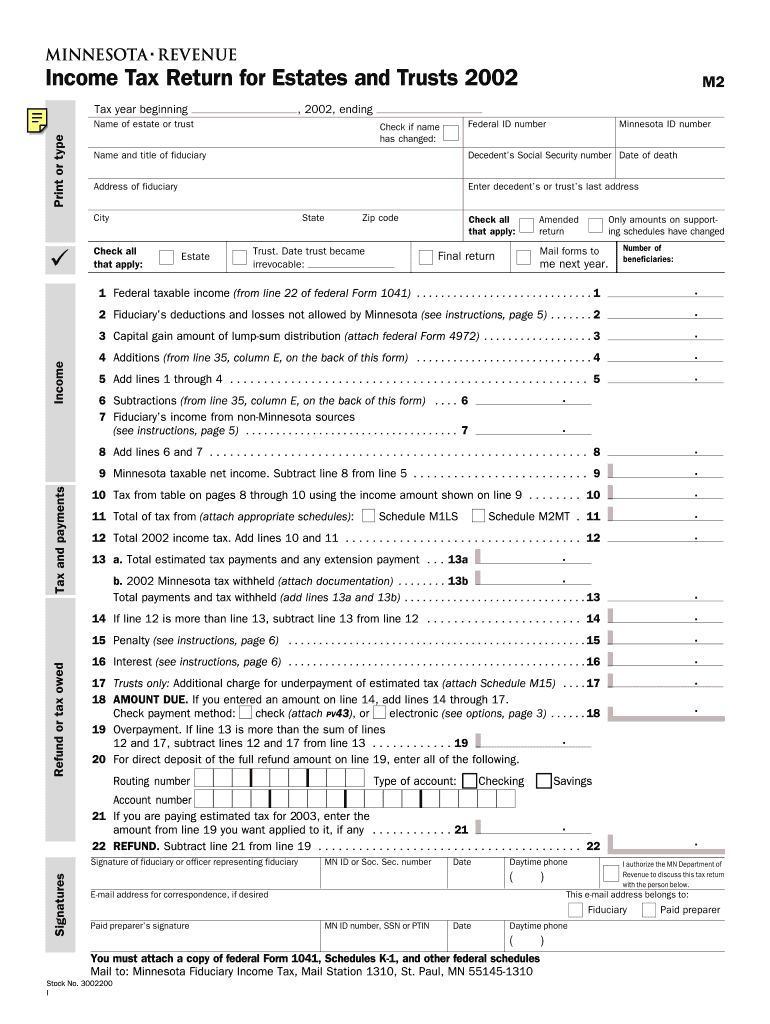

The Income Tax Return for Estates and Trusts M2 is a specific tax form used in Minnesota for reporting income generated by estates and trusts. This form is essential for fiduciaries managing estates or trusts, as it ensures compliance with state tax regulations. The M2 form captures various income types, deductions, and credits applicable to estates and trusts, making it crucial for accurate tax reporting. It is important for fiduciaries to understand the implications of this form, as it directly affects the tax liabilities of the estate or trust.

Steps to Complete the Income Tax Return for Estates and Trusts M2

Completing the Income Tax Return for Estates and Trusts M2 involves several key steps:

- Gather necessary financial documents, including income statements, expense records, and prior tax returns.

- Fill out the form accurately, ensuring all income sources and deductions are reported.

- Review the completed form for accuracy and completeness before submission.

- Submit the form by the specified deadline, either electronically or via mail.

Following these steps can help ensure that the return is filed correctly, reducing the risk of penalties or audits.

Required Documents for the Income Tax Return for Estates and Trusts M2

To complete the Income Tax Return for Estates and Trusts M2, several documents are necessary:

- Financial statements detailing income generated by the estate or trust.

- Records of any deductions, such as administrative expenses or distributions to beneficiaries.

- Prior year tax returns, if applicable, to provide context for current filings.

Having these documents organized can streamline the filing process and ensure compliance with state tax laws.

State-Specific Rules for the Income Tax Return for Estates and Trusts M2

Each state has its own regulations regarding the Income Tax Return for Estates and Trusts M2. In Minnesota, fiduciaries must be aware of specific rules, such as:

- The rates applicable to estates and trusts, which may differ from individual tax rates.

- Filing requirements, including the necessity to file even if the estate or trust has no taxable income.

- Deadlines for submission, which can vary based on the fiscal year of the estate or trust.

Understanding these state-specific rules is crucial for compliance and to avoid potential penalties.

Filing Deadlines for the Income Tax Return for Estates and Trusts M2

Filing deadlines for the Income Tax Return for Estates and Trusts M2 are critical to avoid penalties. Generally, the form is due on the 15th day of the fourth month following the close of the tax year. For estates and trusts operating on a calendar year basis, this typically means the deadline is April 15. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Fiduciaries should mark their calendars and ensure timely submission to maintain compliance with state tax laws.

Penalties for Non-Compliance with the Income Tax Return for Estates and Trusts M2

Failure to file the Income Tax Return for Estates and Trusts M2 on time can result in significant penalties. These may include:

- Late filing penalties, which can accumulate daily until the form is submitted.

- Interest on any unpaid tax liabilities, which can increase the overall amount owed.

- Potential audits or further scrutiny from the state revenue department.

It is essential for fiduciaries to be aware of these consequences and to prioritize timely filing to avoid unnecessary financial burdens.

Quick guide on how to complete income tax return for estates and trusts m2 income tax return for estates and trusts m2 revenue state mn

Complete [SKS] effortlessly on any gadget

Digital document management has become increasingly favored by organizations and individuals. It offers an ideal eco-friendly substitution to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the features necessary to create, modify, and electronically sign your files promptly without delays. Manage [SKS] on any gadget with airSlate SignNow Android or iOS applications and enhance any document-centric task today.

The simplest method to alter and electronically sign [SKS] effortlessly

- Find [SKS] and click on Get Form to commence.

- Utilize the tools we offer to complete your form.

- Highlight important portions of your documents or obscure sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional pen signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device of your choosing. Edit and electronically sign [SKS] and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Income Tax Return For Estates And Trusts M2 Income Tax Return For Estates And Trusts M2 Revenue State Mn

Create this form in 5 minutes!

How to create an eSignature for the income tax return for estates and trusts m2 income tax return for estates and trusts m2 revenue state mn

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Income Tax Return For Estates And Trusts M2 Revenue State Mn?

The Income Tax Return For Estates And Trusts M2 Revenue State Mn is a specific tax form required for estates and trusts in Minnesota. This form helps ensure compliance with state tax regulations and accurately reports income generated by the estate or trust. Understanding this form is crucial for proper tax management.

-

How can airSlate SignNow assist with the Income Tax Return For Estates And Trusts M2?

airSlate SignNow provides a streamlined solution for managing documents related to the Income Tax Return For Estates And Trusts M2. With its eSigning capabilities, users can easily send, sign, and store necessary documents securely. This simplifies the process and ensures timely submissions.

-

What are the pricing options for using airSlate SignNow for tax documents?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for individuals and enterprises. Each plan provides access to features that facilitate the completion of the Income Tax Return For Estates And Trusts M2. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking. These tools are particularly beneficial for managing the Income Tax Return For Estates And Trusts M2, ensuring that all necessary documents are completed accurately and efficiently.

-

Is airSlate SignNow compliant with state regulations for tax documents?

Yes, airSlate SignNow is designed to comply with state regulations, including those related to the Income Tax Return For Estates And Trusts M2 Revenue State Mn. The platform ensures that all documents are handled securely and in accordance with legal requirements, providing peace of mind for users.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow offers integrations with various accounting and tax preparation software. This allows for seamless management of the Income Tax Return For Estates And Trusts M2, making it easier to gather necessary information and complete filings efficiently.

-

What are the benefits of using airSlate SignNow for estate and trust tax returns?

Using airSlate SignNow for estate and trust tax returns, including the Income Tax Return For Estates And Trusts M2, offers numerous benefits. It enhances efficiency, reduces paperwork, and ensures secure document handling. This ultimately leads to a smoother tax filing process.

Get more for Income Tax Return For Estates And Trusts M2 Income Tax Return For Estates And Trusts M2 Revenue State Mn

- Skinpen precison microneedling treatment consent form

- Bunco roster amp sub list form

- Filmsourcing accepts no legal responsibility for the use of filmsourcing sample contracts or templates form

- Sterling bank reference form

- Non exclusive modeling agreement ice hot models form

- Character sheet template form

- Nexus letter form

- Cheer tryouts score sheet form

Find out other Income Tax Return For Estates And Trusts M2 Income Tax Return For Estates And Trusts M2 Revenue State Mn

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament