M1MTC Alternative Minimum Tax Credit M1MTC Alternative Minimum Tax Credit Form

Understanding the M1MTC Alternative Minimum Tax Credit

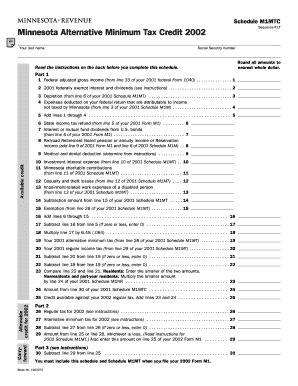

The M1MTC Alternative Minimum Tax Credit is a tax credit available to certain taxpayers in Minnesota. This credit is designed to alleviate the burden of the Alternative Minimum Tax (AMT), which can affect individuals and businesses that have substantial tax preferences. The M1MTC allows eligible taxpayers to reduce their tax liability, ensuring they are not overly penalized by the AMT. It is essential for taxpayers to understand the eligibility criteria and how this credit can benefit their overall tax situation.

How to Obtain the M1MTC Alternative Minimum Tax Credit

To obtain the M1MTC Alternative Minimum Tax Credit, taxpayers must first determine their eligibility. This typically involves filing a Minnesota tax return and completing the necessary forms related to the AMT. Taxpayers should gather relevant financial documents, including income statements and details on any tax preferences that may impact their AMT calculation. Once eligibility is confirmed, the credit can be claimed on the appropriate tax forms during the filing process.

Steps to Complete the M1MTC Alternative Minimum Tax Credit

Completing the M1MTC Alternative Minimum Tax Credit involves several key steps:

- Review your financial situation to determine if you are subject to the AMT.

- Gather all necessary documentation, including income records and deductions.

- Complete the Minnesota tax forms, including the specific section for the M1MTC.

- Calculate the amount of credit you are eligible for based on your tax situation.

- Submit your completed tax return to the Minnesota Department of Revenue.

Key Elements of the M1MTC Alternative Minimum Tax Credit

Several key elements define the M1MTC Alternative Minimum Tax Credit:

- Eligibility Criteria: Taxpayers must meet specific income and tax preference thresholds to qualify.

- Credit Amount: The credit amount varies based on individual tax situations and the extent of AMT liability.

- Filing Requirements: Taxpayers must file a Minnesota tax return to claim the credit.

Legal Use of the M1MTC Alternative Minimum Tax Credit

The M1MTC Alternative Minimum Tax Credit is legally sanctioned under Minnesota tax law. Taxpayers are encouraged to utilize this credit to reduce their tax burden if they qualify. It is important to adhere to all filing requirements and accurately report income and deductions to avoid any potential legal issues. Consulting with a tax professional can provide additional guidance on the proper use of this credit.

Examples of Using the M1MTC Alternative Minimum Tax Credit

Here are a few scenarios illustrating how the M1MTC Alternative Minimum Tax Credit can be applied:

- A taxpayer with significant deductions that trigger the AMT can claim the M1MTC to lower their overall tax liability.

- A self-employed individual who incurs high business expenses may also benefit from the credit, offsetting their AMT obligations.

- Individuals with investment income that contributes to AMT calculations can utilize the credit to manage their tax responsibilities effectively.

Quick guide on how to complete m1mtc alternative minimum tax credit m1mtc alternative minimum tax credit

Prepare [SKS] seamlessly on any device

Digital document management has become increasingly prevalent among businesses and individuals. It offers an ideal eco-conscious substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents quickly without interruptions. Handle [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

The easiest way to modify and electronically sign [SKS] effortlessly

- Obtain [SKS] and click on Get Form to begin.

- Make use of the tools we provide to complete your document.

- Select important sections of your documents or obscure confidential information using the features that airSlate SignNow specifically offers for this purpose.

- Generate your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to M1MTC Alternative Minimum Tax Credit M1MTC Alternative Minimum Tax Credit

Create this form in 5 minutes!

How to create an eSignature for the m1mtc alternative minimum tax credit m1mtc alternative minimum tax credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the M1MTC Alternative Minimum Tax Credit?

The M1MTC Alternative Minimum Tax Credit is a tax credit designed to help taxpayers offset their alternative minimum tax liability. It allows eligible individuals to reduce their overall tax burden, making it an essential consideration for those who qualify. Understanding this credit can signNowly impact your tax planning strategies.

-

How can airSlate SignNow assist with M1MTC Alternative Minimum Tax Credit documentation?

airSlate SignNow provides a streamlined platform for managing and eSigning documents related to the M1MTC Alternative Minimum Tax Credit. Our easy-to-use interface ensures that you can quickly prepare, send, and sign necessary forms, reducing the time spent on paperwork. This efficiency can help you focus more on maximizing your tax benefits.

-

What are the pricing options for using airSlate SignNow for M1MTC Alternative Minimum Tax Credit forms?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including those dealing with M1MTC Alternative Minimum Tax Credit forms. Our cost-effective solutions ensure that you can access essential features without breaking the bank. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing M1MTC Alternative Minimum Tax Credit documents?

Our platform includes features such as customizable templates, secure eSigning, and document tracking, all tailored for M1MTC Alternative Minimum Tax Credit documentation. These tools enhance your workflow, ensuring that you can efficiently manage your tax-related documents. Additionally, our user-friendly interface makes it easy for anyone to navigate.

-

Are there any benefits to using airSlate SignNow for M1MTC Alternative Minimum Tax Credit submissions?

Using airSlate SignNow for M1MTC Alternative Minimum Tax Credit submissions offers numerous benefits, including increased efficiency and reduced errors. Our platform simplifies the signing process, allowing you to complete your submissions quickly and accurately. This can lead to faster processing times and peace of mind during tax season.

-

Can airSlate SignNow integrate with other software for M1MTC Alternative Minimum Tax Credit management?

Yes, airSlate SignNow seamlessly integrates with various software solutions to enhance your M1MTC Alternative Minimum Tax Credit management. Whether you use accounting software or tax preparation tools, our integrations ensure that your workflow remains uninterrupted. This connectivity allows for a more cohesive approach to managing your tax documents.

-

Is airSlate SignNow secure for handling M1MTC Alternative Minimum Tax Credit information?

Absolutely! airSlate SignNow prioritizes security, ensuring that all M1MTC Alternative Minimum Tax Credit information is protected. We utilize advanced encryption and security protocols to safeguard your sensitive data. You can trust our platform to keep your documents safe while you manage your tax credits.

Get more for M1MTC Alternative Minimum Tax Credit M1MTC Alternative Minimum Tax Credit

Find out other M1MTC Alternative Minimum Tax Credit M1MTC Alternative Minimum Tax Credit

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document