M1x Amended Income Tax Return M1x Amended Income Tax Return Revenue State Mn Form

Understanding the M1x Amended Income Tax Return

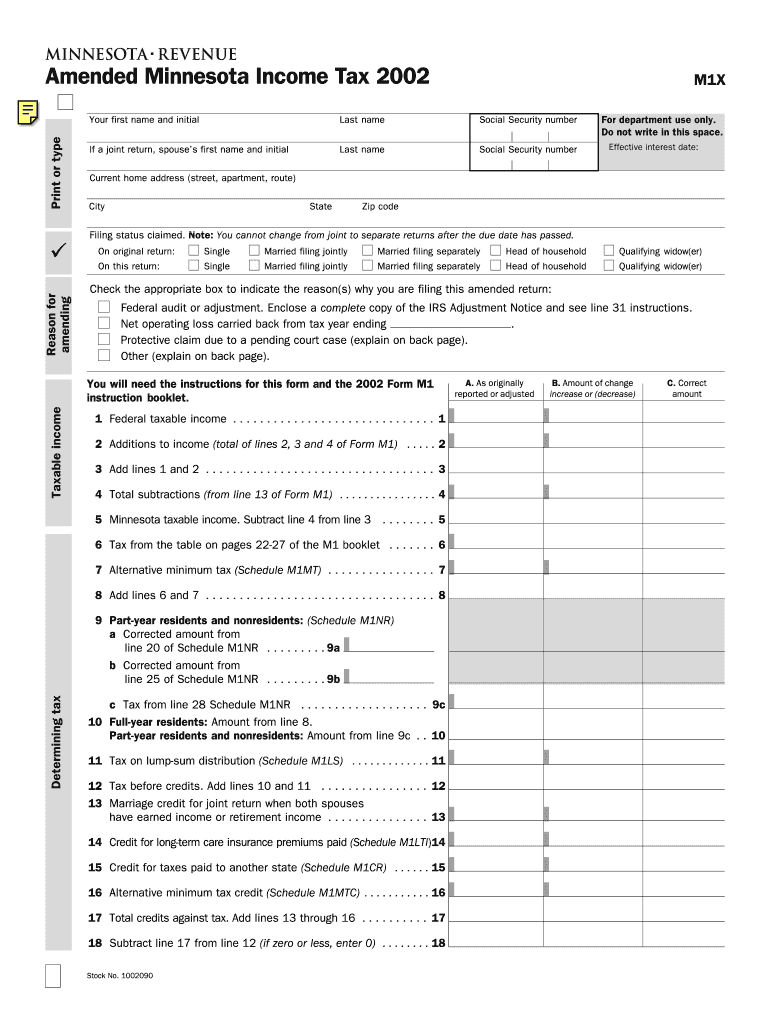

The M1x Amended Income Tax Return is a form used by taxpayers in Minnesota to correct errors or make changes to their previously filed M1 Income Tax Return. This form allows individuals to amend their state tax returns for various reasons, such as correcting income, deductions, or credits. It is essential for ensuring that your tax records accurately reflect your financial situation and comply with state tax laws.

Steps to Complete the M1x Amended Income Tax Return

Completing the M1x Amended Income Tax Return involves several key steps:

- Gather your original M1 Income Tax Return and any supporting documents.

- Clearly indicate the changes you are making on the form. This includes providing explanations for each change.

- Fill out the M1x form accurately, ensuring all information is current and correct.

- Calculate any additional taxes owed or refunds due based on your amendments.

- Review the completed form for accuracy before submission.

How to Obtain the M1x Amended Income Tax Return

The M1x Amended Income Tax Return can be obtained from the Minnesota Department of Revenue's official website. It is available for download in PDF format, allowing you to print and fill it out manually. Additionally, you may request a paper copy by contacting the Minnesota Department of Revenue directly.

Filing Deadlines for the M1x Amended Income Tax Return

Taxpayers should be aware of the filing deadlines for the M1x Amended Income Tax Return. Generally, you must file the amended return within three years from the original due date of your M1 Income Tax Return. This timeframe ensures that you can make necessary corrections and adjustments without facing penalties.

Required Documents for Filing the M1x Amended Income Tax Return

When filing the M1x Amended Income Tax Return, it is important to include supporting documentation. Required documents may include:

- Your original M1 Income Tax Return.

- Any additional forms or schedules that support your amendments.

- Proof of any payments made or refunds received related to the original return.

Legal Use of the M1x Amended Income Tax Return

The M1x Amended Income Tax Return is legally recognized by the state of Minnesota for correcting tax records. It is crucial to use this form to ensure compliance with state tax regulations. Failure to amend your return when necessary could result in penalties or interest on unpaid taxes.

Quick guide on how to complete m1x amended income tax return m1x amended income tax return revenue state mn

Finalize [SKS] effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related operation today.

The easiest way to edit and eSign [SKS] without stress

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive details with tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Choose how you want to send your form, either by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choosing. Edit and eSign [SKS] and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to M1x Amended Income Tax Return M1x Amended Income Tax Return Revenue State Mn

Create this form in 5 minutes!

How to create an eSignature for the m1x amended income tax return m1x amended income tax return revenue state mn

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the M1x Amended Income Tax Return?

The M1x Amended Income Tax Return is a form used to correct errors on a previously filed Minnesota income tax return. This form allows taxpayers to amend their income, deductions, or credits to ensure accurate reporting to the Revenue State Mn. Using airSlate SignNow, you can easily eSign and submit your M1x Amended Income Tax Return.

-

How can airSlate SignNow help with the M1x Amended Income Tax Return?

airSlate SignNow provides a user-friendly platform to prepare, eSign, and submit your M1x Amended Income Tax Return efficiently. With our solution, you can streamline the process, ensuring that your amendments are filed correctly with the Revenue State Mn. This saves you time and reduces the risk of errors.

-

What are the costs associated with filing the M1x Amended Income Tax Return?

Filing the M1x Amended Income Tax Return itself does not incur a fee, but there may be costs associated with using services like airSlate SignNow. Our platform offers competitive pricing plans that provide value for businesses looking to manage their tax documents efficiently. Check our pricing page for detailed information.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers features such as document templates, eSignature capabilities, and secure cloud storage, all of which are beneficial for managing your M1x Amended Income Tax Return. These features ensure that your documents are easily accessible and securely stored, making the filing process with the Revenue State Mn seamless.

-

Is airSlate SignNow compliant with tax regulations?

Yes, airSlate SignNow is designed to comply with all relevant tax regulations, including those pertaining to the M1x Amended Income Tax Return. Our platform ensures that your documents meet the necessary legal standards required by the Revenue State Mn, providing peace of mind during the filing process.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow can be integrated with various tax preparation software, enhancing your ability to manage the M1x Amended Income Tax Return. This integration allows for a smoother workflow, ensuring that all your tax documents are in one place and easily accessible.

-

What are the benefits of using airSlate SignNow for my M1x Amended Income Tax Return?

Using airSlate SignNow for your M1x Amended Income Tax Return offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform simplifies the eSigning process, allowing you to focus on what matters most while ensuring compliance with the Revenue State Mn.

Get more for M1x Amended Income Tax Return M1x Amended Income Tax Return Revenue State Mn

- Frederikshavn kommune fuldmagt center for teknik og frederikshavn form

- Spaghetti dinner order form

- Shift coverage form

- Acvp phase ii sponsor verification form

- Rabun county animal hospital form

- The north face consumer repair return form please complete all applicable fields of this form and attach a copy to your

- Ea 100 request for elder or dependent adult abuse restraining orders form

- 6 k 1 cbd201210036k form

Find out other M1x Amended Income Tax Return M1x Amended Income Tax Return Revenue State Mn

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy