Beneficiary's Share of Minnesota Taxable Income Revenue State Mn Form

What is the Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn

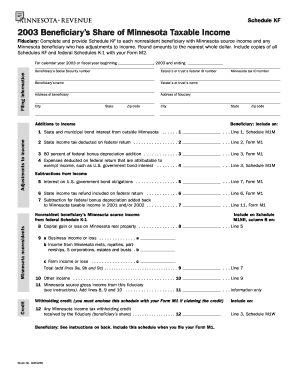

The Beneficiary's Share Of Minnesota Taxable Income is a crucial component for individuals receiving income from trusts or estates in Minnesota. This form outlines the portion of taxable income that beneficiaries must report on their personal tax returns. It is essential for ensuring that beneficiaries accurately reflect their share of income, which may include dividends, interest, or capital gains derived from the trust or estate. Understanding this form helps beneficiaries comply with state tax regulations and avoid any potential penalties.

Steps to complete the Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn

Completing the Beneficiary's Share Of Minnesota Taxable Income involves several key steps:

- Gather all relevant financial documents related to the trust or estate.

- Identify the total taxable income generated by the trust or estate for the tax year.

- Determine the beneficiary's share based on the terms outlined in the trust or estate documents.

- Fill out the form accurately, ensuring all income types are reported correctly.

- Review the completed form for accuracy before submission.

Required Documents

To complete the Beneficiary's Share Of Minnesota Taxable Income, beneficiaries need to have specific documents on hand:

- Trust or estate tax returns for the relevant year.

- Statements detailing income distributions from the trust or estate.

- Records of any deductions or credits that may apply.

- Personal tax identification information, such as Social Security numbers.

Legal use of the Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn

The legal use of the Beneficiary's Share Of Minnesota Taxable Income is primarily to ensure compliance with state tax laws. Beneficiaries are required to report their share of income on their individual tax returns, thus fulfilling their tax obligations. Failure to accurately report this income can lead to penalties, interest on unpaid taxes, and potential legal issues. It is advisable for beneficiaries to consult with a tax professional to navigate the complexities of tax law effectively.

State-specific rules for the Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn

Each state has unique regulations regarding the taxation of trust and estate income. In Minnesota, specific rules dictate how beneficiaries must report their share of income. These rules can include:

- The requirement to use Minnesota tax forms for reporting.

- Guidelines on what constitutes taxable income from trusts and estates.

- Deadlines for filing and payment of any taxes owed.

Filing Deadlines / Important Dates

Beneficiaries must be aware of critical filing deadlines to ensure compliance. In Minnesota, the tax return for beneficiaries typically aligns with the standard tax filing deadline, which is April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is essential for beneficiaries to mark their calendars and prepare their documents in advance to avoid any last-minute issues.

Quick guide on how to complete beneficiary39s share of minnesota taxable income revenue state mn 11331423

Effortlessly Set Up [SKS] on Any Device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily find the correct template and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The Simplest Way to Modify and Electronically Sign [SKS] with Ease

- Obtain [SKS] and then click Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight important sections of your documents or conceal sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from your chosen device. Edit and electronically sign [SKS] and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn

Create this form in 5 minutes!

How to create an eSignature for the beneficiary39s share of minnesota taxable income revenue state mn 11331423

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn?

The Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn refers to the portion of taxable income that beneficiaries must report for state tax purposes. Understanding this concept is crucial for accurate tax filing and compliance in Minnesota.

-

How can airSlate SignNow help with managing the Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn?

airSlate SignNow provides a streamlined platform for managing documents related to the Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn. With our eSigning capabilities, you can easily send, sign, and store important tax documents securely.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers features such as customizable templates, automated workflows, and secure cloud storage, all of which are beneficial for managing the Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn. These tools simplify the process of preparing and signing tax-related documents.

-

Is airSlate SignNow cost-effective for small businesses handling Minnesota tax documents?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses. Our pricing plans are flexible, allowing you to choose the best option that fits your needs while efficiently managing the Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn.

-

Can airSlate SignNow integrate with other accounting software for tax purposes?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, making it easier to manage the Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn. This integration ensures that your tax documents are aligned with your financial records.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents offers numerous benefits, including enhanced security, faster processing times, and improved collaboration. These advantages are particularly useful when dealing with the Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn.

-

How does airSlate SignNow ensure the security of sensitive tax information?

airSlate SignNow employs advanced security measures, including encryption and secure access controls, to protect sensitive tax information. This is especially important when handling documents related to the Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn.

Get more for Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn

Find out other Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later