Shareholder's Share of Income, Credits and Modifications Revenue State Mn Form

Understanding the Shareholder's Share Of Income, Credits And Modifications Revenue State Mn

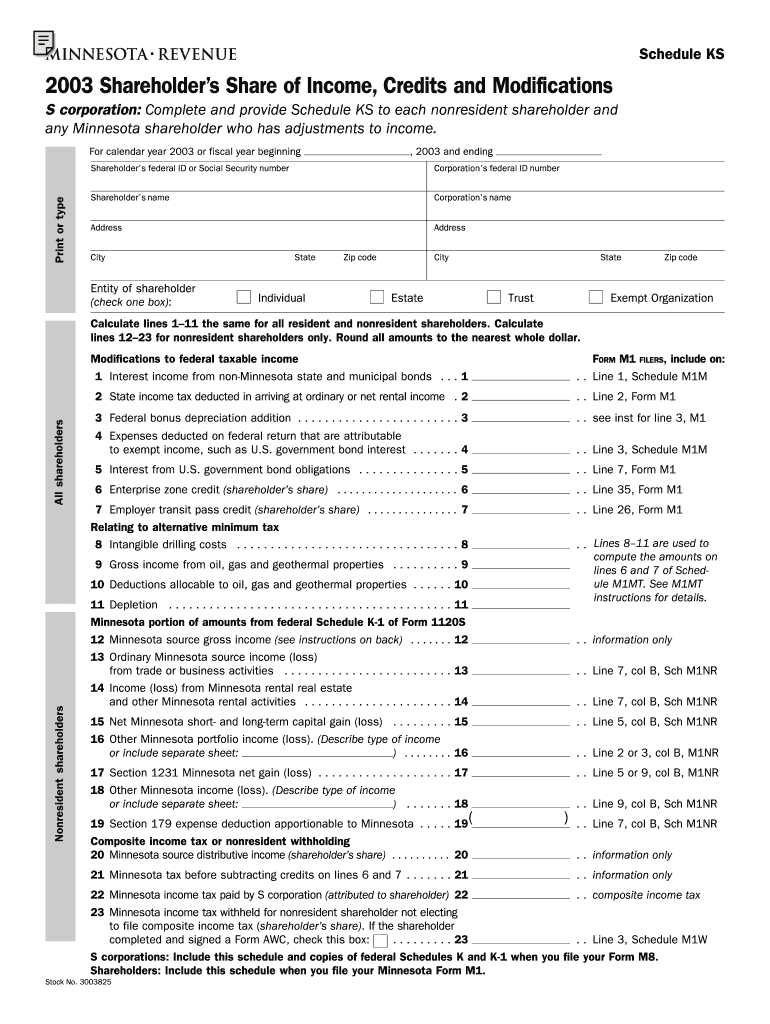

The Shareholder's Share Of Income, Credits And Modifications Revenue State Mn is a crucial document for shareholders in Minnesota. It outlines the allocation of income, credits, and any modifications that may affect a shareholder's tax liability. This form is essential for ensuring that shareholders accurately report their income and claim any applicable credits on their state tax returns. It is particularly relevant for those involved in pass-through entities, such as S corporations and partnerships, where income is reported on individual tax returns rather than at the corporate level.

Steps to Complete the Shareholder's Share Of Income, Credits And Modifications Revenue State Mn

Completing the Shareholder's Share Of Income, Credits And Modifications Revenue State Mn involves several key steps:

- Gather relevant financial documents, including K-1 forms and other income statements.

- Identify the total income earned from the entity and any credits that apply.

- Fill out the form with accurate figures, ensuring that all income and credits are reported correctly.

- Review the completed form for any errors or omissions before submission.

- Submit the form by the designated deadline to avoid penalties.

Legal Use of the Shareholder's Share Of Income, Credits And Modifications Revenue State Mn

This form is legally required for shareholders in Minnesota to report their share of income and any credits or modifications. Failure to accurately complete and submit this form can lead to penalties, including fines and interest on unpaid taxes. It is important for shareholders to understand their legal obligations regarding this document to ensure compliance with state tax laws.

State-Specific Rules for the Shareholder's Share Of Income, Credits And Modifications Revenue State Mn

In Minnesota, specific rules govern how income, credits, and modifications are reported on the Shareholder's Share Of Income, Credits And Modifications Revenue State Mn. Shareholders must adhere to state tax regulations, which may differ from federal guidelines. For example, certain state-specific credits may only be available to shareholders based on their residency or the type of income received. Understanding these nuances is essential for accurate tax reporting.

Examples of Using the Shareholder's Share Of Income, Credits And Modifications Revenue State Mn

Consider a shareholder in an S corporation who receives a K-1 form detailing their share of the corporation's income. This shareholder must use the Shareholder's Share Of Income, Credits And Modifications Revenue State Mn to report their allocated income and any credits available. For instance, if the corporation qualifies for a state tax credit for job creation, the shareholder can claim their proportionate share of that credit on this form, impacting their overall tax liability.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the Shareholder's Share Of Income, Credits And Modifications Revenue State Mn. Typically, this form must be submitted by the same deadline as individual income tax returns in Minnesota, which is usually April 15. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. Shareholders should mark their calendars to ensure timely submission and avoid penalties.

Quick guide on how to complete shareholder39s share of income credits and modifications revenue state mn

Complete [SKS] effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can easily locate the proper form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based task today.

The easiest way to modify and eSign [SKS] without any hassle

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Shareholder's Share Of Income, Credits And Modifications Revenue State Mn

Create this form in 5 minutes!

How to create an eSignature for the shareholder39s share of income credits and modifications revenue state mn

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Shareholder's Share Of Income, Credits And Modifications Revenue State Mn?

The Shareholder's Share Of Income, Credits And Modifications Revenue State Mn refers to the allocation of income, credits, and modifications that shareholders must report for state tax purposes in Minnesota. Understanding this concept is crucial for accurate tax reporting and compliance.

-

How can airSlate SignNow help with managing Shareholder's Share Of Income, Credits And Modifications Revenue State Mn?

airSlate SignNow provides a streamlined platform for eSigning and managing documents related to the Shareholder's Share Of Income, Credits And Modifications Revenue State Mn. This ensures that all necessary documents are signed and stored securely, simplifying the tax reporting process.

-

What features does airSlate SignNow offer for handling tax-related documents?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing tax-related documents like the Shareholder's Share Of Income, Credits And Modifications Revenue State Mn. These features enhance efficiency and ensure compliance.

-

Is airSlate SignNow cost-effective for small businesses dealing with Shareholder's Share Of Income, Credits And Modifications Revenue State Mn?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses. By reducing the time and resources spent on document management related to the Shareholder's Share Of Income, Credits And Modifications Revenue State Mn, it ultimately saves money.

-

Can airSlate SignNow integrate with accounting software for tax purposes?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, making it easier to manage documents related to the Shareholder's Share Of Income, Credits And Modifications Revenue State Mn. This integration helps streamline workflows and ensures that all financial data is accurately captured.

-

What are the benefits of using airSlate SignNow for tax document management?

Using airSlate SignNow for tax document management offers numerous benefits, including enhanced security, improved efficiency, and easy access to important documents like the Shareholder's Share Of Income, Credits And Modifications Revenue State Mn. These advantages help businesses stay organized and compliant.

-

How does airSlate SignNow ensure the security of sensitive tax documents?

airSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect sensitive tax documents such as the Shareholder's Share Of Income, Credits And Modifications Revenue State Mn. This commitment to security ensures that your data remains confidential and safe.

Get more for Shareholder's Share Of Income, Credits And Modifications Revenue State Mn

Find out other Shareholder's Share Of Income, Credits And Modifications Revenue State Mn

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter