M15NP, Underpayment of Estimated Tax by Nonprofit Organizations Form

What is the M15NP, Underpayment Of Estimated Tax By Nonprofit Organizations

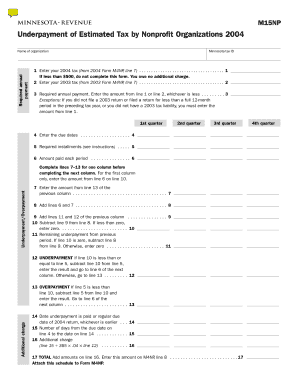

The M15NP form is specifically designed for nonprofit organizations in the United States to report underpayment of estimated tax. Nonprofits, like other tax-exempt entities, are required to pay certain taxes if they have unrelated business income. This form helps organizations calculate any underpayment penalties that may apply due to insufficient estimated tax payments throughout the year. Understanding the M15NP is essential for nonprofits to maintain compliance with IRS regulations and avoid potential penalties.

How to use the M15NP, Underpayment Of Estimated Tax By Nonprofit Organizations

To effectively use the M15NP form, nonprofits must first determine if they are subject to estimated tax payments based on their unrelated business income. The form requires organizations to gather financial information related to their income and expenses. Once this data is compiled, nonprofits can accurately calculate their estimated tax liability and any underpayment penalties. It is crucial to complete the M15NP accurately to ensure compliance and avoid unnecessary fines.

Steps to complete the M15NP, Underpayment Of Estimated Tax By Nonprofit Organizations

Completing the M15NP involves several key steps:

- Gather financial records, including income from unrelated business activities.

- Calculate the total estimated tax liability for the year.

- Determine the amount of estimated tax payments made during the year.

- Calculate any underpayments by comparing the estimated tax liability to the payments made.

- Complete the M15NP form with the calculated figures.

- Submit the form to the IRS by the specified deadline.

Filing Deadlines / Important Dates

Nonprofit organizations must adhere to specific deadlines when filing the M15NP. The form is typically due on the same date as the organization's annual tax return. It is essential to remain aware of these deadlines to avoid penalties. Nonprofits should also consider any extensions that may apply to their tax filings, as these can affect the due date for the M15NP.

Penalties for Non-Compliance

Failure to file the M15NP or to pay the required estimated taxes can result in significant penalties for nonprofit organizations. The IRS may impose fines based on the amount of underpayment and the duration of the non-compliance. Understanding these potential penalties is vital for nonprofits to ensure they remain compliant and avoid financial repercussions.

Eligibility Criteria

To be eligible to use the M15NP form, an organization must be classified as a nonprofit and must have unrelated business income that exceeds the threshold set by the IRS. Additionally, the organization must have made estimated tax payments during the tax year. It is important for nonprofits to review their eligibility carefully to ensure they are using the correct forms and processes for their tax obligations.

IRS Guidelines

The IRS provides specific guidelines for completing the M15NP form. These guidelines include instructions on calculating estimated tax payments, determining underpayment penalties, and filing procedures. Nonprofits should refer to these guidelines to ensure they are following the correct processes and to minimize the risk of errors in their filings.

Quick guide on how to complete m15np underpayment of estimated tax by nonprofit organizations

Complete [SKS] effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed papers, as you can locate the appropriate form and securely store it in the cloud. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents promptly without delays. Manage [SKS] on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign [SKS] and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to M15NP, Underpayment Of Estimated Tax By Nonprofit Organizations

Create this form in 5 minutes!

How to create an eSignature for the m15np underpayment of estimated tax by nonprofit organizations

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the M15NP form and why is it important for nonprofit organizations?

The M15NP form is used by nonprofit organizations to report the underpayment of estimated tax. Understanding the M15NP, Underpayment Of Estimated Tax By Nonprofit Organizations, is crucial for compliance and avoiding penalties. Nonprofits must accurately assess their tax obligations to ensure they meet federal requirements.

-

How can airSlate SignNow help with the M15NP process?

airSlate SignNow streamlines the document signing process, making it easier for nonprofit organizations to manage their M15NP submissions. With our platform, you can quickly eSign and send necessary documents, ensuring timely compliance with the M15NP, Underpayment Of Estimated Tax By Nonprofit Organizations. This efficiency helps reduce administrative burdens.

-

What features does airSlate SignNow offer for nonprofits?

airSlate SignNow offers features tailored for nonprofits, including customizable templates, bulk sending, and secure eSigning. These features facilitate the management of documents related to the M15NP, Underpayment Of Estimated Tax By Nonprofit Organizations, ensuring that all necessary forms are completed accurately and efficiently.

-

Is airSlate SignNow cost-effective for nonprofit organizations?

Yes, airSlate SignNow provides a cost-effective solution for nonprofit organizations. Our pricing plans are designed to accommodate various budgets, making it easier for nonprofits to manage their documentation needs, including those related to the M15NP, Underpayment Of Estimated Tax By Nonprofit Organizations, without overspending.

-

Can airSlate SignNow integrate with other software used by nonprofits?

Absolutely! airSlate SignNow integrates seamlessly with various software solutions commonly used by nonprofits. This integration capability enhances the management of documents related to the M15NP, Underpayment Of Estimated Tax By Nonprofit Organizations, allowing for a more streamlined workflow and better data management.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including the M15NP, Underpayment Of Estimated Tax By Nonprofit Organizations, offers numerous benefits. These include improved efficiency, reduced paper usage, and enhanced security for sensitive information. Nonprofits can focus more on their mission rather than administrative tasks.

-

How does airSlate SignNow ensure the security of sensitive documents?

airSlate SignNow prioritizes the security of sensitive documents through advanced encryption and secure storage solutions. This is particularly important for documents related to the M15NP, Underpayment Of Estimated Tax By Nonprofit Organizations, where confidentiality is crucial. Our platform complies with industry standards to protect your data.

Get more for M15NP, Underpayment Of Estimated Tax By Nonprofit Organizations

- Osaac certificate california 2008 form

- Stipulation early organizational meeting los angeles superior form

- Wg002 2016 form

- Abstract of judgment michigan forms ej 001

- Jv 222 input on application for psychotropi medication fillable editable and saveable california judicial council forms

- Ccp 446 form

- Fl 800 joint petition for summary dissolution fillable editable and saveable california judicial council forms

- Request for stock loan for voting at general shareholders de meetings form

Find out other M15NP, Underpayment Of Estimated Tax By Nonprofit Organizations

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile