KF, Beneficiary's Share of Minnesota Taxable Income Revenue State Mn Form

Understanding the KF, Beneficiary's Share Of Minnesota Taxable Income

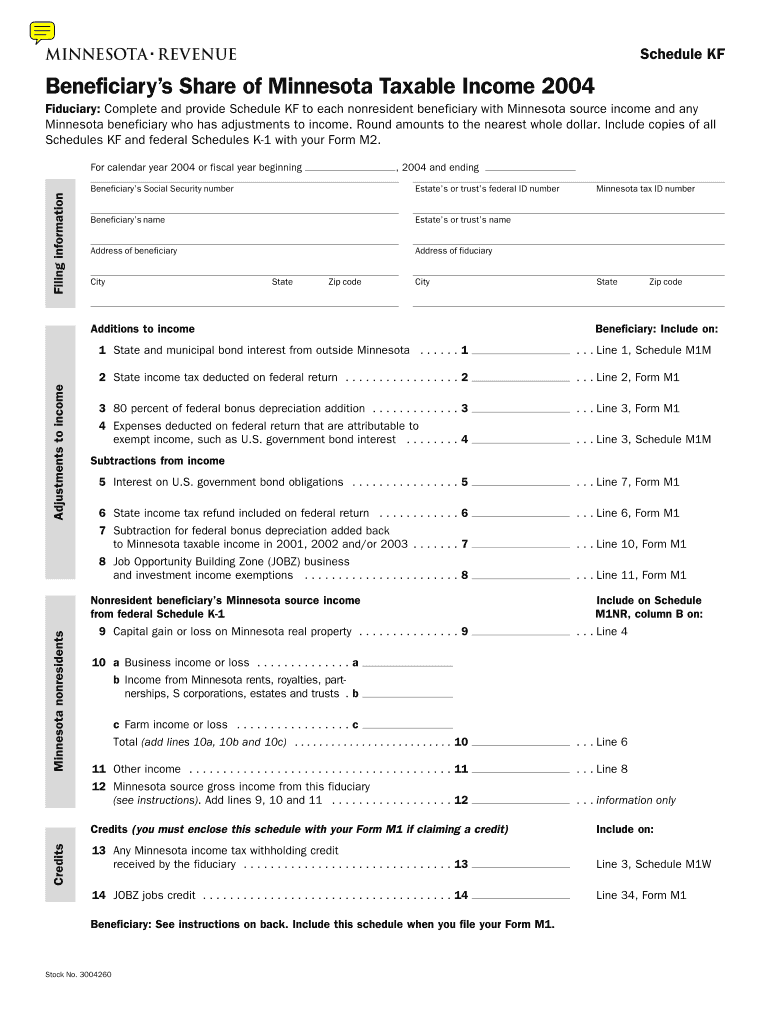

The KF, Beneficiary's Share Of Minnesota Taxable Income is a specific tax form used in Minnesota to report the income allocated to beneficiaries from trusts or estates. This form is essential for ensuring that beneficiaries accurately report their share of taxable income on their individual tax returns. The form helps in determining the tax obligations of each beneficiary based on the income generated by the trust or estate.

Steps to Complete the KF, Beneficiary's Share Of Minnesota Taxable Income

Completing the KF form involves several key steps:

- Gather necessary financial documents related to the trust or estate.

- Determine the total taxable income generated by the trust or estate for the tax year.

- Allocate the income among beneficiaries according to the trust or estate's terms.

- Fill out the KF form with the allocated amounts for each beneficiary.

- Review the completed form for accuracy before submission.

Legal Use of the KF, Beneficiary's Share Of Minnesota Taxable Income

The KF form serves a critical legal function in the tax reporting process. It ensures compliance with Minnesota tax laws by providing a clear record of income distribution to beneficiaries. Proper use of this form helps prevent legal issues related to tax evasion or misreporting of income. Beneficiaries must use the information from this form to accurately report their income on their personal tax returns.

Required Documents for the KF, Beneficiary's Share Of Minnesota Taxable Income

To complete the KF form, several documents are typically required:

- Financial statements of the trust or estate.

- Records of income generated during the tax year.

- Allocation agreements or trust documents outlining beneficiary shares.

- Previous tax returns, if applicable, for reference.

Filing Deadlines for the KF, Beneficiary's Share Of Minnesota Taxable Income

It is important to be aware of the filing deadlines associated with the KF form. Generally, the form must be submitted by the same deadline as individual income tax returns in Minnesota. This ensures that beneficiaries can accurately report their share of income in a timely manner. Missing the deadline may result in penalties or interest on unpaid taxes.

Examples of Using the KF, Beneficiary's Share Of Minnesota Taxable Income

Consider a scenario where a trust generates a total taxable income of $100,000. If there are four beneficiaries, each entitled to a twenty-five percent share, the KF form would reflect each beneficiary's share as $25,000. This amount must then be reported on their individual tax returns. Another example could involve a single beneficiary receiving the entire income from a trust, who would report the full $100,000 on their tax return.

Quick guide on how to complete kf beneficiary39s share of minnesota taxable income revenue state mn

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers a perfect eco-friendly substitute for traditional printed and signed paperwork, allowing you to acquire the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without any delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

The Optimal Method to Modify and Electronically Sign [SKS] with Ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize key sections of your documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced files, tedious form searches, or errors that necessitate the printing of new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign [SKS] and ensure outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the kf beneficiary39s share of minnesota taxable income revenue state mn

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is KF, Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn?

KF, Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn refers to the portion of taxable income that beneficiaries must report for state tax purposes. Understanding this concept is crucial for accurate tax reporting and compliance in Minnesota.

-

How can airSlate SignNow help with KF, Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn documentation?

airSlate SignNow streamlines the process of preparing and signing documents related to KF, Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn. Our platform allows users to create, send, and eSign necessary tax documents efficiently, ensuring compliance and accuracy.

-

What features does airSlate SignNow offer for managing tax-related documents?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing tax-related documents like those involving KF, Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn. These features enhance efficiency and reduce the risk of errors.

-

Is airSlate SignNow cost-effective for small businesses dealing with KF, Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn?

Yes, airSlate SignNow provides a cost-effective solution for small businesses needing to manage KF, Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn documentation. Our pricing plans are designed to fit various budgets while offering robust features that enhance productivity.

-

Can I integrate airSlate SignNow with other software for tax management?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax management software, making it easier to handle KF, Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn documents. This integration helps streamline workflows and ensures all your data is synchronized.

-

What are the benefits of using airSlate SignNow for KF, Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn?

Using airSlate SignNow for KF, Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn offers numerous benefits, including improved efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are signed and stored securely, making tax compliance simpler.

-

How secure is airSlate SignNow for handling sensitive tax documents?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive tax documents, including those related to KF, Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn. You can trust that your information is safe with us.

Get more for KF, Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn

- Mediation data sheet fcs002 form

- Los angeles county conservatorship re evaluation physicians declaration form

- Subp 020 deposition subpoena for personal appearance and form

- Post office box 14710 form

- Self help the superior court of california county of orange form

- Jdf 1111 sworn financial statementdoc ssareporter spanish form

- Colorado affidavit law marriage form

- Seec form 20 fillable

Find out other KF, Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement