M3, Partnership Return Minnesota Department of Revenue Revenue State Mn Form

What is the M3, Partnership Return Minnesota Department Of Revenue Revenue State Mn

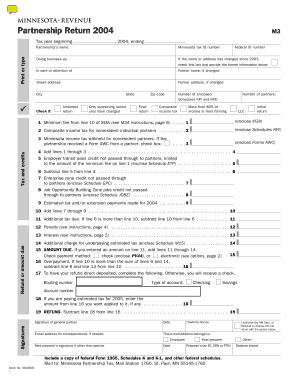

The M3, Partnership Return is a specific tax form required by the Minnesota Department of Revenue for partnerships operating within the state. This form is used to report the income, deductions, and credits of partnerships, which are business entities where two or more individuals share ownership. The M3 form ensures that partnerships comply with state tax laws and helps in the accurate calculation of taxes owed to the state of Minnesota.

Steps to complete the M3, Partnership Return Minnesota Department Of Revenue Revenue State Mn

Completing the M3, Partnership Return involves several key steps:

- Gather necessary financial documents, including income statements, balance sheets, and any relevant supporting documentation.

- Fill out the M3 form accurately, ensuring all income, deductions, and credits are reported correctly.

- Review the completed form for any errors or omissions to avoid potential penalties.

- Submit the form by the designated deadline, either electronically or by mail, as per the Minnesota Department of Revenue guidelines.

Key elements of the M3, Partnership Return Minnesota Department Of Revenue Revenue State Mn

The M3 form includes several critical components:

- Partnership Information: This section requires details about the partnership, including its name, address, and federal employer identification number (EIN).

- Income Reporting: Partnerships must report all sources of income, including sales, services, and any other revenue streams.

- Deductions: Partnerships can claim various deductions, such as business expenses, to reduce taxable income.

- Tax Credits: Any applicable tax credits must be reported to potentially lower the overall tax liability.

Filing Deadlines / Important Dates

Timely filing of the M3, Partnership Return is crucial to avoid penalties. The typical deadline for submitting this form is the fifteenth day of the fourth month following the end of the partnership's fiscal year. For partnerships operating on a calendar year, the deadline is April 15. Extensions may be available, but they must be requested in advance.

Form Submission Methods (Online / Mail / In-Person)

The M3, Partnership Return can be submitted through various methods:

- Online Submission: Partnerships can file electronically through the Minnesota Department of Revenue's e-file system, which is often faster and more efficient.

- Mail: The completed form can be printed and mailed to the appropriate address provided by the Minnesota Department of Revenue.

- In-Person: Partnerships may also choose to deliver the form in person at designated Department of Revenue offices, though this option may be less common.

Penalties for Non-Compliance

Failing to file the M3, Partnership Return by the deadline can result in significant penalties. These may include late fees and interest on any unpaid taxes. Additionally, partnerships may face further scrutiny from the Minnesota Department of Revenue, which could lead to audits or additional penalties if discrepancies are found. It is essential for partnerships to ensure compliance to avoid these consequences.

Quick guide on how to complete m3 partnership return minnesota department of revenue revenue state mn

Complete [SKS] effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly option to conventional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, amend, and electronically sign your documents promptly without delays. Handle [SKS] on any platform with the airSlate SignNow apps for Android or iOS and enhance any document-centric procedure today.

How to modify and electronically sign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Use the tools we provide to fill out your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from whichever device you prefer. Modify and electronically sign [SKS] and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to M3, Partnership Return Minnesota Department Of Revenue Revenue State Mn

Create this form in 5 minutes!

How to create an eSignature for the m3 partnership return minnesota department of revenue revenue state mn

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the M3, Partnership Return Minnesota Department Of Revenue Revenue State Mn?

The M3, Partnership Return Minnesota Department Of Revenue Revenue State Mn is a tax form required for partnerships operating in Minnesota. It is essential for reporting income, deductions, and credits to the Minnesota Department of Revenue. Completing this form accurately ensures compliance with state tax regulations.

-

How can airSlate SignNow help with the M3, Partnership Return Minnesota Department Of Revenue Revenue State Mn?

airSlate SignNow simplifies the process of preparing and submitting the M3, Partnership Return Minnesota Department Of Revenue Revenue State Mn. Our platform allows users to easily fill out, sign, and send documents electronically, ensuring a smooth and efficient filing process.

-

What are the pricing options for using airSlate SignNow for the M3, Partnership Return Minnesota Department Of Revenue Revenue State Mn?

airSlate SignNow offers flexible pricing plans that cater to various business needs. Whether you are a small partnership or a large firm, our cost-effective solutions provide the necessary tools to manage the M3, Partnership Return Minnesota Department Of Revenue Revenue State Mn efficiently. Visit our pricing page for detailed information.

-

What features does airSlate SignNow offer for managing the M3, Partnership Return Minnesota Department Of Revenue Revenue State Mn?

Our platform includes features such as document templates, eSignature capabilities, and secure cloud storage, all tailored to assist with the M3, Partnership Return Minnesota Department Of Revenue Revenue State Mn. These tools streamline the document management process, making it easier to stay organized and compliant.

-

Are there any integrations available with airSlate SignNow for the M3, Partnership Return Minnesota Department Of Revenue Revenue State Mn?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software, enhancing your ability to manage the M3, Partnership Return Minnesota Department Of Revenue Revenue State Mn. These integrations allow for easy data transfer and improved workflow efficiency, saving you time and reducing errors.

-

What are the benefits of using airSlate SignNow for the M3, Partnership Return Minnesota Department Of Revenue Revenue State Mn?

Using airSlate SignNow for the M3, Partnership Return Minnesota Department Of Revenue Revenue State Mn offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are signed and submitted quickly, helping you meet deadlines and avoid penalties.

-

Is airSlate SignNow user-friendly for filing the M3, Partnership Return Minnesota Department Of Revenue Revenue State Mn?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to navigate the platform. Whether you are familiar with tax forms or new to the process, our intuitive interface guides you through filing the M3, Partnership Return Minnesota Department Of Revenue Revenue State Mn effortlessly.

Get more for M3, Partnership Return Minnesota Department Of Revenue Revenue State Mn

- Photo permission slip ans directory permission 2014doc form

- Fundraising agreement form spiceabovetherestcom

- Disclosure statement and hold harmless agreement notary gsn notary form

- Sample pet agreements form

- Aarp vision form

- Nasm overhead squat solutions table form

- Simple cremation form

- Fitness membership ze request form

Find out other M3, Partnership Return Minnesota Department Of Revenue Revenue State Mn

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word