KPC, Partner's Share of Income, Credits and Modifications Revenue State Mn Form

What is the KPC, Partner's Share Of Income, Credits And Modifications Revenue State Mn

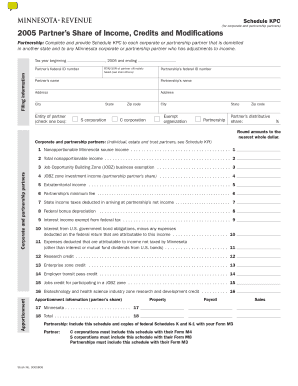

The KPC, or Partner's Share Of Income, Credits And Modifications Revenue State Mn, is a specific tax form used in Minnesota. This form is essential for partnerships to report the income, credits, and modifications that are allocated to each partner. It ensures that all partners accurately report their share of the partnership's income on their individual tax returns. Understanding this form is crucial for compliance with state tax regulations and for ensuring that partners receive the correct credits and deductions.

How to use the KPC, Partner's Share Of Income, Credits And Modifications Revenue State Mn

Using the KPC form involves several steps. First, partnerships must gather all relevant financial data, including income, deductions, and credits for the tax year. Each partner's share of these amounts must then be calculated according to the partnership agreement. After completing the calculations, the partnership fills out the KPC form, detailing each partner's share. This form is then submitted to the Minnesota Department of Revenue, and copies should be provided to each partner for their tax filings.

Steps to complete the KPC, Partner's Share Of Income, Credits And Modifications Revenue State Mn

Completing the KPC form requires careful attention to detail. The following steps outline the process:

- Gather all income and expense records for the partnership.

- Determine each partner's share of income, credits, and modifications based on the partnership agreement.

- Fill out the KPC form accurately, ensuring all calculations are correct.

- Review the completed form for any errors or omissions.

- Submit the form to the Minnesota Department of Revenue and provide copies to all partners.

Key elements of the KPC, Partner's Share Of Income, Credits And Modifications Revenue State Mn

The KPC form includes several key elements that must be accurately reported. These elements typically consist of:

- Total income earned by the partnership.

- Specific deductions that apply to the partnership.

- Credits available to partners, such as those for taxes paid or other eligible expenses.

- Modifications that may affect the taxable income of each partner.

Each of these elements plays a critical role in determining the overall tax liability for both the partnership and its individual partners.

Filing Deadlines / Important Dates

Filing deadlines for the KPC form are crucial to avoid penalties. Typically, the form must be filed by the due date of the partnership’s tax return. For most partnerships, this date falls on the 15th day of the fourth month following the end of the tax year. It is advisable to check for any updates or changes in deadlines each tax year to ensure compliance.

Penalties for Non-Compliance

Failure to file the KPC form on time or inaccuracies in the form can result in penalties. The Minnesota Department of Revenue may impose fines for late submissions or incorrect information. Partners may also face issues with their personal tax returns if the KPC form is not properly completed or filed, leading to potential audits or additional tax liabilities.

Quick guide on how to complete kpc partners share of income credits and modifications revenue state mn

Complete [SKS] effortlessly on any device

Digital document management has gained traction among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, alter, and electronically sign your documents promptly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign [SKS] with ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal authority as a traditional ink signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred delivery method for your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you choose. Alter and eSign [SKS] and guarantee excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to KPC, Partner's Share Of Income, Credits And Modifications Revenue State Mn

Create this form in 5 minutes!

How to create an eSignature for the kpc partners share of income credits and modifications revenue state mn

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is KPC, Partner's Share Of Income, Credits And Modifications Revenue State Mn?

KPC, Partner's Share Of Income, Credits And Modifications Revenue State Mn refers to the specific tax regulations and guidelines that govern how partners in a business report their income and credits in Minnesota. Understanding these regulations is crucial for accurate tax filing and compliance.

-

How can airSlate SignNow help with KPC, Partner's Share Of Income, Credits And Modifications Revenue State Mn?

airSlate SignNow provides a streamlined platform for businesses to manage and eSign documents related to KPC, Partner's Share Of Income, Credits And Modifications Revenue State Mn. This ensures that all necessary documentation is handled efficiently, reducing the risk of errors in tax reporting.

-

What features does airSlate SignNow offer for managing KPC-related documents?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing KPC, Partner's Share Of Income, Credits And Modifications Revenue State Mn documents. These tools help ensure that all parties can easily access and sign necessary forms.

-

Is airSlate SignNow cost-effective for small businesses dealing with KPC issues?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses managing KPC, Partner's Share Of Income, Credits And Modifications Revenue State Mn. Our pricing plans are flexible, allowing you to choose the best option for your budget.

-

Can airSlate SignNow integrate with accounting software for KPC management?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, making it easier to manage KPC, Partner's Share Of Income, Credits And Modifications Revenue State Mn documentation alongside your financial records. This integration helps streamline your workflow and improve accuracy.

-

What are the benefits of using airSlate SignNow for KPC documentation?

Using airSlate SignNow for KPC, Partner's Share Of Income, Credits And Modifications Revenue State Mn documentation offers numerous benefits, including enhanced security, faster turnaround times, and improved collaboration among partners. These advantages help ensure compliance and efficiency in your business operations.

-

How does airSlate SignNow ensure the security of KPC-related documents?

airSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect KPC, Partner's Share Of Income, Credits And Modifications Revenue State Mn documents. This ensures that sensitive information remains confidential and secure throughout the signing process.

Get more for KPC, Partner's Share Of Income, Credits And Modifications Revenue State Mn

- Bank muscat corporate online banking form

- Vs form 9 3

- Katoliki nyimbo form

- Unclaimed money alabama form

- Plants can only grow under certain form

- Washington state ferry medical pass form

- Airsev form

- New student schedule change prospective george mason university college of health and human services bs health form

Find out other KPC, Partner's Share Of Income, Credits And Modifications Revenue State Mn

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself