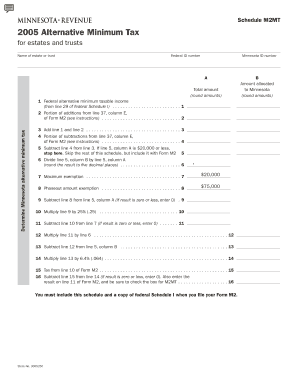

M2MT, Alternative Minimum Tax for Estates and Trusts Form

Understanding the M2MT, Alternative Minimum Tax For Estates And Trusts

The M2MT, or Alternative Minimum Tax for Estates and Trusts, is a tax mechanism designed to ensure that estates and trusts pay a minimum amount of tax, regardless of deductions and credits that may otherwise reduce their taxable income. This tax applies to estates and trusts that have a certain level of income, effectively preventing them from avoiding tax liabilities through excessive deductions. The M2MT calculation is based on the taxable income of the estate or trust, adjusted for specific preferences and adjustments defined by the IRS.

Steps to Complete the M2MT, Alternative Minimum Tax For Estates And Trusts

Completing the M2MT requires a systematic approach to ensure accuracy. Here are the key steps involved:

- Gather all financial documents related to the estate or trust, including income statements, deduction records, and prior tax returns.

- Calculate the regular taxable income of the estate or trust before any adjustments.

- Identify and apply any specific adjustments required by the IRS, such as tax-exempt interest or accelerated depreciation.

- Determine the Alternative Minimum Taxable Income (AMTI) by adding back certain deductions to the taxable income.

- Calculate the M2MT using the appropriate tax rates on the AMTI.

- Complete the M2MT form accurately, ensuring all calculations are double-checked for correctness.

- File the completed M2MT form along with the regular tax return for the estate or trust.

Legal Use of the M2MT, Alternative Minimum Tax For Estates And Trusts

The M2MT is legally mandated under U.S. tax law, ensuring compliance with federal regulations regarding the taxation of estates and trusts. It is essential for fiduciaries managing estates and trusts to understand the legal implications of the M2MT. Failure to comply with the M2MT requirements can lead to penalties, interest, and additional tax liabilities. Proper legal guidance is advisable to navigate the complexities of this tax and ensure all filings are completed accurately and timely.

Filing Deadlines and Important Dates

Filing deadlines for the M2MT coincide with the tax return deadlines for estates and trusts. Generally, the due date for filing Form 1041, which includes the M2MT, is the fifteenth day of the fourth month following the close of the tax year. For estates and trusts operating on a calendar year, this typically falls on April 15. It is crucial to be aware of any extensions that may apply and to keep track of any changes in tax law that could affect these deadlines.

Required Documents for M2MT Filing

To file the M2MT, several documents are necessary to ensure accurate reporting. These include:

- Form 1041, U.S. Income Tax Return for Estates and Trusts

- Financial statements detailing income and deductions

- Records of any tax-exempt interest income

- Documentation of any adjustments or preferences applicable to the estate or trust

- Prior year tax returns for reference

Examples of Using the M2MT, Alternative Minimum Tax For Estates And Trusts

Understanding practical applications of the M2MT can clarify its importance. For instance, if an estate has significant deductions from charitable contributions, these may reduce the taxable income significantly. However, the M2MT ensures that the estate pays a minimum tax based on its AMTI, which may result in a tax liability even if the deductions are high. Similarly, trusts with substantial income from investments may find themselves subject to the M2MT, ensuring they contribute a fair share to federal tax revenues.

Quick guide on how to complete m2mt alternative minimum tax for estates and trusts

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained traction among companies and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed documentation, allowing you to access the required form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to Modify and Electronically Sign [SKS] with Ease

- Find [SKS] and click on Get Form to begin.

- Make use of the tools we offer to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with the specialized tools provided by airSlate SignNow.

- Create your electronic signature using the Sign feature, which only takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Alter and electronically sign [SKS] to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to M2MT, Alternative Minimum Tax For Estates And Trusts

Create this form in 5 minutes!

How to create an eSignature for the m2mt alternative minimum tax for estates and trusts

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is M2MT, Alternative Minimum Tax For Estates And Trusts?

M2MT, Alternative Minimum Tax For Estates And Trusts, is a tax calculation that ensures estates and trusts pay a minimum amount of tax, regardless of deductions. This tax applies to certain estates and trusts that exceed specific income thresholds. Understanding M2MT is crucial for effective tax planning and compliance.

-

How can airSlate SignNow help with M2MT, Alternative Minimum Tax For Estates And Trusts?

airSlate SignNow provides a streamlined solution for managing documents related to M2MT, Alternative Minimum Tax For Estates And Trusts. With our eSigning capabilities, you can easily send and sign tax-related documents, ensuring compliance and efficiency. This helps you focus on your tax strategy rather than paperwork.

-

What features does airSlate SignNow offer for managing M2MT, Alternative Minimum Tax For Estates And Trusts?

Our platform offers features like customizable templates, secure eSigning, and document tracking specifically designed for M2MT, Alternative Minimum Tax For Estates And Trusts. These tools simplify the document management process, making it easier to handle tax-related paperwork. Additionally, our user-friendly interface ensures a smooth experience.

-

Is airSlate SignNow cost-effective for handling M2MT, Alternative Minimum Tax For Estates And Trusts?

Yes, airSlate SignNow is a cost-effective solution for managing M2MT, Alternative Minimum Tax For Estates And Trusts. Our pricing plans are designed to fit various budgets, ensuring that businesses of all sizes can access essential eSigning features. This affordability allows you to allocate resources more effectively while ensuring compliance.

-

Can airSlate SignNow integrate with other tools for M2MT, Alternative Minimum Tax For Estates And Trusts?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, enhancing your workflow for M2MT, Alternative Minimum Tax For Estates And Trusts. This integration allows for automatic document generation and streamlined processes, making tax management more efficient. You can connect your existing tools without hassle.

-

What are the benefits of using airSlate SignNow for M2MT, Alternative Minimum Tax For Estates And Trusts?

Using airSlate SignNow for M2MT, Alternative Minimum Tax For Estates And Trusts offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance. Our platform simplifies the eSigning process, allowing you to focus on strategic tax planning. Additionally, our secure environment ensures that your sensitive tax documents are protected.

-

How does airSlate SignNow ensure the security of documents related to M2MT, Alternative Minimum Tax For Estates And Trusts?

airSlate SignNow prioritizes security, employing advanced encryption and secure storage for documents related to M2MT, Alternative Minimum Tax For Estates And Trusts. Our platform complies with industry standards to protect your sensitive information. You can confidently manage your tax documents, knowing they are safe and secure.

Get more for M2MT, Alternative Minimum Tax For Estates And Trusts

- Kansas application of ex parte orders form

- Journal entry of competency hearing kansasjudicialcouncil form

- 1 101 informaci n para padres sus derechos y responsabilidades kansasjudicialcouncil

- Xml us government publishing office kansasjudicialcouncil form

- Diversion application neosho county form

- Ky need deposition form

- Lusersa_mgmt sharedconnieformsrepossession form 2

- Voluntary transfer of custody louisiana form

Find out other M2MT, Alternative Minimum Tax For Estates And Trusts

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online