Credit for Income Tax Paid to Another State Minnesota Department Form

What is the Credit For Income Tax Paid To Another State Minnesota Department

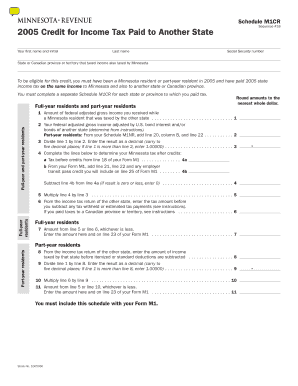

The Credit For Income Tax Paid To Another State is a tax benefit provided by the Minnesota Department of Revenue. This credit allows Minnesota residents to reduce their state tax liability by the amount of income tax they have paid to another state. This provision is particularly beneficial for individuals who earn income in multiple states, ensuring they are not taxed twice on the same earnings. The credit is designed to promote fairness in the tax system, allowing taxpayers to receive a refund or reduction in their Minnesota state tax obligations based on taxes paid elsewhere.

How to use the Credit For Income Tax Paid To Another State Minnesota Department

To utilize the Credit For Income Tax Paid To Another State, taxpayers must first determine the amount of income tax paid to the other state. This amount can be found on the tax return filed with that state. Once the amount is established, taxpayers can claim the credit on their Minnesota tax return by completing the appropriate forms. It is essential to ensure that the income reported on the Minnesota return reflects the income earned in the other state to accurately calculate the credit. Proper documentation, including copies of the tax returns from the other state, should be maintained for verification purposes.

Steps to complete the Credit For Income Tax Paid To Another State Minnesota Department

Completing the Credit For Income Tax Paid To Another State involves several key steps:

- Gather documentation from the other state, including your tax return and proof of payment.

- Calculate the total income tax paid to the other state.

- Complete the Minnesota tax return, ensuring to include the income earned in the other state.

- Fill out the Minnesota form specifically for claiming the credit, providing details of the taxes paid to the other state.

- Attach any required documentation, such as copies of the other state's tax return.

- Submit your Minnesota tax return by the designated deadline.

Eligibility Criteria

To qualify for the Credit For Income Tax Paid To Another State, taxpayers must meet specific eligibility criteria. Primarily, the taxpayer must be a resident of Minnesota and have earned income in another state that is subject to taxation. The income must be reported on both the Minnesota tax return and the tax return of the other state. Additionally, the credit is only available for taxes that are legally owed and paid to the other state. Taxpayers should ensure they comply with all requirements to avoid issues with their credit claim.

Required Documents

When claiming the Credit For Income Tax Paid To Another State, taxpayers need to provide certain documents to support their claim. These documents typically include:

- A copy of the tax return filed with the other state.

- Proof of payment of the income tax to the other state, such as a payment receipt or bank statement.

- The completed Minnesota tax return, including any forms related to the credit.

Having these documents ready can facilitate a smoother filing process and help ensure that the credit is applied correctly.

Filing Deadlines / Important Dates

Taxpayers should be aware of the filing deadlines associated with the Credit For Income Tax Paid To Another State. Typically, Minnesota state tax returns are due on April 15 each year, aligning with federal tax deadlines. If taxpayers are claiming this credit, it is crucial to file by this date to avoid penalties. Additionally, if an extension is requested for filing the Minnesota return, it is essential to pay any estimated taxes owed by the original due date to prevent interest and penalties.

Quick guide on how to complete credit for income tax paid to another state minnesota department

Complete [SKS] seamlessly on any device

Online document management has become increasingly sought after by businesses and individuals alike. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, as you can easily find the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Manage [SKS] on any device utilizing the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to edit and electronically sign [SKS] effortlessly

- Obtain [SKS] and click on Get Form to initiate the process.

- Utilize the tools we provide to fill out your form.

- Emphasize crucial sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Generate your electronic signature with the Sign tool, which takes just seconds and possesses the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Choose how you prefer to submit your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you choose. Edit and electronically sign [SKS] and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Credit For Income Tax Paid To Another State Minnesota Department

Create this form in 5 minutes!

How to create an eSignature for the credit for income tax paid to another state minnesota department

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Credit For Income Tax Paid To Another State Minnesota Department?

The Credit For Income Tax Paid To Another State Minnesota Department allows residents to claim a credit for taxes paid to another state on income earned there. This helps to avoid double taxation and ensures that taxpayers are only taxed on their income once. Understanding this credit can signNowly benefit those who work in different states.

-

How can I apply for the Credit For Income Tax Paid To Another State Minnesota Department?

To apply for the Credit For Income Tax Paid To Another State Minnesota Department, you need to complete the appropriate forms when filing your Minnesota state tax return. This typically involves providing documentation of the taxes paid to the other state. It's essential to follow the guidelines provided by the Minnesota Department of Revenue to ensure a smooth application process.

-

What documents do I need for the Credit For Income Tax Paid To Another State Minnesota Department?

You will need to provide proof of income earned in the other state and the taxes paid there. This may include W-2 forms, 1099s, or tax returns from the other state. Having these documents ready will help streamline your application for the Credit For Income Tax Paid To Another State Minnesota Department.

-

Is there a limit to the Credit For Income Tax Paid To Another State Minnesota Department?

Yes, there are limits to the Credit For Income Tax Paid To Another State Minnesota Department based on the amount of income earned and the taxes paid to the other state. The credit cannot exceed the amount of Minnesota tax owed on the income earned in the other state. It's important to review the specific guidelines to understand these limits.

-

How does the Credit For Income Tax Paid To Another State Minnesota Department affect my overall tax liability?

The Credit For Income Tax Paid To Another State Minnesota Department can signNowly reduce your overall tax liability by allowing you to offset taxes paid to another state against your Minnesota tax obligation. This means you may owe less in Minnesota taxes, which can lead to a refund or a lower tax bill. Understanding this credit is crucial for effective tax planning.

-

Can I use airSlate SignNow to manage documents related to the Credit For Income Tax Paid To Another State Minnesota Department?

Absolutely! airSlate SignNow provides an easy-to-use platform for managing and eSigning documents related to your tax filings, including those for the Credit For Income Tax Paid To Another State Minnesota Department. This can streamline your process and ensure that all necessary documents are organized and accessible.

-

What features does airSlate SignNow offer that can assist with tax documentation?

airSlate SignNow offers features such as secure eSigning, document templates, and cloud storage, which can assist you in managing tax documentation efficiently. These features ensure that you can easily prepare, sign, and store documents related to the Credit For Income Tax Paid To Another State Minnesota Department, making tax season less stressful.

Get more for Credit For Income Tax Paid To Another State Minnesota Department

- Number knowledge test form

- New headway elementary 4th edition tests pdf form

- Principles of risk management and insurance 13th edition pdf download form

- Humana medical precertification request form

- Eimm5669 form

- Troubleshooting cisco ip telephony form

- Scale factor worksheet form

- Maersk letterhead form

Find out other Credit For Income Tax Paid To Another State Minnesota Department

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself