M1WFC, Minnesota Working Family Credit Form

What is the M1WFC, Minnesota Working Family Credit

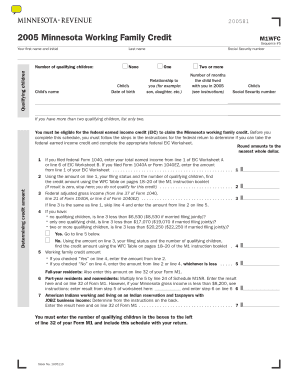

The M1WFC, or Minnesota Working Family Credit, is a state tax credit designed to support low- to moderate-income working families in Minnesota. This credit aims to reduce poverty and encourage employment by providing financial relief to eligible taxpayers. The M1WFC is based on income and family size, allowing families to receive a credit that can significantly lower their tax liability. It is similar to the federal Earned Income Tax Credit (EITC) but tailored specifically for Minnesota residents.

Eligibility Criteria

To qualify for the M1WFC, taxpayers must meet specific eligibility requirements. These include:

- Filing a Minnesota tax return for the year in which the credit is claimed.

- Having earned income from employment or self-employment.

- Meeting income limits based on family size, which are adjusted annually.

- Being a resident of Minnesota for at least half of the year.

Additionally, taxpayers must have qualifying children under the age of 19, or under the age of 24 if they are full-time students, to maximize their credit amount.

Steps to complete the M1WFC, Minnesota Working Family Credit

Completing the M1WFC involves several key steps:

- Gather necessary documents, including proof of income and identification for qualifying children.

- Complete the Minnesota tax return (Form M1) and include the M1WFC section.

- Calculate the credit amount based on the number of qualifying children and total earned income.

- Submit the tax return by the filing deadline, ensuring all information is accurate.

Utilizing tax preparation software can simplify this process, allowing for easier calculations and form submissions.

Required Documents

When applying for the M1WFC, certain documents are essential to support your claim. These may include:

- W-2 forms or 1099 forms that report earned income.

- Social Security numbers for all family members, including qualifying children.

- Proof of residency, such as utility bills or lease agreements.

Having these documents ready can streamline the application process and ensure compliance with state requirements.

Form Submission Methods

The M1WFC can be submitted through various methods, allowing flexibility for taxpayers. Options include:

- Online submission through tax preparation software, which often includes the M1WFC as part of the filing process.

- Mailing a paper tax return to the Minnesota Department of Revenue.

- In-person filing at designated tax assistance locations or offices.

Each method has its advantages, and taxpayers should choose the one that best fits their needs and preferences.

Examples of using the M1WFC, Minnesota Working Family Credit

Understanding how the M1WFC applies in real-life scenarios can help clarify its benefits. For instance:

- A single parent with two children earning $30,000 annually may qualify for a substantial credit, reducing their tax burden significantly.

- A married couple with three children earning $50,000 might also benefit, receiving a credit that helps offset childcare costs.

These examples illustrate how the credit can provide essential financial support, making it easier for families to manage expenses and invest in their futures.

Quick guide on how to complete m1wfc minnesota working family credit

Prepare [SKS] effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Handle [SKS] on any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign [SKS] without hassle

- Locate [SKS] and click on Get Form to initiate.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to M1WFC, Minnesota Working Family Credit

Create this form in 5 minutes!

How to create an eSignature for the m1wfc minnesota working family credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the M1WFC, Minnesota Working Family Credit?

The M1WFC, Minnesota Working Family Credit, is a tax credit designed to assist low- to moderate-income working families in Minnesota. This credit helps reduce the tax burden and can provide signNow financial relief for eligible families. Understanding the M1WFC can help you maximize your tax benefits.

-

Who is eligible for the M1WFC, Minnesota Working Family Credit?

Eligibility for the M1WFC, Minnesota Working Family Credit, typically includes working families with children who meet specific income requirements. To qualify, you must have earned income and file a Minnesota tax return. It's essential to review the eligibility criteria to ensure you can benefit from this credit.

-

How do I apply for the M1WFC, Minnesota Working Family Credit?

To apply for the M1WFC, Minnesota Working Family Credit, you need to complete the Minnesota tax return and include the necessary forms for the credit. Make sure to gather all required documentation, such as proof of income and dependent information. Filing accurately will help you receive the credit you deserve.

-

What are the benefits of the M1WFC, Minnesota Working Family Credit?

The M1WFC, Minnesota Working Family Credit, offers several benefits, including reducing your overall tax liability and providing additional financial support for families. This credit can help cover essential expenses, making it easier for families to manage their budgets. Utilizing the M1WFC can signNowly enhance your financial situation.

-

How much can I receive from the M1WFC, Minnesota Working Family Credit?

The amount you can receive from the M1WFC, Minnesota Working Family Credit, varies based on your income and the number of qualifying children. Generally, the credit increases with the number of children, providing more substantial support for larger families. It's advisable to use tax calculators or consult a tax professional to estimate your potential credit.

-

Can I claim the M1WFC, Minnesota Working Family Credit if I am self-employed?

Yes, self-employed individuals can claim the M1WFC, Minnesota Working Family Credit, as long as they meet the income and eligibility requirements. It's crucial to report your self-employment income accurately on your tax return. This credit can still provide valuable financial assistance for self-employed working families.

-

Are there any changes to the M1WFC, Minnesota Working Family Credit for the current tax year?

Tax credits, including the M1WFC, Minnesota Working Family Credit, may undergo changes each tax year. It's important to stay updated on any modifications to eligibility, credit amounts, or filing procedures. Checking the Minnesota Department of Revenue website can provide the latest information regarding the M1WFC.

Get more for M1WFC, Minnesota Working Family Credit

Find out other M1WFC, Minnesota Working Family Credit

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer

- Electronic signature Utah Rental Invoice Template Online

- Electronic signature Louisiana Commercial Lease Agreement Template Free

- eSignature Delaware Sales Invoice Template Free

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online

- eSignature Pennsylvania Sales Invoice Template Free