KF, Beneficiary's Share of Minnesota Taxable Income Revenue State Mn Form

What is the KF, Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn

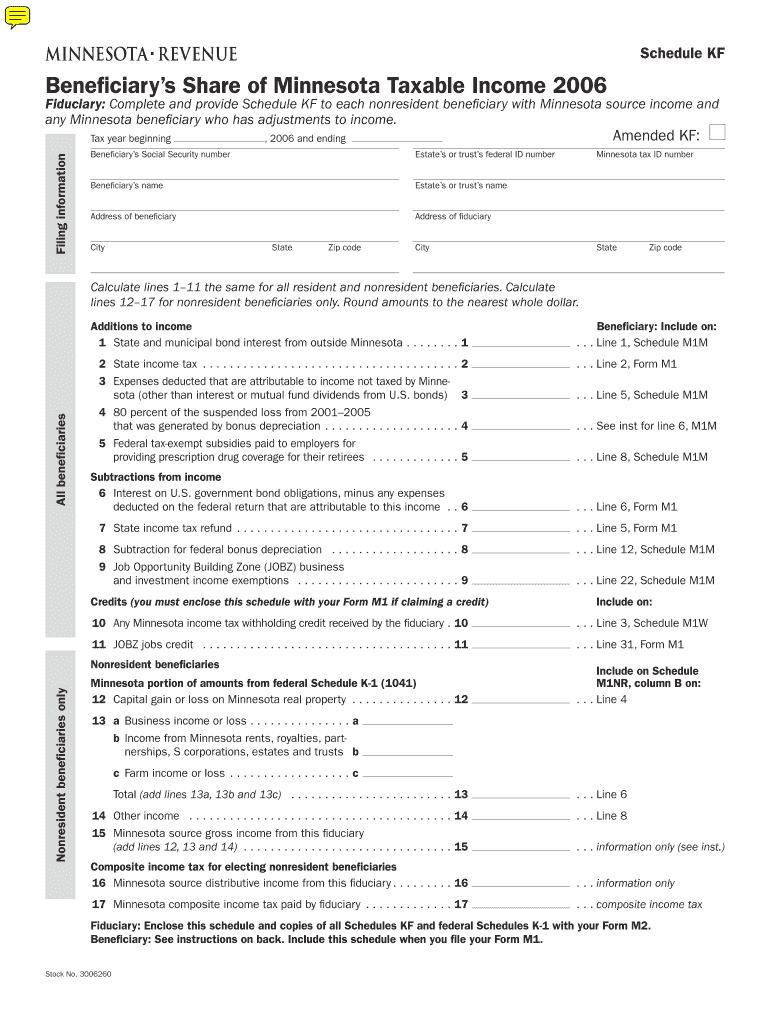

The KF, Beneficiary's Share Of Minnesota Taxable Income is a tax form used in Minnesota to report the share of taxable income that beneficiaries receive from trusts or estates. This form is essential for ensuring that the income distributed to beneficiaries is accurately reported for state tax purposes. It helps beneficiaries understand their tax responsibilities and ensures compliance with Minnesota tax laws.

How to use the KF, Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn

To use the KF form, beneficiaries must first receive their share of taxable income from the trust or estate. Once they have this information, they can fill out the KF form by entering the relevant income details. It is important to ensure that all figures are accurate and that the form is completed in accordance with Minnesota tax regulations. After completing the form, beneficiaries should retain a copy for their records and submit it as part of their state tax return.

Steps to complete the KF, Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn

Completing the KF form involves several key steps:

- Gather necessary information regarding the income received from the trust or estate.

- Fill out the KF form, ensuring all income figures are accurate.

- Double-check the completed form for any errors or omissions.

- Keep a copy of the form for your records.

- Submit the form with your Minnesota state tax return by the filing deadline.

State-specific rules for the KF, Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn

In Minnesota, specific rules apply to the KF form. Beneficiaries must report their share of taxable income as outlined by Minnesota tax law. This includes understanding how to allocate income based on the trust or estate's overall income. It is crucial for beneficiaries to be aware of any changes in state tax regulations that may affect their reporting obligations.

Required Documents

When completing the KF form, beneficiaries should have the following documents ready:

- Tax documents from the trust or estate detailing income distributions.

- Previous year’s tax returns, if applicable, for reference.

- Any additional documentation that supports the reported income.

Penalties for Non-Compliance

Failure to accurately report income using the KF form can result in penalties from the Minnesota Department of Revenue. This may include fines or interest on unpaid taxes. It is important for beneficiaries to ensure compliance with all reporting requirements to avoid these potential consequences.

Quick guide on how to complete kf beneficiarys share of minnesota taxable income revenue state mn

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides all the resources necessary to create, modify, and electronically sign your documents swiftly without interruptions. Handle [SKS] on any system using airSlate SignNow's Android or iOS applications and enhance your document-centric processes today.

How to Modify and Electronically Sign [SKS] with Ease

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools provided to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Generate your signature using the Sign feature, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to preserve your modifications.

- Select your preferred method of delivering your form, whether via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Modify and electronically sign [SKS] to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the kf beneficiarys share of minnesota taxable income revenue state mn

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is KF, Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn?

KF, Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn refers to the portion of taxable income that beneficiaries must report for Minnesota state tax purposes. Understanding this concept is crucial for beneficiaries to ensure compliance with state tax regulations and to accurately file their taxes.

-

How can airSlate SignNow help with KF, Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn documentation?

airSlate SignNow provides an efficient platform for creating, sending, and eSigning documents related to KF, Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn. This streamlines the process of managing tax-related documents, ensuring that beneficiaries can easily handle their paperwork.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for individuals and teams. Each plan provides access to features that can assist with KF, Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn documentation, making it a cost-effective solution for managing tax-related tasks.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure eSigning capabilities. These features are particularly beneficial for managing KF, Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn documents, ensuring that all necessary forms are completed accurately and efficiently.

-

Can airSlate SignNow integrate with other software for tax management?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software, enhancing your ability to manage KF, Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn documentation. This integration allows for a more streamlined workflow, reducing the time spent on administrative tasks.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents offers numerous benefits, including increased efficiency, reduced errors, and enhanced security. By simplifying the process of handling KF, Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn documents, businesses can focus more on their core operations.

-

Is airSlate SignNow user-friendly for those unfamiliar with eSigning?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to navigate the platform, even those unfamiliar with eSigning. This accessibility is particularly important for managing KF, Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn documents, ensuring that all users can complete their tasks without hassle.

Get more for KF, Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn

- Faculty guide directing international faculty led programs and form

- Lagcc transcripts form

- Were sdsurf employees injured form

- Office for inclusion and culture university of rochester form

- Bloodborne pathogens exposure control plan the form

- Iowa drainage school sponsorship form

- Clinic registration information

- Mouse genetics core in vitro fertilization request form

Find out other KF, Beneficiary's Share Of Minnesota Taxable Income Revenue State Mn

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template