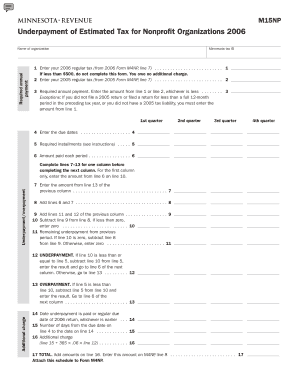

M15NP, Underpayment of Estimated Tax for Nonprofit Organizations Form

What is the M15NP, Underpayment Of Estimated Tax For Nonprofit Organizations

The M15NP form is specifically designed for nonprofit organizations in the United States to address the underpayment of estimated taxes. This form allows these organizations to report any estimated tax liabilities that were not met during the tax year. Nonprofits, while often exempt from certain taxes, may still be subject to unrelated business income tax (UBIT) and other tax obligations, making it essential to accurately report any underpayments.

How to use the M15NP, Underpayment Of Estimated Tax For Nonprofit Organizations

To effectively use the M15NP form, nonprofit organizations should first determine their estimated tax liability based on their income sources. Once the liability is calculated, organizations can fill out the M15NP to report any underpayment. It is crucial to provide accurate financial information and ensure that all relevant calculations are correct to avoid penalties. The completed form must then be submitted to the appropriate tax authority as part of the organization's tax filings.

Steps to complete the M15NP, Underpayment Of Estimated Tax For Nonprofit Organizations

Completing the M15NP involves several key steps:

- Gather financial records to determine total income and expenses for the year.

- Calculate the estimated tax liability, including any applicable UBIT.

- Assess any payments already made towards estimated taxes.

- Fill out the M15NP form accurately, reflecting the calculated underpayment.

- Review the form for accuracy and completeness.

- Submit the form to the appropriate tax authority by the designated deadline.

Filing Deadlines / Important Dates

Nonprofit organizations must be aware of specific deadlines when submitting the M15NP form. Generally, the form should be filed by the same deadline as the organization's annual tax return. This typically falls on the fifteenth day of the fifth month following the end of the tax year. However, organizations should verify the exact dates each year, as they may vary based on weekends or holidays.

Penalties for Non-Compliance

Failure to file the M15NP form or to pay the required estimated taxes can result in significant penalties for nonprofit organizations. These penalties may include interest on the unpaid tax amount and additional fines for late filing. It is essential for organizations to stay compliant with tax obligations to avoid these financial repercussions.

Legal use of the M15NP, Underpayment Of Estimated Tax For Nonprofit Organizations

The M15NP form has legal significance for nonprofit organizations as it ensures compliance with federal tax laws regarding estimated tax payments. By utilizing this form, organizations can formally acknowledge any underpayment and take steps to rectify it. This legal documentation helps protect the organization from potential audits and penalties associated with non-compliance.

Quick guide on how to complete m15np underpayment of estimated tax for nonprofit organizations

Accomplish [SKS] effortlessly on any device

Digital document administration has become increasingly favored by businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, enabling you to locate the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage [SKS] on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

How to modify and eSign [SKS] with ease

- Access [SKS] and click Get Form to begin.

- Make use of the tools we provide to finalize your document.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tiring form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your preference. Edit and eSign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to M15NP, Underpayment Of Estimated Tax For Nonprofit Organizations

Create this form in 5 minutes!

How to create an eSignature for the m15np underpayment of estimated tax for nonprofit organizations

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the M15NP, Underpayment Of Estimated Tax For Nonprofit Organizations?

The M15NP, Underpayment Of Estimated Tax For Nonprofit Organizations, is a tax form that helps nonprofits calculate any underpayment of estimated taxes. This form is essential for ensuring compliance with tax regulations and avoiding penalties. Understanding this form can help nonprofits manage their finances more effectively.

-

How can airSlate SignNow assist with the M15NP, Underpayment Of Estimated Tax For Nonprofit Organizations?

airSlate SignNow provides an efficient platform for nonprofits to eSign and send documents related to the M15NP, Underpayment Of Estimated Tax For Nonprofit Organizations. By streamlining the document management process, nonprofits can focus on their mission while ensuring compliance with tax obligations. Our solution is designed to be user-friendly and cost-effective.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are crucial for managing tax documents like the M15NP, Underpayment Of Estimated Tax For Nonprofit Organizations. These features enhance efficiency and ensure that all necessary documents are completed accurately and on time. Additionally, our platform is designed to simplify the entire process for nonprofits.

-

Is airSlate SignNow affordable for nonprofit organizations?

Yes, airSlate SignNow is a cost-effective solution tailored for nonprofit organizations. We offer competitive pricing plans that cater to the budget constraints of nonprofits while providing essential features for managing documents like the M15NP, Underpayment Of Estimated Tax For Nonprofit Organizations. This affordability ensures that nonprofits can access the tools they need without overspending.

-

Can airSlate SignNow integrate with other software used by nonprofits?

Absolutely! airSlate SignNow integrates seamlessly with various software solutions commonly used by nonprofit organizations. This includes accounting software and CRM systems, which can help streamline the process of managing documents related to the M15NP, Underpayment Of Estimated Tax For Nonprofit Organizations. Our integrations enhance productivity and ensure a smooth workflow.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including the M15NP, Underpayment Of Estimated Tax For Nonprofit Organizations, offers numerous benefits. These include increased efficiency, reduced paperwork, and enhanced security for sensitive information. Nonprofits can save time and resources while ensuring compliance with tax regulations.

-

How does airSlate SignNow ensure the security of sensitive documents?

airSlate SignNow prioritizes the security of sensitive documents through advanced encryption and secure cloud storage. This is particularly important for documents like the M15NP, Underpayment Of Estimated Tax For Nonprofit Organizations, which contain confidential information. Our platform is designed to protect your data while providing easy access for authorized users.

Get more for M15NP, Underpayment Of Estimated Tax For Nonprofit Organizations

- Required formsuconn pre college summer

- Dependent student verification worksheetforms ampampamp policies

- Opt stem request form the university of texas at dallas

- Cbo visit checklist sjsu form

- Printing services brand standards the university of texas at dallas form

- Internship in guangzhou chinachina internship placements form

- Education recordsletters of recommendation form

- Application for gap year 20 2021 research internship form

Find out other M15NP, Underpayment Of Estimated Tax For Nonprofit Organizations

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile