M11AR, Fire Insurance Tax Retaliatory Schedule Form M19, Insurance Estimated Premium Tax Payment Revenue State Mn

Understanding the M11AR, Fire Insurance Tax Retaliatory Schedule Form M19

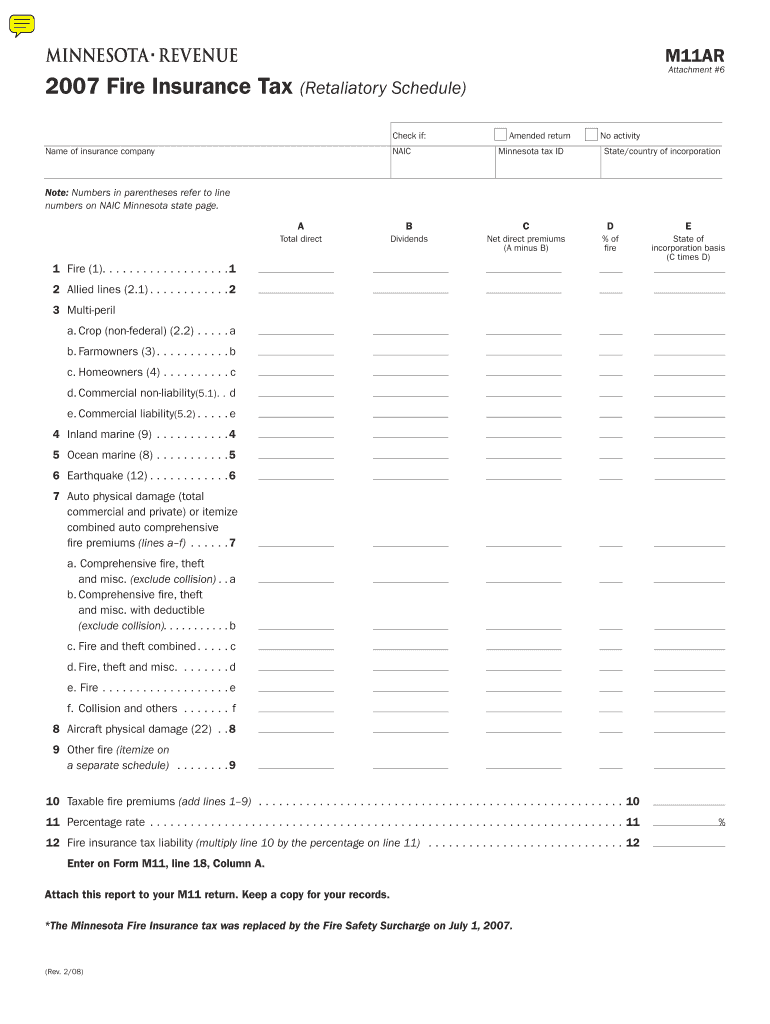

The M11AR, Fire Insurance Tax Retaliatory Schedule Form M19, is a crucial document for insurance providers operating in Minnesota. This form is used to report and calculate retaliatory taxes on fire insurance premiums. It is essential for ensuring compliance with state tax regulations, particularly for companies that may be subject to retaliatory tax provisions due to their operations in multiple states. Understanding this form is vital for maintaining accurate tax records and fulfilling legal obligations.

Steps to Complete the M11AR, Fire Insurance Tax Retaliatory Schedule Form M19

Completing the M11AR form involves several key steps. First, gather all necessary financial information related to fire insurance premiums collected during the reporting period. This includes details about premiums written, losses incurred, and any applicable deductions. Next, accurately fill out each section of the form, ensuring that all calculations are correct. Finally, review the completed form for accuracy before submission to avoid potential penalties. It is advisable to keep copies of all documents for your records.

Legal Use of the M11AR, Fire Insurance Tax Retaliatory Schedule Form M19

The M11AR form serves a legal purpose by ensuring that insurance companies comply with Minnesota's tax laws. Filing this form is a legal requirement for insurers who collect fire insurance premiums. Failure to submit the form or inaccuracies in reporting can lead to penalties, including fines or increased tax liabilities. Therefore, understanding the legal implications of this form is essential for insurance providers to avoid non-compliance issues.

Key Elements of the M11AR, Fire Insurance Tax Retaliatory Schedule Form M19

Several key elements must be included in the M11AR form. These include the insurer's identification information, total premiums written, total losses, and any applicable adjustments or deductions. Additionally, the form requires detailed calculations to determine the retaliatory tax owed. Each section must be completed accurately to ensure that the form meets state requirements and reflects the insurer's financial activities correctly.

Filing Deadlines for the M11AR, Fire Insurance Tax Retaliatory Schedule Form M19

It is important to be aware of the filing deadlines for the M11AR form. Typically, the form must be submitted annually, and the due date aligns with the state’s tax filing schedule. Missing the deadline can result in penalties or interest charges on unpaid taxes. Insurers should mark their calendars and prepare the necessary documentation well in advance to ensure timely submission.

Obtaining the M11AR, Fire Insurance Tax Retaliatory Schedule Form M19

The M11AR form can be obtained from the Minnesota Department of Revenue's official website or directly from their office. It is available in both digital and paper formats, allowing insurers to choose the method that best suits their needs. For those preferring to file electronically, ensure that you have the necessary software or tools to complete the form accurately.

Quick guide on how to complete m11ar fire insurance tax retaliatory schedule form m19 insurance estimated premium tax payment revenue state mn

Easily Prepare [SKS] on Any Device

Managing documents online has gained traction among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents quickly without delays. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The Easiest Way to Edit and eSign [SKS] Effortlessly

- Obtain [SKS] and then select Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and then click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searches, or mistakes that require reprinting new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] while ensuring excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the m11ar fire insurance tax retaliatory schedule form m19 insurance estimated premium tax payment revenue state mn

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the M11AR, Fire Insurance Tax Retaliatory Schedule Form M19?

The M11AR, Fire Insurance Tax Retaliatory Schedule Form M19 is a document required by the state of Minnesota for reporting insurance premium taxes. It helps ensure compliance with state regulations regarding insurance revenue. Understanding this form is crucial for businesses operating in the insurance sector.

-

How can airSlate SignNow help with the M11AR, Fire Insurance Tax Retaliatory Schedule Form M19?

airSlate SignNow provides an efficient platform for eSigning and managing documents like the M11AR, Fire Insurance Tax Retaliatory Schedule Form M19. Our solution streamlines the process, making it easier to complete and submit necessary forms. This can save time and reduce errors in your tax reporting.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of various businesses. Our plans are designed to be cost-effective while providing access to essential features for managing documents, including the M11AR, Fire Insurance Tax Retaliatory Schedule Form M19. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as eSigning, document templates, and secure cloud storage. These tools enhance your ability to manage documents like the M11AR, Fire Insurance Tax Retaliatory Schedule Form M19 efficiently. Our platform is designed to simplify the document workflow for businesses of all sizes.

-

Is airSlate SignNow compliant with state regulations for insurance documents?

Yes, airSlate SignNow is designed to comply with state regulations, including those related to the M11AR, Fire Insurance Tax Retaliatory Schedule Form M19. We prioritize security and compliance to ensure that your documents meet all necessary legal requirements. This gives you peace of mind when handling sensitive information.

-

Can I integrate airSlate SignNow with other software tools?

Absolutely! airSlate SignNow offers integrations with various software tools to enhance your workflow. Whether you need to connect with CRM systems or accounting software, our platform can work seamlessly with your existing tools, making it easier to manage documents like the M11AR, Fire Insurance Tax Retaliatory Schedule Form M19.

-

What are the benefits of using airSlate SignNow for insurance companies?

Using airSlate SignNow provides numerous benefits for insurance companies, including increased efficiency and reduced paperwork. Our platform allows for quick eSigning and document management, which is essential for forms like the M11AR, Fire Insurance Tax Retaliatory Schedule Form M19. This can lead to faster processing times and improved customer satisfaction.

Get more for M11AR, Fire Insurance Tax Retaliatory Schedule Form M19, Insurance Estimated Premium Tax Payment Revenue State Mn

- Consent to adopt kansas form

- Kansas affidavit of proverty form

- Pmy documentsksjc webdocumentsmiscellaneous formsrtfksa61_2713_smallclaimssummons7 16 10rtf kansasjudicialcouncil

- Kansas application of ex parte orders form

- Journal entry of competency hearing kansasjudicialcouncil form

- 1 101 informaci n para padres sus derechos y responsabilidades kansasjudicialcouncil

- Xml us government publishing office kansasjudicialcouncil form

- Diversion application neosho county form

Find out other M11AR, Fire Insurance Tax Retaliatory Schedule Form M19, Insurance Estimated Premium Tax Payment Revenue State Mn

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple