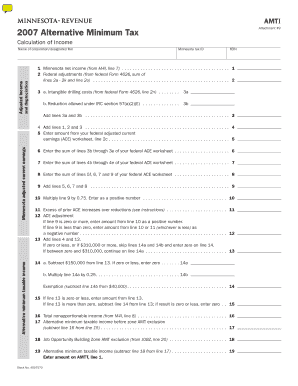

AMTI Attachment #9 Alternative Minimum Tax Calculation of Income Name of Corporationdesignated Filer Minnesota Tax ID FEIN Adjus Form

Understanding the AMTI Attachment #9

The AMTI Attachment #9 is a crucial form for corporations operating in Minnesota, specifically designed for the calculation of Alternative Minimum Tax (AMT). This form requires specific details such as the name of the corporation, the designated filer, the Minnesota Tax ID, and the Federal Employer Identification Number (FEIN). Additionally, it incorporates adjusted income and depreciation figures, which are essential for accurately determining the corporation's Minnesota net income as reported on the M4I, Line 7. Understanding this form is vital for compliance with state tax regulations and ensuring that corporations meet their tax obligations effectively.

Steps to Complete the AMTI Attachment #9

Completing the AMTI Attachment #9 involves several key steps that ensure accurate reporting of income and tax obligations. First, gather all necessary documentation, including the corporation's financial statements and previous tax returns. Next, fill in the corporation's name, designated filer information, and tax identification numbers accurately. Calculate the adjusted income and depreciation, ensuring that all figures align with the requirements outlined in the Minnesota tax guidelines. Finally, review the completed form for accuracy before submission, as any discrepancies may lead to penalties or delays in processing.

Legal Use of the AMTI Attachment #9

The AMTI Attachment #9 serves a legal purpose in the context of Minnesota tax law. It is utilized by corporations to report their Alternative Minimum Tax calculations, which are necessary for compliance with state tax regulations. Proper completion and submission of this form help avoid legal issues related to tax evasion or non-compliance. Corporations must ensure that they adhere to the specific guidelines set forth by the Minnesota Department of Revenue to maintain their legal standing and avoid potential penalties.

State-Specific Rules for the AMTI Attachment #9

In Minnesota, the AMTI Attachment #9 must be completed following specific state rules that may differ from federal tax regulations. Corporations must be aware of the unique adjustments and calculations required by the state to accurately report their Alternative Minimum Tax. This includes understanding how to account for state-specific deductions and credits that may impact the overall tax liability. Familiarity with these rules is essential for ensuring compliance and optimizing tax outcomes for the corporation.

Required Documents for the AMTI Attachment #9

To successfully complete the AMTI Attachment #9, certain documents are required. These include the corporation's financial statements, previous tax returns, and any supporting documentation for adjustments made to income and depreciation. Additionally, the corporation should have its Minnesota Tax ID and FEIN readily available. Having these documents organized and accessible will facilitate a smoother completion process and ensure that all necessary information is accurately reported.

Filing Deadlines for the AMTI Attachment #9

Corporations must be aware of the filing deadlines associated with the AMTI Attachment #9 to ensure timely submission. Typically, the due date aligns with the corporation's annual tax return deadline. It is essential to verify the specific dates each tax year, as they may vary. Missing the filing deadline can result in penalties and interest on unpaid taxes, making it critical for corporations to stay informed about these important dates.

Quick guide on how to complete amti attachment 9 alternative minimum tax calculation of income name of corporationdesignated filer minnesota tax id fein

Complete [SKS] effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct format and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and streamline any document-centric process today.

How to edit and electronically sign [SKS] with ease

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers for that purpose.

- Generate your signature using the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to preserve your modifications.

- Choose your preferred method to deliver your form, via email, text message (SMS), an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign [SKS] to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to AMTI Attachment #9 Alternative Minimum Tax Calculation Of Income Name Of Corporationdesignated Filer Minnesota Tax ID FEIN Adjus

Create this form in 5 minutes!

How to create an eSignature for the amti attachment 9 alternative minimum tax calculation of income name of corporationdesignated filer minnesota tax id fein

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the AMTI Attachment #9 Alternative Minimum Tax Calculation Of Income Name Of Corporationdesignated Filer Minnesota Tax ID FEIN Adjusted Income And Depreciation 1 Minnesota Net Income from M4I, Line 7?

The AMTI Attachment #9 is a crucial document for corporations in Minnesota, detailing the Alternative Minimum Tax calculation. It includes essential information such as the corporation's Tax ID, FEIN, adjusted income, and net income from M4I, Line 7. Understanding this attachment is vital for accurate tax reporting and compliance.

-

How does airSlate SignNow help with the AMTI Attachment #9 process?

airSlate SignNow streamlines the process of preparing and submitting the AMTI Attachment #9 by providing an easy-to-use platform for eSigning and document management. Our solution ensures that all necessary information, including the Minnesota Tax ID and adjusted income, is accurately captured and securely stored. This simplifies compliance and reduces the risk of errors.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers a range of features tailored for tax document management, including customizable templates, secure eSigning, and automated workflows. These features facilitate the efficient handling of documents like the AMTI Attachment #9 Alternative Minimum Tax Calculation. Users can easily track document status and ensure timely submissions.

-

Is airSlate SignNow cost-effective for businesses handling AMTI Attachment #9?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses managing documents like the AMTI Attachment #9. Our pricing plans cater to various business sizes, ensuring that you only pay for what you need. This affordability, combined with our robust features, makes it an ideal choice for tax compliance.

-

Can airSlate SignNow integrate with other accounting software for AMTI Attachment #9?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, allowing for smooth data transfer and document management related to the AMTI Attachment #9. This integration helps streamline your workflow, ensuring that all necessary information is readily available and accurately reflected in your tax documents.

-

What are the benefits of using airSlate SignNow for tax compliance?

Using airSlate SignNow for tax compliance offers numerous benefits, including enhanced efficiency, reduced paperwork, and improved accuracy. Our platform simplifies the preparation of documents like the AMTI Attachment #9 Alternative Minimum Tax Calculation, ensuring that all required information is captured correctly. This leads to a smoother filing process and peace of mind.

-

How secure is airSlate SignNow for handling sensitive tax documents?

Security is a top priority at airSlate SignNow. We implement advanced encryption and security protocols to protect sensitive tax documents, including the AMTI Attachment #9. Our platform ensures that your data is safe and compliant with industry standards, giving you confidence in your document management.

Get more for AMTI Attachment #9 Alternative Minimum Tax Calculation Of Income Name Of Corporationdesignated Filer Minnesota Tax ID FEIN Adjus

- Rankin county chancery court electronic filing form

- Jackson county mo local rules form

- An advance directive for north carolina elder law clinic form

- How to expunge your criminal andor juvneile record form

- Power of attorney for care and custody pdf form

- New mexico power attorney child form

- New mexico form 4 831 writ of certiorari

- Single home closing statement example form

Find out other AMTI Attachment #9 Alternative Minimum Tax Calculation Of Income Name Of Corporationdesignated Filer Minnesota Tax ID FEIN Adjus

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word