KPI, Partner's Share of Income, Credits and Modifications Revenue State Mn Form

Understanding the KPI, Partner's Share Of Income, Credits And Modifications Revenue State Mn

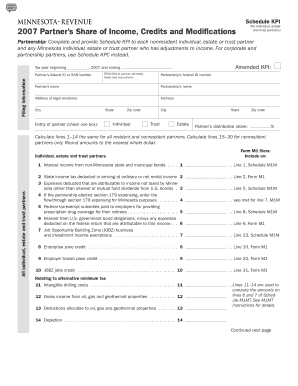

The KPI, Partner's Share Of Income, Credits And Modifications Revenue State Mn is a critical form used to report income and modifications for partners in a business partnership. This form helps in determining each partner's share of income, ensuring accurate reporting for tax purposes. It typically includes information on income received, credits applicable, and any modifications that may affect the revenue reported to the state of Minnesota.

Steps to Complete the KPI, Partner's Share Of Income, Credits And Modifications Revenue State Mn

Completing the KPI, Partner's Share Of Income, Credits And Modifications Revenue State Mn involves several key steps:

- Gather necessary financial documents, including income statements and previous tax returns.

- Identify each partner's share of income based on the partnership agreement.

- Calculate any applicable credits and modifications that may impact the total revenue.

- Fill out the form accurately, ensuring all figures are correct and reflect the partnership's financial activities.

- Review the completed form for accuracy before submission.

Key Elements of the KPI, Partner's Share Of Income, Credits And Modifications Revenue State Mn

Several key elements are essential when working with the KPI, Partner's Share Of Income, Credits And Modifications Revenue State Mn:

- Partner Identification: Clearly list each partner's name, address, and identification number.

- Income Reporting: Detail the income earned by the partnership and how it is allocated among partners.

- Credits and Modifications: Include any tax credits or modifications that apply to the partnership's income.

- Signature Requirement: Ensure that all partners sign the form to validate the information provided.

Legal Use of the KPI, Partner's Share Of Income, Credits And Modifications Revenue State Mn

The legal use of the KPI, Partner's Share Of Income, Credits And Modifications Revenue State Mn is crucial for compliance with state tax laws. This form must be filed accurately to avoid penalties. It serves as an official record of income distribution among partners and is often required during audits or financial reviews. Proper filing ensures that each partner receives the appropriate tax treatment based on their share of the partnership's income.

Examples of Using the KPI, Partner's Share Of Income, Credits And Modifications Revenue State Mn

Examples of using the KPI, Partner's Share Of Income, Credits And Modifications Revenue State Mn include:

- A partnership with three partners reporting total income of one hundred thousand dollars, with each partner's share calculated according to their investment.

- A business that qualifies for state tax credits due to specific operational activities, which are documented on the form.

- Adjustments made to income due to expenses that were not initially accounted for, ensuring accurate reporting to the state.

Filing Deadlines / Important Dates

Filing deadlines for the KPI, Partner's Share Of Income, Credits And Modifications Revenue State Mn are essential to ensure compliance. Typically, the form must be submitted by the tax filing deadline, which is generally April fifteenth for most partnerships. Partners should be aware of any extensions or specific state requirements that may affect their filing timeline. Keeping track of these dates helps avoid late fees and penalties.

Quick guide on how to complete kpi partners share of income credits and modifications revenue state mn

Complete [SKS] effortlessly on any device

Online document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any platform using airSlate SignNow Android or iOS applications and enhance any document-based procedure today.

The optimal method to modify and electronically sign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Employ the tools we provide to complete your form.

- Highlight pertinent parts of the documents or redact sensitive information using the tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature with the Sign tool, which takes seconds and carries the same legal authority as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, and errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Alter and electronically sign [SKS] and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to KPI, Partner's Share Of Income, Credits And Modifications Revenue State Mn

Create this form in 5 minutes!

How to create an eSignature for the kpi partners share of income credits and modifications revenue state mn

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of KPI, Partner's Share Of Income, Credits And Modifications Revenue State Mn in business operations?

The KPI, Partner's Share Of Income, Credits And Modifications Revenue State Mn is crucial for understanding how income is distributed among partners and how modifications can impact revenue. This metric helps businesses assess their financial health and make informed decisions regarding partnerships and income allocation.

-

How does airSlate SignNow support tracking KPI, Partner's Share Of Income, Credits And Modifications Revenue State Mn?

airSlate SignNow provides tools that allow businesses to easily track and manage their KPIs, including the Partner's Share Of Income, Credits And Modifications Revenue State Mn. With our platform, users can create and manage documents that reflect these metrics, ensuring accurate reporting and compliance.

-

What features does airSlate SignNow offer to enhance the management of KPI, Partner's Share Of Income, Credits And Modifications Revenue State Mn?

Our platform offers features such as customizable templates, automated workflows, and real-time collaboration, which are essential for managing KPI, Partner's Share Of Income, Credits And Modifications Revenue State Mn. These tools streamline the documentation process, making it easier to track and modify revenue-related agreements.

-

Is airSlate SignNow cost-effective for small businesses looking to manage KPI, Partner's Share Of Income, Credits And Modifications Revenue State Mn?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. Our pricing plans are flexible, allowing small businesses to access essential features for managing KPI, Partner's Share Of Income, Credits And Modifications Revenue State Mn without breaking the bank.

-

Can airSlate SignNow integrate with other tools to help manage KPI, Partner's Share Of Income, Credits And Modifications Revenue State Mn?

Absolutely! airSlate SignNow integrates seamlessly with various business tools and software, enhancing your ability to manage KPI, Partner's Share Of Income, Credits And Modifications Revenue State Mn. This integration allows for better data synchronization and improved workflow efficiency.

-

What benefits can businesses expect from using airSlate SignNow for KPI, Partner's Share Of Income, Credits And Modifications Revenue State Mn?

By using airSlate SignNow, businesses can expect improved accuracy in tracking their KPI, Partner's Share Of Income, Credits And Modifications Revenue State Mn. Additionally, our platform enhances collaboration and speeds up the document signing process, ultimately leading to better financial management.

-

How does airSlate SignNow ensure compliance when managing KPI, Partner's Share Of Income, Credits And Modifications Revenue State Mn?

airSlate SignNow ensures compliance by providing secure and legally binding eSignatures, along with audit trails for all documents. This feature is particularly important for managing KPI, Partner's Share Of Income, Credits And Modifications Revenue State Mn, as it helps maintain transparency and accountability.

Get more for KPI, Partner's Share Of Income, Credits And Modifications Revenue State Mn

Find out other KPI, Partner's Share Of Income, Credits And Modifications Revenue State Mn

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy