M706, Estate Tax Return to Be Used by an Estate of a Decedent Who Died in to File and Pay Minnesota Estate Tax Revenue State Mn Form

What is the M706, Estate Tax Return

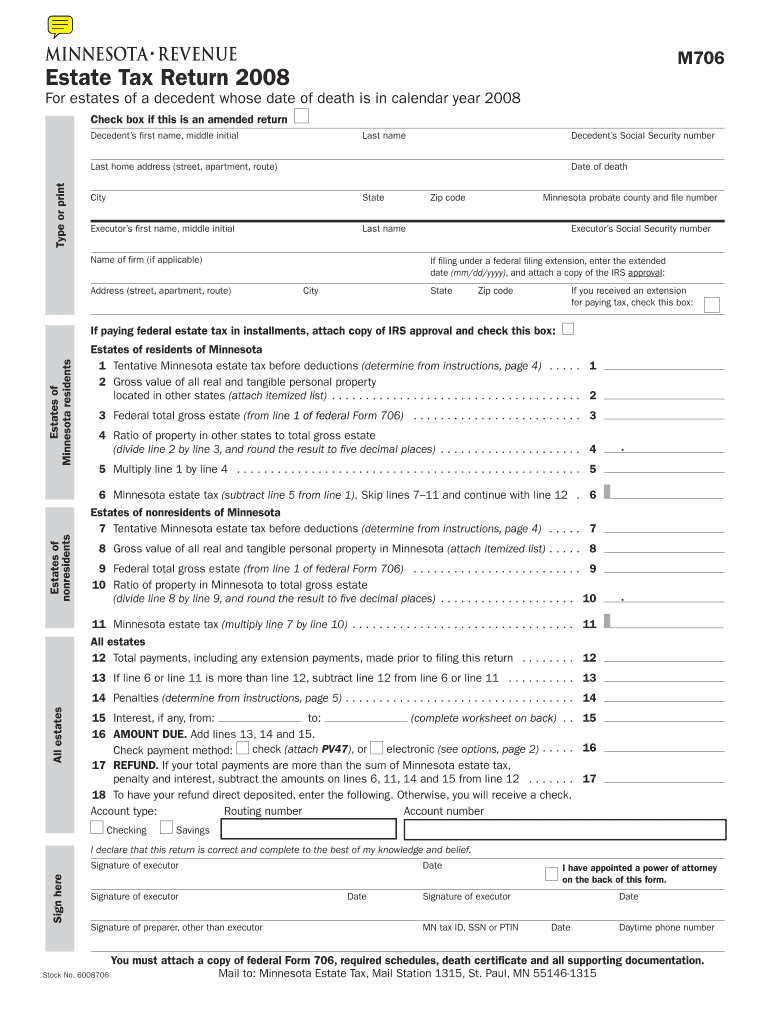

The M706, Estate Tax Return, is a specific form required by the state of Minnesota for the estates of decedents who passed away within the state. This form is essential for reporting the value of the estate and determining the estate tax owed. The M706 serves as a formal declaration to the Minnesota Department of Revenue, ensuring compliance with state tax laws. It is crucial for executors or administrators of the estate to understand the requirements associated with this form to avoid penalties or legal issues.

How to use the M706, Estate Tax Return

Using the M706 involves several key steps. First, gather all necessary information about the decedent’s assets, liabilities, and any applicable deductions. The form requires detailed financial data, including property values and outstanding debts. Once the information is compiled, fill out the M706 accurately, ensuring all sections are completed. After completing the form, it must be submitted to the Minnesota Department of Revenue, along with any required payment for estate taxes due. It is advisable to keep copies of all documents for your records.

Steps to complete the M706, Estate Tax Return

Completing the M706 involves a systematic approach:

- Collect all relevant financial documents, including wills, property appraisals, and bank statements.

- Determine the total value of the estate by assessing all assets and liabilities.

- Fill out the M706 form, ensuring to provide accurate figures and complete all required sections.

- Review the form for any errors or omissions before submission.

- Submit the completed form along with payment for any estate taxes owed to the Minnesota Department of Revenue.

Required Documents

When filing the M706, several documents are necessary to support the information provided. These may include:

- The decedent’s death certificate.

- A copy of the will or trust documents.

- Property appraisals for real estate and other significant assets.

- Financial statements from banks and investment accounts.

- Documentation of any debts or liabilities owed by the estate.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the M706. Generally, the estate tax return must be filed within nine months of the decedent's date of death. If the deadline falls on a weekend or holiday, the due date is extended to the next business day. Timely submission is essential to avoid penalties and interest on unpaid taxes.

Penalties for Non-Compliance

Failure to file the M706 or pay the associated estate taxes can result in significant penalties. The Minnesota Department of Revenue may impose fines, interest on unpaid taxes, and additional legal consequences. It is crucial for executors to adhere to filing requirements and deadlines to protect the estate from unnecessary financial burdens.

Quick guide on how to complete m706 estate tax return to be used by an estate of a decedent who died in to file and pay minnesota estate tax revenue state mn

Effortlessly Prepare [SKS] on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, as you can easily find the right form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Handle [SKS] on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The Easiest Way to Edit and Electronically Sign [SKS] with Ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools provided to complete your form.

- Emphasize important sections of the documents or conceal sensitive information with the tools specifically designed by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tiring form searches, or mistakes that necessitate printing new versions. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and electronically sign [SKS] and guarantee exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to M706, Estate Tax Return To Be Used By An Estate Of A Decedent Who Died In To File And Pay Minnesota Estate Tax Revenue State Mn

Create this form in 5 minutes!

How to create an eSignature for the m706 estate tax return to be used by an estate of a decedent who died in to file and pay minnesota estate tax revenue state mn

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the M706, Estate Tax Return To Be Used By An Estate Of A Decedent Who Died In To File And Pay Minnesota Estate Tax Revenue State Mn?

The M706 is a specific form required for estates in Minnesota to report and pay estate taxes for decedents who passed away in the state. This form ensures compliance with Minnesota estate tax laws and helps executors manage the estate's tax obligations effectively.

-

How can airSlate SignNow assist with filing the M706, Estate Tax Return?

airSlate SignNow provides a streamlined platform for completing and eSigning the M706, Estate Tax Return To Be Used By An Estate Of A Decedent Who Died In To File And Pay Minnesota Estate Tax Revenue State Mn. Our user-friendly interface simplifies the process, ensuring that all necessary information is accurately captured and submitted.

-

What are the pricing options for using airSlate SignNow for estate tax returns?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including options for individuals and larger estates. By using our platform for the M706, Estate Tax Return To Be Used By An Estate Of A Decedent Who Died In To File And Pay Minnesota Estate Tax Revenue State Mn, you can save time and reduce costs associated with traditional filing methods.

-

What features does airSlate SignNow offer for estate tax document management?

Our platform includes features such as document templates, eSigning, and secure storage, all designed to facilitate the completion of the M706, Estate Tax Return To Be Used By An Estate Of A Decedent Who Died In To File And Pay Minnesota Estate Tax Revenue State Mn. These tools help ensure that your estate tax documents are organized and easily accessible.

-

Is airSlate SignNow compliant with Minnesota estate tax regulations?

Yes, airSlate SignNow is designed to comply with all relevant regulations, including those pertaining to the M706, Estate Tax Return To Be Used By An Estate Of A Decedent Who Died In To File And Pay Minnesota Estate Tax Revenue State Mn. Our platform is regularly updated to reflect any changes in state tax laws, ensuring your filings are always compliant.

-

Can I integrate airSlate SignNow with other software for estate management?

Absolutely! airSlate SignNow offers integrations with various software solutions that can enhance your estate management processes. This allows you to seamlessly manage the M706, Estate Tax Return To Be Used By An Estate Of A Decedent Who Died In To File And Pay Minnesota Estate Tax Revenue State Mn alongside your other financial and legal tools.

-

What are the benefits of using airSlate SignNow for estate tax returns?

Using airSlate SignNow for the M706, Estate Tax Return To Be Used By An Estate Of A Decedent Who Died In To File And Pay Minnesota Estate Tax Revenue State Mn provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform simplifies the filing process, allowing you to focus on other important aspects of estate management.

Get more for M706, Estate Tax Return To Be Used By An Estate Of A Decedent Who Died In To File And Pay Minnesota Estate Tax Revenue State Mn

Find out other M706, Estate Tax Return To Be Used By An Estate Of A Decedent Who Died In To File And Pay Minnesota Estate Tax Revenue State Mn

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free