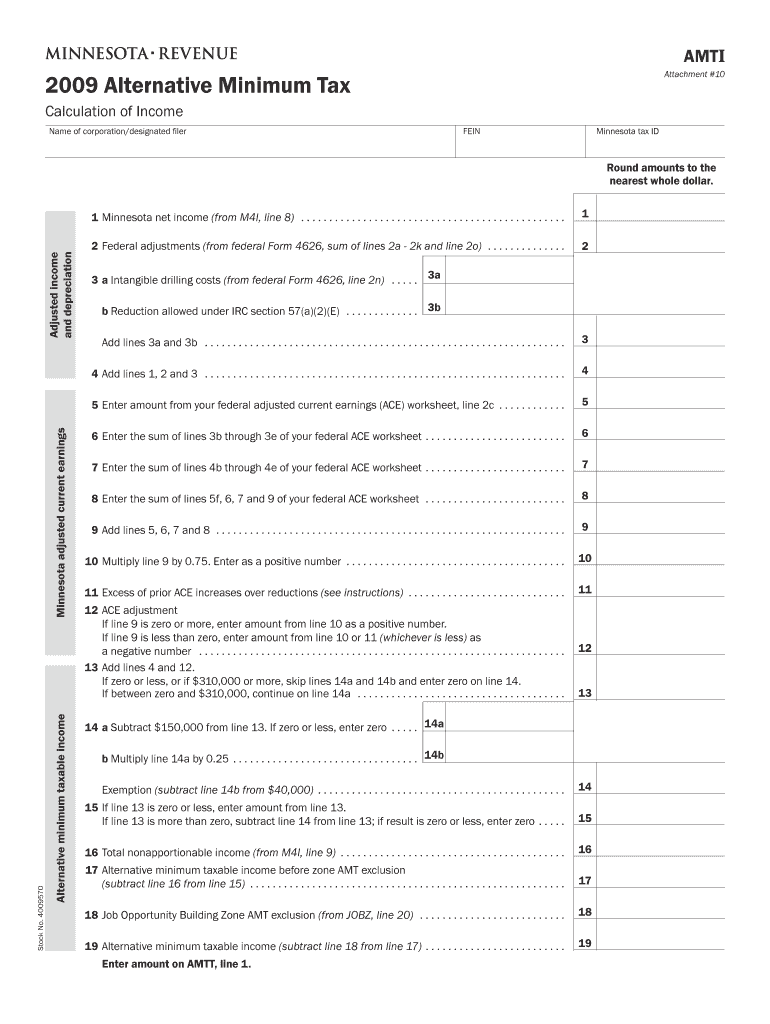

AMTI, Alternative Minimum Tax Calculation of Income Form

Understanding the AMTI, Alternative Minimum Tax Calculation Of Income

The Alternative Minimum Tax Calculation Of Income (AMTI) is a crucial component of the U.S. tax system designed to ensure that individuals and corporations pay a minimum amount of tax, regardless of deductions, credits, or other tax benefits they may claim. The AMTI is calculated by adjusting your regular taxable income, adding back certain tax preference items, and applying the Alternative Minimum Tax (AMT) rates. This process helps to prevent high-income earners from significantly reducing their tax liability through various deductions.

Steps to Complete the AMTI, Alternative Minimum Tax Calculation Of Income

Completing the AMTI involves several key steps:

- Calculate your regular taxable income based on your income, deductions, and credits.

- Add back specific preference items and adjustments, such as state and local tax deductions and certain business expenses.

- Determine the AMT exemption amount applicable to your filing status.

- Subtract the AMT exemption from your adjusted income to find your AMTI.

- Apply the AMT rates to your AMTI to calculate your alternative minimum tax liability.

Key Elements of the AMTI, Alternative Minimum Tax Calculation Of Income

Several key elements influence the AMTI calculation:

- Exemption Amount: The AMT exemption varies based on filing status and phases out at higher income levels.

- Tax Rates: The AMT applies different tax rates, typically 26% and 28%, depending on the income bracket.

- Preference Items: Certain deductions, such as state and local taxes, are added back to income when calculating AMTI.

- Filing Status: Your filing status (single, married filing jointly, etc.) affects both the exemption and tax rates.

IRS Guidelines for AMTI, Alternative Minimum Tax Calculation Of Income

The Internal Revenue Service (IRS) provides specific guidelines for calculating AMTI. Taxpayers must refer to IRS publications and forms, such as Form 6251, to understand the requirements and procedures. It is essential to stay updated on any changes in tax laws that may affect AMTI calculations. The IRS also outlines the necessary documentation to support your calculations, ensuring compliance with tax regulations.

Required Documents for AMTI, Alternative Minimum Tax Calculation Of Income

To accurately complete the AMTI, you will need several documents, including:

- Your previous year's tax return for reference.

- W-2 forms from employers and 1099 forms for other income sources.

- Records of deductions and credits claimed, such as mortgage interest and charitable contributions.

- Any relevant documentation for preference items that must be added back to income.

Examples of Using the AMTI, Alternative Minimum Tax Calculation Of Income

Understanding practical scenarios can clarify how AMTI affects taxpayers:

- A high-income individual who claims substantial deductions may find their AMTI significantly higher than their regular taxable income, resulting in AMT liability.

- A self-employed taxpayer might need to add back certain business expenses when calculating AMTI, impacting their overall tax burden.

- Married couples filing jointly may experience different AMT calculations based on combined income and deductions, highlighting the importance of strategic tax planning.

Quick guide on how to complete amti alternative minimum tax calculation of income

Prepare [SKS] effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents promptly without delays. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

The simplest way to modify and eSign [SKS] with ease

- Locate [SKS] and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark signNow sections of the documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which only takes a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose your preferred method of submitting your form, whether by email, text message (SMS), invite link, or downloading it to your computer.

Eliminate concerns about lost or misplaced documents, frustrating form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device you choose. Edit and eSign [SKS] to guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to AMTI, Alternative Minimum Tax Calculation Of Income

Create this form in 5 minutes!

How to create an eSignature for the amti alternative minimum tax calculation of income

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is AMTI, Alternative Minimum Tax Calculation Of Income?

AMTI, Alternative Minimum Tax Calculation Of Income, refers to the process of determining the income subject to the Alternative Minimum Tax. This calculation ensures that individuals and corporations pay a minimum amount of tax, regardless of deductions and credits. Understanding AMTI is crucial for accurate tax planning and compliance.

-

How can airSlate SignNow assist with AMTI, Alternative Minimum Tax Calculation Of Income?

airSlate SignNow provides a streamlined platform for managing tax-related documents, including those necessary for AMTI, Alternative Minimum Tax Calculation Of Income. By enabling easy document sharing and eSigning, businesses can efficiently handle tax forms and ensure compliance. This saves time and reduces the risk of errors in tax calculations.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing tax documents related to AMTI, Alternative Minimum Tax Calculation Of Income. These features enhance efficiency and ensure that all necessary documentation is completed accurately and on time.

-

Is airSlate SignNow cost-effective for small businesses handling AMTI?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses managing AMTI, Alternative Minimum Tax Calculation Of Income. With flexible pricing plans, companies can choose a package that fits their budget while still accessing essential features for document management and eSigning.

-

Can airSlate SignNow integrate with other accounting software for AMTI calculations?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, making it easier to manage AMTI, Alternative Minimum Tax Calculation Of Income. This integration allows users to import and export documents directly, streamlining the tax preparation process and enhancing overall efficiency.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents offers numerous benefits, including enhanced security, ease of use, and improved collaboration. For AMTI, Alternative Minimum Tax Calculation Of Income, these advantages ensure that sensitive information is protected while allowing teams to work together efficiently on tax filings.

-

How does airSlate SignNow ensure the security of tax documents?

airSlate SignNow prioritizes security with features like encryption, secure cloud storage, and compliance with industry standards. This is particularly important for documents related to AMTI, Alternative Minimum Tax Calculation Of Income, as they often contain sensitive financial information. Users can trust that their data is safe and secure.

Get more for AMTI, Alternative Minimum Tax Calculation Of Income

Find out other AMTI, Alternative Minimum Tax Calculation Of Income

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF