DIV Attachment #9 Deduction for Dividends Received the Deduction for Dividends Received is Not Allowed If the Corporation Includ Form

Understanding the DIV Attachment #9 Deduction for Dividends Received

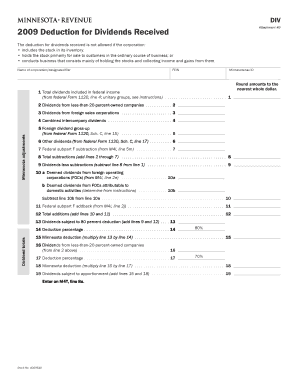

The DIV Attachment #9 Deduction for Dividends Received allows corporations to deduct certain dividends received from their taxable income. However, this deduction is not permitted if the corporation includes the stock from which the dividends are received in its inventory. This limitation is crucial for businesses to understand, as it affects their overall tax liability and financial reporting.

Eligibility Criteria for the DIV Attachment #9 Deduction

To qualify for the DIV Attachment #9 Deduction, a corporation must meet specific eligibility criteria. The corporation must be a domestic entity that receives dividends from another domestic corporation. Additionally, the stock must not be included in the corporation's inventory. Understanding these criteria helps ensure compliance with IRS regulations and maximizes potential tax benefits.

Steps to Complete the DIV Attachment #9 Deduction

Completing the DIV Attachment #9 Deduction requires careful attention to detail. The following steps outline the process:

- Gather all relevant financial documents, including dividend statements and inventory records.

- Determine the total amount of dividends received during the tax year.

- Verify that the stock related to these dividends is not included in your inventory.

- Fill out the DIV Attachment #9 form accurately, ensuring all information is complete.

- Attach the completed form to your corporate tax return when filing.

IRS Guidelines for the DIV Attachment #9 Deduction

The IRS provides specific guidelines regarding the DIV Attachment #9 Deduction. These guidelines outline the conditions under which the deduction is allowed and detail the necessary documentation required for substantiation. Corporations should familiarize themselves with these guidelines to ensure compliance and avoid potential penalties.

Common Scenarios for Using the DIV Attachment #9 Deduction

Various taxpayer scenarios may benefit from the DIV Attachment #9 Deduction. For instance, corporations that receive significant dividend income from investments in other domestic companies can leverage this deduction to reduce their taxable income. Additionally, businesses that do not hold the related stock as inventory are in a favorable position to claim this deduction, enhancing their overall tax strategy.

Penalties for Non-Compliance with the DIV Attachment #9 Deduction

Failure to comply with the regulations surrounding the DIV Attachment #9 Deduction can result in penalties. These may include fines, interest on unpaid taxes, and potential audits by the IRS. It is essential for corporations to adhere strictly to the guidelines and accurately report their dividend income to mitigate these risks.

Quick guide on how to complete div attachment 9 deduction for dividends received the deduction for dividends received is not allowed if the corporation

Effortlessly Complete [SKS] on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed forms, allowing you to access the correct document and securely store it online. airSlate SignNow equips you with all the necessary tools to create, alter, and electronically sign your documents swiftly without any delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to Alter and Electronically Sign [SKS] with Ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature with the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to submit your form via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, the hassle of searching for forms, or mistakes that necessitate reprinting new document copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device you prefer. Alter and electronically sign [SKS] to ensure excellent communication throughout the preparation of your forms with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to DIV Attachment #9 Deduction For Dividends Received The Deduction For Dividends Received Is Not Allowed If The Corporation Includ

Create this form in 5 minutes!

How to create an eSignature for the div attachment 9 deduction for dividends received the deduction for dividends received is not allowed if the corporation

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the DIV Attachment #9 Deduction for Dividends Received?

The DIV Attachment #9 Deduction for Dividends Received allows corporations to deduct certain dividends from their taxable income. However, it's important to note that the deduction is not allowed if the corporation includes the stock in its inventory. Understanding this deduction can help businesses optimize their tax strategies.

-

How does airSlate SignNow help with managing DIV Attachment #9 documentation?

airSlate SignNow provides a streamlined platform for sending and eSigning documents related to the DIV Attachment #9 Deduction for Dividends Received. Our solution simplifies the process, ensuring that all necessary documentation is easily accessible and securely stored, which is crucial for compliance and record-keeping.

-

What features does airSlate SignNow offer for tax-related documents?

Our platform includes features such as customizable templates, secure eSigning, and automated workflows that are particularly beneficial for managing tax-related documents like the DIV Attachment #9 Deduction for Dividends Received. These features enhance efficiency and reduce the risk of errors in documentation.

-

Is airSlate SignNow cost-effective for small businesses?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses. With flexible pricing plans, you can choose the option that best fits your needs while ensuring you have the tools necessary to manage documents like the DIV Attachment #9 Deduction for Dividends Received.

-

Can airSlate SignNow integrate with other accounting software?

Absolutely! airSlate SignNow offers integrations with various accounting and financial software, making it easier to manage documents related to the DIV Attachment #9 Deduction for Dividends Received. This seamless integration helps streamline your workflow and ensures that all your financial documentation is in one place.

-

What are the benefits of using airSlate SignNow for eSigning?

Using airSlate SignNow for eSigning provides numerous benefits, including enhanced security, faster turnaround times, and improved document tracking. These advantages are particularly important when dealing with sensitive documents like the DIV Attachment #9 Deduction for Dividends Received, ensuring that your information remains secure and compliant.

-

How can I ensure compliance when using airSlate SignNow?

airSlate SignNow is built with compliance in mind, offering features that help you adhere to legal standards when managing documents like the DIV Attachment #9 Deduction for Dividends Received. Our platform provides audit trails and secure storage, ensuring that your documents are compliant with industry regulations.

Get more for DIV Attachment #9 Deduction For Dividends Received The Deduction For Dividends Received Is Not Allowed If The Corporation Includ

Find out other DIV Attachment #9 Deduction For Dividends Received The Deduction For Dividends Received Is Not Allowed If The Corporation Includ

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile