Schedule M1CRN Sequence #15 Credit for Nonresident Partners on Taxes Paid to Home State on the Sale of a Partnership Interest Ta Form

Understanding the Schedule M1CRN Sequence #15 Credit

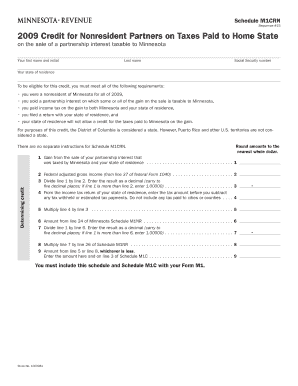

The Schedule M1CRN Sequence #15 Credit is designed for nonresident partners who have paid taxes to their home state on the sale of a partnership interest that is taxable to Minnesota. This credit allows these individuals to reduce their Minnesota tax liability by the amount of tax paid to their home state. It is essential for nonresident partners to understand this credit to ensure they are not taxed twice on the same income.

Steps to Complete the Schedule M1CRN Sequence #15 Credit

Completing the Schedule M1CRN Sequence #15 Credit involves several straightforward steps:

- Gather necessary information, including your first name, initial, last name, Social Security number, and state of residence.

- Determine the amount of taxes paid to your home state on the sale of the partnership interest.

- Fill out the Schedule M1CRN form accurately, ensuring all information is correct.

- Submit the form along with your Minnesota tax return.

Eligibility Criteria for the Schedule M1CRN Sequence #15 Credit

To qualify for the Schedule M1CRN Sequence #15 Credit, you must meet specific criteria:

- You must be a nonresident partner of a partnership that sold an interest taxable to Minnesota.

- You must have paid taxes to your home state on the income from the sale.

- Your home state must allow a credit for taxes paid to Minnesota.

Key Elements of the Schedule M1CRN Sequence #15 Credit

Important elements to consider when filing for the Schedule M1CRN Sequence #15 Credit include:

- The amount of tax paid to your home state must be documented.

- Accurate completion of personal identification details is crucial.

- Understanding the tax implications of both Minnesota and your home state is necessary for proper filing.

Filing Deadlines for the Schedule M1CRN Sequence #15 Credit

It is vital to be aware of the filing deadlines associated with the Schedule M1CRN Sequence #15 Credit:

- The credit must be filed along with your Minnesota tax return, typically due on April 15.

- Extensions may be available, but the credit must still be claimed within the appropriate timeframe to avoid penalties.

Required Documents for the Schedule M1CRN Sequence #15 Credit

When preparing to file for the Schedule M1CRN Sequence #15 Credit, ensure you have the following documents ready:

- Proof of taxes paid to your home state.

- Your completed Minnesota tax return.

- Any additional forms that may be required by the Minnesota Department of Revenue.

Quick guide on how to complete schedule m1crn sequence 15 credit for nonresident partners on taxes paid to home state on the sale of a partnership interest

easily create [SKS] on any device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed materials, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the features needed to create, edit, and electronically sign your documents quickly and efficiently. Work with [SKS] on any platform using airSlate SignNow's applications for Android or iOS and streamline any document-related procedure today.

Effortlessly modify and electronically sign [SKS]

- Find [SKS] and click Get Form to commence.

- Utilize the tools we provide to complete your document.

- Emphasize relevant parts of the documents or black out sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you wish to share your form, either via email, text message (SMS), or an invitation link, or download it to your computer.

No more worrying about lost or misplaced documents, tedious form searching, or mistakes that require re-printing new document versions. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Edit and electronically sign [SKS] to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule M1CRN Sequence #15 Credit For Nonresident Partners On Taxes Paid To Home State On The Sale Of A Partnership Interest Ta

Create this form in 5 minutes!

How to create an eSignature for the schedule m1crn sequence 15 credit for nonresident partners on taxes paid to home state on the sale of a partnership interest

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule M1CRN Sequence #15 Credit for Nonresident Partners?

The Schedule M1CRN Sequence #15 Credit For Nonresident Partners On Taxes Paid To Home State On The Sale Of A Partnership Interest Taxable To Minnesota allows nonresident partners to claim a credit for taxes paid to their home state. This credit helps reduce the tax burden for those who have sold partnership interests and are subject to Minnesota taxes.

-

How can airSlate SignNow assist with filing the Schedule M1CRN?

airSlate SignNow provides an easy-to-use platform for managing and eSigning documents related to the Schedule M1CRN Sequence #15 Credit For Nonresident Partners On Taxes Paid To Home State On The Sale Of A Partnership Interest Taxable To Minnesota. Our solution streamlines the document preparation process, ensuring you have all necessary information ready for submission.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers features such as document templates, eSignature capabilities, and secure cloud storage. These features are designed to simplify the process of managing tax documents, including those related to the Schedule M1CRN Sequence #15 Credit For Nonresident Partners On Taxes Paid To Home State On The Sale Of A Partnership Interest Taxable To Minnesota.

-

Is airSlate SignNow cost-effective for small businesses?

Yes, airSlate SignNow is a cost-effective solution for small businesses looking to manage their tax documents efficiently. With competitive pricing plans, it provides access to essential features that support the filing of the Schedule M1CRN Sequence #15 Credit For Nonresident Partners On Taxes Paid To Home State On The Sale Of A Partnership Interest Taxable To Minnesota.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow offers integrations with various software applications, enhancing your workflow. This is particularly beneficial for managing the Schedule M1CRN Sequence #15 Credit For Nonresident Partners On Taxes Paid To Home State On The Sale Of A Partnership Interest Taxable To Minnesota alongside your existing tools.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents provides numerous benefits, including increased efficiency, reduced errors, and enhanced security. This is especially important when dealing with the Schedule M1CRN Sequence #15 Credit For Nonresident Partners On Taxes Paid To Home State On The Sale Of A Partnership Interest Taxable To Minnesota.

-

How secure is my information with airSlate SignNow?

airSlate SignNow prioritizes the security of your information with advanced encryption and compliance with industry standards. This ensures that your sensitive data, including details related to the Schedule M1CRN Sequence #15 Credit For Nonresident Partners On Taxes Paid To Home State On The Sale Of A Partnership Interest Taxable To Minnesota, is protected.

Get more for Schedule M1CRN Sequence #15 Credit For Nonresident Partners On Taxes Paid To Home State On The Sale Of A Partnership Interest Ta

Find out other Schedule M1CRN Sequence #15 Credit For Nonresident Partners On Taxes Paid To Home State On The Sale Of A Partnership Interest Ta

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy

- Sign Tennessee Legal LLC Operating Agreement Online

- How To Sign Tennessee Legal Cease And Desist Letter

- How Do I Sign Tennessee Legal Separation Agreement

- Sign Virginia Insurance Memorandum Of Understanding Easy

- Sign Utah Legal Living Will Easy

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online

- Sign Life Sciences PPT Idaho Later

- How Do I Sign Hawaii Life Sciences LLC Operating Agreement

- Sign Idaho Life Sciences Promissory Note Template Secure

- How To Sign Wyoming Legal Quitclaim Deed

- Sign Wisconsin Insurance Living Will Now

- Sign Wyoming Insurance LLC Operating Agreement Simple