You Must Have Receipts as Proof of Your Education Expenses Keep with Your Tax Records Form

Understanding the Importance of Receipts for Education Expenses

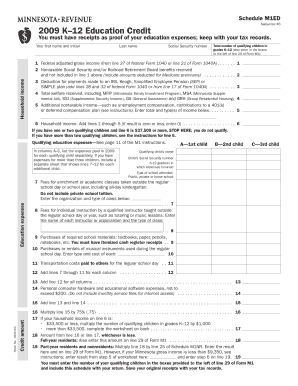

Keeping receipts as proof of your education expenses is crucial for accurate tax reporting. The IRS allows taxpayers to deduct certain education-related costs, such as tuition, books, and supplies. To qualify for these deductions, you must maintain detailed records of your expenditures. Receipts serve as your evidence, demonstrating that you incurred these expenses and are eligible for potential tax benefits.

How to Gather and Organize Your Receipts

To effectively manage your education expense receipts, start by collecting all relevant documents. This includes invoices, payment confirmations, and any other proof of payment. Organize these receipts by category, such as tuition, books, and supplies. Consider using digital tools to scan and store these documents securely. This method not only saves physical space but also makes it easier to retrieve documents when filing your taxes.

IRS Guidelines on Education Expense Deductions

The IRS provides specific guidelines regarding what qualifies as an education expense. According to IRS publications, qualified expenses include tuition, fees, and course materials required for enrollment. However, expenses like transportation and room and board are generally not deductible. Familiarizing yourself with these guidelines ensures that you keep the appropriate receipts and maximize your tax benefits.

Steps to File Your Taxes with Education Expenses

When filing your taxes with education expenses, follow these steps:

- Gather all receipts and documentation related to your education expenses.

- Review IRS guidelines to determine which expenses are deductible.

- Complete the appropriate tax forms, such as Form 8863 for education credits.

- Attach copies of your receipts to your tax return, if required.

- Submit your tax return by the filing deadline, ensuring all information is accurate.

Potential Penalties for Incomplete Documentation

Failure to maintain proper documentation for your education expenses can lead to penalties or disallowance of deductions by the IRS. If you cannot provide adequate proof of your expenses during an audit, you may be required to pay back any deductions claimed, along with possible interest and penalties. Therefore, it is essential to keep your receipts organized and accessible.

Examples of Education Expenses to Document

Common education expenses that you should document include:

- Tuition fees paid to accredited institutions.

- Books and supplies required for courses.

- Fees for mandatory course materials.

- Expenses for specialized equipment, if necessary for your program.

By keeping receipts for these items, you can substantiate your claims and ensure compliance with IRS regulations.

Quick guide on how to complete you must have receipts as proof of your education expenses keep with your tax records

Effortlessly finalize [SKS] on any gadget

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents promptly without interruptions. Manage [SKS] on any gadget with the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest method to modify and electronically sign [SKS] with ease

- Obtain [SKS] and click Obtain Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Generate your electronic signature with the Sign tool, which takes mere moments and holds the same legal standing as a conventional ink signature.

- Review all the information and press the Finished button to store your modifications.

- Select your preferred method for sending your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs within a few clicks from any device you choose. Modify and electronically sign [SKS] to ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to You Must Have Receipts As Proof Of Your Education Expenses Keep With Your Tax Records

Create this form in 5 minutes!

How to create an eSignature for the you must have receipts as proof of your education expenses keep with your tax records

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

Why is it important to keep receipts as proof of my education expenses?

You must have receipts as proof of your education expenses keep with your tax records to ensure you can claim any eligible deductions. These receipts serve as documentation that supports your claims during tax filing, helping you avoid potential issues with the IRS.

-

How does airSlate SignNow help in managing education expense receipts?

With airSlate SignNow, you can easily upload, store, and manage your receipts digitally. This ensures that you must have receipts as proof of your education expenses keep with your tax records in a secure and organized manner, making tax season much simpler.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow offers features such as eSigning, document templates, and secure storage. These features ensure that you must have receipts as proof of your education expenses keep with your tax records, allowing for easy access and management of important documents.

-

Is airSlate SignNow cost-effective for managing tax-related documents?

Yes, airSlate SignNow provides a cost-effective solution for managing your tax-related documents. By using this service, you ensure that you must have receipts as proof of your education expenses keep with your tax records without incurring high costs associated with traditional document management.

-

Can I integrate airSlate SignNow with other software I use?

Absolutely! airSlate SignNow offers integrations with various software applications, enhancing your workflow. This means you must have receipts as proof of your education expenses keep with your tax records seamlessly integrated into your existing systems.

-

What are the benefits of using airSlate SignNow for eSigning documents?

Using airSlate SignNow for eSigning documents streamlines the signing process, saving you time and effort. Additionally, you must have receipts as proof of your education expenses keep with your tax records electronically, ensuring they are easily retrievable when needed.

-

How secure is my data with airSlate SignNow?

airSlate SignNow prioritizes the security of your data with advanced encryption and compliance with industry standards. This means you can confidently store documents knowing that you must have receipts as proof of your education expenses keep with your tax records securely protected.

Get more for You Must Have Receipts As Proof Of Your Education Expenses Keep With Your Tax Records

Find out other You Must Have Receipts As Proof Of Your Education Expenses Keep With Your Tax Records

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed