Schedule M1LTI Sequence #14 Long Term Care Insurance Credit Your First Name and Initial Last Name Social Security Number If You Form

Understanding the Schedule M1LTI Sequence #14 Long Term Care Insurance Credit

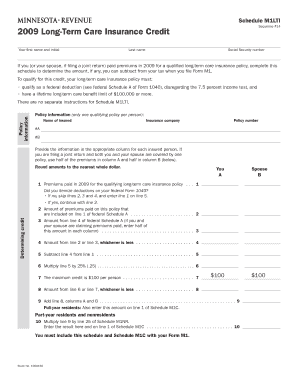

The Schedule M1LTI Sequence #14 Long Term Care Insurance Credit is a specific tax form used in the United States for claiming credits related to long-term care insurance premiums. This form allows taxpayers to report premiums paid for qualified long-term care insurance policies. It is essential for individuals or couples filing jointly who wish to receive tax credits for these expenses. The credit can help reduce the overall tax burden, making it an important consideration for those planning for long-term care needs.

Steps to Complete the Schedule M1LTI Sequence #14

Completing the Schedule M1LTI Sequence #14 requires careful attention to detail. Here are the key steps:

- Gather necessary documentation, including your Social Security number and details of premiums paid.

- Determine if you or your spouse, if filing jointly, are eligible for the credit.

- Fill out the form accurately, ensuring all information is current and correct.

- Submit the completed form with your tax return, either electronically or by mail.

Eligibility Criteria for the Credit

To qualify for the Schedule M1LTI Sequence #14 Long Term Care Insurance Credit, certain eligibility criteria must be met:

- You must have paid premiums for a qualified long-term care insurance policy.

- Both you and your spouse, if filing jointly, must meet age and health requirements as specified by IRS guidelines.

- The insurance policy must meet the standards set by the IRS for long-term care coverage.

Required Documents for Filing

When filing the Schedule M1LTI Sequence #14, you will need to provide specific documents to support your claim:

- Your Social Security number and that of your spouse, if applicable.

- Records of premium payments made for the qualified long-term care insurance.

- Any additional documentation that may be required by the IRS for verification purposes.

IRS Guidelines for Long-Term Care Insurance Credit

The IRS provides specific guidelines on how to claim the Long Term Care Insurance Credit. These guidelines outline the types of policies that qualify, the maximum amounts that can be claimed, and the necessary forms to submit. It is crucial to review these guidelines to ensure compliance and maximize your potential credit.

Common Scenarios for Claiming the Credit

Taxpayers may find themselves in various scenarios when considering the Schedule M1LTI Sequence #14. For example:

- Individuals who are self-employed may have different considerations regarding premium deductions.

- Married couples filing jointly must account for both partners’ premiums.

- Retirees may need to assess their long-term care needs and insurance coverage to determine eligibility.

Quick guide on how to complete schedule m1lti sequence 14 long term care insurance credit your first name and initial last name social security number if you

Effortlessly prepare [SKS] on any device

The management of online documents has become increasingly popular among businesses and individuals. It presents an excellent eco-friendly alternative to traditional printed and signed papers, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the necessary tools to quickly create, modify, and electronically sign your documents without delays. Manage [SKS] on any platform with the airSlate SignNow Android or iOS applications and simplify any document-related processes today.

The easiest way to modify and electronically sign [SKS] seamlessly

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Choose how you want to send your form: via email, text message (SMS), an invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that require new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and electronically sign [SKS] and ensure exceptional communication at any stage of your form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule M1LTI Sequence #14 Long Term Care Insurance Credit Your First Name And Initial Last Name Social Security Number If You

Create this form in 5 minutes!

How to create an eSignature for the schedule m1lti sequence 14 long term care insurance credit your first name and initial last name social security number if you

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule M1LTI Sequence #14 Long Term Care Insurance Credit?

The Schedule M1LTI Sequence #14 Long Term Care Insurance Credit allows taxpayers to claim a credit for premiums paid for qualified long-term care insurance. This credit is available if you or your spouse, if filing a joint return, paid premiums in for a qualified long-term care insurance policy. It's essential to provide your first name, initial last name, and Social Security number when filing.

-

Who qualifies for the Schedule M1LTI Sequence #14 Long Term Care Insurance Credit?

To qualify for the Schedule M1LTI Sequence #14 Long Term Care Insurance Credit, you must have paid premiums for a qualified long-term care insurance policy. This applies to you or your spouse if you are filing a joint return. Ensure that you meet the eligibility criteria set by the IRS for long-term care insurance.

-

How do I apply for the Schedule M1LTI Sequence #14 Long Term Care Insurance Credit?

To apply for the Schedule M1LTI Sequence #14 Long Term Care Insurance Credit, you need to complete the appropriate tax forms and include your first name, initial last name, and Social Security number. Make sure to provide documentation of the premiums paid for qualified long-term care insurance. Consulting a tax professional can also help streamline the process.

-

What are the benefits of using airSlate SignNow for long-term care insurance documentation?

Using airSlate SignNow for long-term care insurance documentation simplifies the process of sending and eSigning necessary forms. It provides a cost-effective solution that ensures your documents are securely handled and easily accessible. This efficiency can help you focus on claiming the Schedule M1LTI Sequence #14 Long Term Care Insurance Credit without unnecessary delays.

-

Is there a cost associated with using airSlate SignNow for my long-term care insurance needs?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. The cost is competitive and reflects the value of an easy-to-use platform for managing documents related to the Schedule M1LTI Sequence #14 Long Term Care Insurance Credit. You can choose a plan that best fits your requirements.

-

Can I integrate airSlate SignNow with other software for better management?

Absolutely! airSlate SignNow offers integrations with various software solutions to enhance your document management process. This can be particularly beneficial when dealing with the Schedule M1LTI Sequence #14 Long Term Care Insurance Credit, as it allows for seamless data transfer and improved efficiency.

-

What features does airSlate SignNow offer for managing long-term care insurance documents?

airSlate SignNow provides features such as eSigning, document templates, and secure storage to manage your long-term care insurance documents effectively. These features help ensure that you can easily prepare and submit the necessary information for the Schedule M1LTI Sequence #14 Long Term Care Insurance Credit.

Get more for Schedule M1LTI Sequence #14 Long Term Care Insurance Credit Your First Name And Initial Last Name Social Security Number If You

Find out other Schedule M1LTI Sequence #14 Long Term Care Insurance Credit Your First Name And Initial Last Name Social Security Number If You

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document