Schedule M1MTC Sequence #17 Alternative Minimum Tax Credit Your First Name and Initial Last Name Social Security Number Read the Form

Understanding the Schedule M1MTC Sequence #17 Alternative Minimum Tax Credit

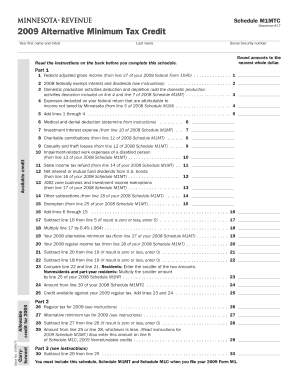

The Schedule M1MTC Sequence #17 is a crucial form for taxpayers in the United States who are claiming the Alternative Minimum Tax Credit. This credit is designed to ensure that individuals who benefit from certain tax advantages still pay a minimum amount of tax. By completing this schedule, taxpayers can calculate their eligibility for the credit based on their income and tax situation.

This form requires specific personal information, including your first name, initial, last name, and Social Security number. It is essential to read the instructions provided on the back of the form carefully before proceeding, as this will guide you through the necessary steps to accurately complete the schedule.

Steps to Complete the Schedule M1MTC Sequence #17

Completing the Schedule M1MTC Sequence #17 involves several steps to ensure accuracy and compliance with IRS regulations. Begin by gathering all necessary documentation, including your income statements and previous tax returns. Follow these steps:

- Fill in your personal details, including your first name, initial, last name, and Social Security number.

- Refer to the instructions on the back of the form to understand the specific calculations required for the Alternative Minimum Tax Credit.

- Complete the relevant sections of the form, ensuring that all figures are accurate and match your supporting documents.

- Review the completed form for any errors or omissions before submission.

Key Elements of the Schedule M1MTC Sequence #17

The Schedule M1MTC Sequence #17 includes several key elements that are vital for determining your eligibility for the Alternative Minimum Tax Credit. These elements typically consist of:

- Your total income, including wages, interest, and dividends.

- Adjustments to your income, which may include certain deductions and credits.

- The calculation of your Alternative Minimum Tax, which is essential for determining the amount of credit you may claim.

Understanding these components will help you accurately complete the schedule and maximize your potential credit.

Legal Use of the Schedule M1MTC Sequence #17

The Schedule M1MTC Sequence #17 must be used in accordance with IRS regulations to ensure compliance with tax laws. Taxpayers are legally required to provide accurate information when completing this form. Misrepresentation or errors can lead to penalties or audits by the IRS. It is advisable to consult with a tax professional if you have questions about your eligibility or how to complete the form correctly.

Filing Deadlines for the Schedule M1MTC Sequence #17

Filing deadlines for the Schedule M1MTC Sequence #17 align with the overall tax filing deadlines set by the IRS. Typically, individual tax returns are due on April fifteenth of each year. If you require additional time, you may file for an extension, but it is essential to ensure that any taxes owed are paid by the original deadline to avoid penalties and interest. Always check the IRS website for the most current deadlines and any changes to tax filing requirements.

Eligibility Criteria for the Alternative Minimum Tax Credit

To qualify for the Alternative Minimum Tax Credit using the Schedule M1MTC Sequence #17, you must meet specific eligibility criteria. Generally, these criteria include:

- Having a taxable income that exceeds a certain threshold.

- Being subject to the Alternative Minimum Tax in previous years.

- Meeting any additional requirements outlined in the IRS instructions for the form.

Reviewing these criteria will help you determine if you can claim the credit and ensure that you complete the form accurately.

Quick guide on how to complete schedule m1mtc sequence 17 alternative minimum tax credit your first name and initial last name social security number read the

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and store it securely online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents swiftly and without delays. Manage [SKS] on any platform using airSlate SignNow’s Android or iOS applications and streamline any document-related tasks today.

The easiest way to modify and eSign [SKS] effortlessly

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you wish to submit your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

No more concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from your preferred device. Edit and eSign [SKS] and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule m1mtc sequence 17 alternative minimum tax credit your first name and initial last name social security number read the

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule M1MTC Sequence #17 Alternative Minimum Tax Credit?

The Schedule M1MTC Sequence #17 Alternative Minimum Tax Credit is a form used to calculate the alternative minimum tax credit for individuals. It is essential to provide your first name, initial last name, and social security number accurately. Make sure to read the instructions on the back before you complete this schedule to ensure compliance.

-

How can airSlate SignNow help with completing the Schedule M1MTC Sequence #17?

airSlate SignNow offers an easy-to-use platform that allows you to fill out and eSign documents, including the Schedule M1MTC Sequence #17 Alternative Minimum Tax Credit. Our solution streamlines the process, ensuring that you can complete your tax forms efficiently and accurately. With our platform, you can focus on your finances without the hassle of paperwork.

-

What features does airSlate SignNow provide for tax document management?

airSlate SignNow provides features such as document templates, eSignature capabilities, and secure cloud storage for your tax documents. These features are particularly useful when dealing with forms like the Schedule M1MTC Sequence #17 Alternative Minimum Tax Credit. Our platform ensures that your documents are organized and easily accessible.

-

Is there a cost associated with using airSlate SignNow for tax documents?

Yes, airSlate SignNow offers various pricing plans to suit different needs, including options for individuals and businesses. The cost is competitive and reflects the value of our features, including support for documents like the Schedule M1MTC Sequence #17 Alternative Minimum Tax Credit. You can choose a plan that best fits your requirements.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax preparation software. This integration allows you to manage your documents, including the Schedule M1MTC Sequence #17 Alternative Minimum Tax Credit, alongside your other financial tools. This enhances your workflow and ensures all your data is synchronized.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents offers numerous benefits, including time savings, enhanced security, and ease of use. You can efficiently complete forms like the Schedule M1MTC Sequence #17 Alternative Minimum Tax Credit without the stress of traditional paperwork. Our platform simplifies the eSigning process, making it accessible for everyone.

-

How secure is my information when using airSlate SignNow?

Security is a top priority at airSlate SignNow. We implement advanced encryption and security protocols to protect your information, including sensitive data required for the Schedule M1MTC Sequence #17 Alternative Minimum Tax Credit. You can trust that your documents and personal information are safe with us.

Get more for Schedule M1MTC Sequence #17 Alternative Minimum Tax Credit Your First Name And Initial Last Name Social Security Number Read The

Find out other Schedule M1MTC Sequence #17 Alternative Minimum Tax Credit Your First Name And Initial Last Name Social Security Number Read The

- eSign Missouri Gift Affidavit Myself

- eSign Missouri Gift Affidavit Safe

- eSign Nevada Gift Affidavit Easy

- eSign Arizona Mechanic's Lien Online

- eSign Connecticut IOU Online

- How To eSign Florida Mechanic's Lien

- eSign Hawaii Mechanic's Lien Online

- How To eSign Hawaii Mechanic's Lien

- eSign Hawaii IOU Simple

- eSign Maine Mechanic's Lien Computer

- eSign Maryland Mechanic's Lien Free

- How To eSign Illinois IOU

- Help Me With eSign Oregon Mechanic's Lien

- eSign South Carolina Mechanic's Lien Secure

- eSign Tennessee Mechanic's Lien Later

- eSign Iowa Revocation of Power of Attorney Online

- How Do I eSign Maine Revocation of Power of Attorney

- eSign Hawaii Expense Statement Fast

- eSign Minnesota Share Donation Agreement Simple

- Can I eSign Hawaii Collateral Debenture