M500, Reporting of JOBZ Tax Benefits for Tax Year Revenue State Mn Form

Overview of the M500, Reporting of JOBZ Tax Benefits

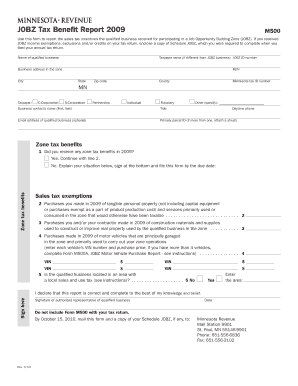

The M500 form is essential for businesses in Minnesota that wish to report Job Opportunity Building Zone (JOBZ) tax benefits. This form allows eligible businesses to claim tax reductions and exemptions designed to stimulate economic growth in designated areas. Understanding the purpose of the M500 is crucial for compliance and maximizing tax benefits.

Steps to Complete the M500 Form

Completing the M500 form involves several key steps:

- Gather necessary information, including business details and tax identification numbers.

- Determine eligibility for JOBZ tax benefits based on location and business type.

- Fill out the form accurately, ensuring all required sections are completed.

- Review the form for any errors or omissions before submission.

- Submit the form by the specified deadline to avoid penalties.

Eligibility Criteria for the M500 Form

To qualify for the JOBZ tax benefits reported on the M500 form, businesses must meet specific eligibility criteria:

- The business must be located within a designated JOBZ zone.

- It should meet the minimum investment requirements set by the state.

- The business must create a certain number of jobs within a specified timeframe.

Required Documents for M500 Submission

When submitting the M500 form, businesses should have the following documents ready:

- Proof of business location within a JOBZ zone.

- Documentation of job creation and investment amounts.

- Tax identification numbers and relevant financial statements.

Filing Deadlines for the M500 Form

Timely submission of the M500 form is critical. The filing deadlines typically align with the annual tax return deadlines. Businesses should verify the specific dates each year to ensure compliance and avoid potential penalties.

Form Submission Methods for the M500

The M500 form can be submitted through various methods:

- Online submission via the Minnesota Department of Revenue's portal.

- Mailing the completed form to the appropriate state office.

- In-person submission at designated state revenue offices.

Quick guide on how to complete m500 reporting of jobz tax benefits for tax year revenue state mn 11331915

Complete [SKS] effortlessly on any device

Managing documents online has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents promptly without delays. Handle [SKS] on any device using airSlate SignNow’s Android or iOS applications and enhance any document-centered process today.

How to modify and eSign [SKS] with ease

- Locate [SKS] and select Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive details using the tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes only a few seconds and carries the same legal significance as a conventional wet ink signature.

- Review all information carefully and click on the Done button to save your changes.

- Choose how you would like to send your form—by email, SMS, or via an invite link, or download it to your computer.

Eliminate worries over lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to M500, Reporting Of JOBZ Tax Benefits For Tax Year Revenue State Mn

Create this form in 5 minutes!

How to create an eSignature for the m500 reporting of jobz tax benefits for tax year revenue state mn 11331915

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the M500, Reporting Of JOBZ Tax Benefits For Tax Year Revenue State Mn?

The M500 form is used for reporting JOBZ tax benefits for businesses operating in Minnesota. It allows companies to claim tax incentives that promote economic development in designated zones. Understanding how to properly fill out this form is crucial for maximizing your tax benefits.

-

How can airSlate SignNow assist with the M500, Reporting Of JOBZ Tax Benefits For Tax Year Revenue State Mn?

airSlate SignNow provides a streamlined platform for eSigning and managing documents related to the M500 form. Our solution simplifies the process, ensuring that all necessary signatures are obtained quickly and securely. This efficiency can help you meet deadlines for reporting JOBZ tax benefits.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers features such as customizable templates, automated workflows, and secure cloud storage. These tools help you manage the M500, Reporting Of JOBZ Tax Benefits For Tax Year Revenue State Mn, efficiently. Additionally, our platform ensures compliance with state regulations, reducing the risk of errors.

-

Is airSlate SignNow cost-effective for small businesses handling the M500 form?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. Our pricing plans are flexible, allowing small businesses to access essential features without breaking the bank. This affordability makes it easier to manage the M500, Reporting Of JOBZ Tax Benefits For Tax Year Revenue State Mn.

-

Can I integrate airSlate SignNow with other software for tax reporting?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software. This integration allows for a smoother workflow when preparing the M500, Reporting Of JOBZ Tax Benefits For Tax Year Revenue State Mn, ensuring that all your data is synchronized and up-to-date.

-

What are the benefits of using airSlate SignNow for tax document management?

Using airSlate SignNow for tax document management offers numerous benefits, including enhanced security, improved efficiency, and reduced paperwork. Our platform allows you to track the status of your M500, Reporting Of JOBZ Tax Benefits For Tax Year Revenue State Mn, ensuring that you never miss a deadline. Additionally, the user-friendly interface makes it easy for anyone to navigate.

-

How does airSlate SignNow ensure the security of my tax documents?

airSlate SignNow prioritizes the security of your documents with advanced encryption and secure cloud storage. We comply with industry standards to protect sensitive information related to the M500, Reporting Of JOBZ Tax Benefits For Tax Year Revenue State Mn. You can trust that your data is safe with us.

Get more for M500, Reporting Of JOBZ Tax Benefits For Tax Year Revenue State Mn

Find out other M500, Reporting Of JOBZ Tax Benefits For Tax Year Revenue State Mn

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now