Schedule M1R Sequence #11 Age 65 or OlderDisabled Subtraction Before You Complete This Schedule, Read the Instructions on the Ba Form

Understanding Schedule M1R Sequence #11 for Seniors and Disabled Individuals

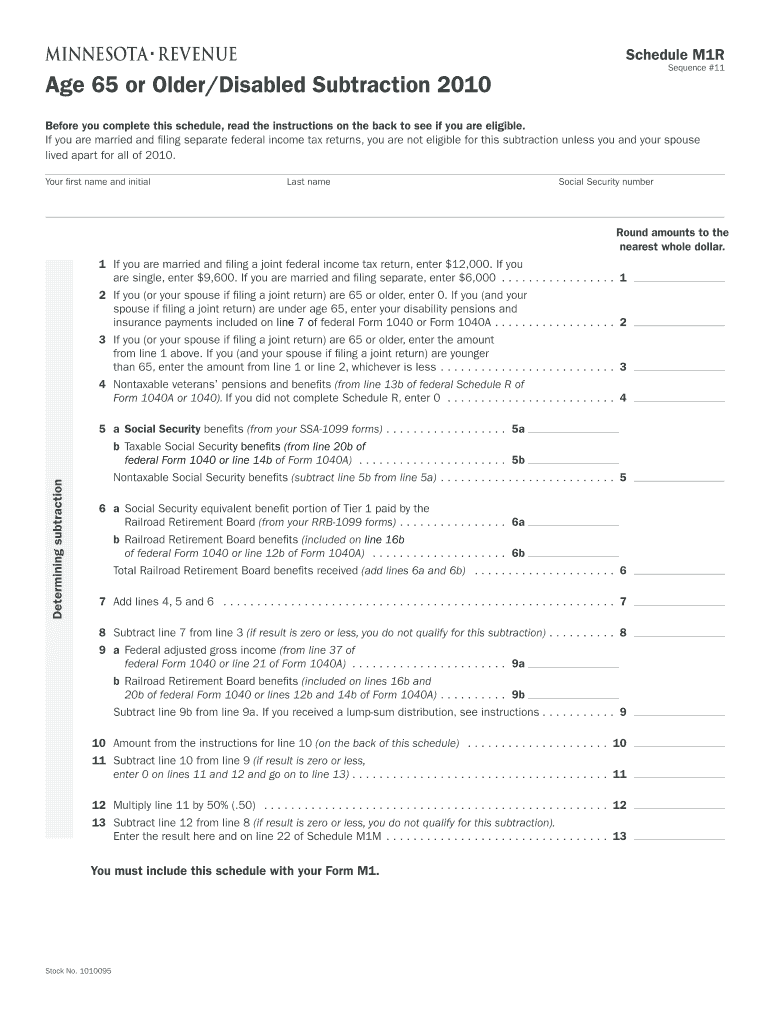

The Schedule M1R Sequence #11 is a specific tax form designed for individuals aged 65 or older or those who are disabled. This form allows eligible taxpayers to claim a subtraction from their taxable income, which can result in a lower tax liability. Before filling out this schedule, it is crucial to review the instructions provided on the back of the form to confirm eligibility. The guidelines will outline the necessary qualifications and any specific conditions that must be met to utilize this subtraction effectively.

Steps to Complete Schedule M1R Sequence #11

Completing the Schedule M1R Sequence #11 involves several key steps. Begin by gathering all relevant financial documents, including income statements and previous tax returns. Next, carefully read the instructions on the back of the form to ensure you understand the eligibility criteria. Fill out the form accurately, entering your personal information and income details. After completing the form, double-check all entries for accuracy before submission. It is also advisable to keep a copy of the completed form for your records.

Eligibility Criteria for Schedule M1R Sequence #11

To qualify for the Schedule M1R Sequence #11 subtraction, taxpayers must meet specific eligibility requirements. Generally, individuals must be aged 65 or older or have a qualifying disability. Additionally, income thresholds may apply, which can vary by state. It is essential to review the instructions on the back of the form for detailed information regarding these criteria and any required documentation that may need to be submitted along with the form.

Obtaining Schedule M1R Sequence #11

The Schedule M1R Sequence #11 can be obtained through various channels. Taxpayers can download the form from the official state tax department website or request a physical copy by contacting the relevant tax authority. Many tax preparation software programs also include this form, allowing for easier completion and submission. Ensure that you are using the most current version of the form to avoid any issues during filing.

Legal Use of Schedule M1R Sequence #11

The Schedule M1R Sequence #11 is legally recognized for tax purposes in the United States. It is important to use this form in accordance with the guidelines set forth by the state tax authorities. Misuse of the form, such as submitting false information, can lead to penalties or legal repercussions. Taxpayers should ensure that they are fully compliant with all tax laws when utilizing this schedule to claim their subtraction.

Form Submission Methods for Schedule M1R Sequence #11

Once the Schedule M1R Sequence #11 is completed, taxpayers have several options for submission. The form can typically be filed electronically through state tax filing systems, which may offer a quicker processing time. Alternatively, individuals may choose to mail their completed form to the designated tax office. In some cases, in-person submission may also be available, providing an opportunity to ask questions or clarify any uncertainties with tax officials.

Quick guide on how to complete schedule m1r sequence 11 age 65 or olderdisabled subtraction before you complete this schedule read the instructions on the 11331981

Effortlessly prepare [SKS] on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, allowing easy access to the correct form and secure storage online. airSlate SignNow provides you with all the resources necessary to create, edit, and electronically sign your documents swiftly without hindrances. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The easiest way to edit and eSign [SKS] with ease

- Obtain [SKS] and click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Mark important sections of your documents or redact sensitive details with tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Forget the hassle of lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and electronically sign [SKS] and maintain effective communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule m1r sequence 11 age 65 or olderdisabled subtraction before you complete this schedule read the instructions on the 11331981

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule M1R Sequence #11 Age 65 Or OlderDisabled Subtraction?

The Schedule M1R Sequence #11 Age 65 Or OlderDisabled Subtraction is a tax form designed for individuals aged 65 or older or those who are disabled. It allows eligible taxpayers to subtract a specific amount from their taxable income. Before you complete this schedule, read the instructions on the back to see if you are eligible.

-

How can airSlate SignNow help with the Schedule M1R Sequence #11?

airSlate SignNow provides an easy-to-use platform for eSigning and sending documents related to the Schedule M1R Sequence #11 Age 65 Or OlderDisabled Subtraction. Our solution streamlines the process, ensuring you can complete your tax forms efficiently. Make sure to read the instructions on the back to see if you are eligible before using our services.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for individuals and teams. Each plan provides access to features that can assist with the Schedule M1R Sequence #11 Age 65 Or OlderDisabled Subtraction. Be sure to review our pricing page for detailed information and choose the plan that best fits your requirements.

-

What features does airSlate SignNow offer for document management?

Our platform includes features such as customizable templates, secure eSigning, and document tracking, which are essential for managing forms like the Schedule M1R Sequence #11 Age 65 Or OlderDisabled Subtraction. These tools help ensure that your documents are completed accurately and efficiently. Remember to read the instructions on the back to see if you are eligible before proceeding.

-

Is airSlate SignNow compliant with legal standards?

Yes, airSlate SignNow is compliant with legal standards for electronic signatures, ensuring that your documents, including those related to the Schedule M1R Sequence #11 Age 65 Or OlderDisabled Subtraction, are legally binding. Our platform adheres to regulations such as the ESIGN Act and UETA. Always read the instructions on the back to see if you are eligible before signing.

-

Can I integrate airSlate SignNow with other applications?

Absolutely! airSlate SignNow offers integrations with various applications, enhancing your workflow when dealing with documents like the Schedule M1R Sequence #11 Age 65 Or OlderDisabled Subtraction. This allows you to streamline processes and improve efficiency. Be sure to check the integrations available and read the instructions on the back to see if you are eligible.

-

What benefits does airSlate SignNow provide for businesses?

airSlate SignNow empowers businesses by providing a cost-effective solution for document management and eSigning. This is particularly beneficial when handling forms like the Schedule M1R Sequence #11 Age 65 Or OlderDisabled Subtraction, as it saves time and reduces errors. Always read the instructions on the back to see if you are eligible before using our services.

Get more for Schedule M1R Sequence #11 Age 65 Or OlderDisabled Subtraction Before You Complete This Schedule, Read The Instructions On The Ba

Find out other Schedule M1R Sequence #11 Age 65 Or OlderDisabled Subtraction Before You Complete This Schedule, Read The Instructions On The Ba

- Can I Sign Wisconsin Freelance Contract

- Sign Hawaii Employee Performance Review Template Simple

- Sign Indiana Termination Letter Template Simple

- Sign Michigan Termination Letter Template Free

- Sign Colorado Independent Contractor Agreement Template Simple

- How Can I Sign Florida Independent Contractor Agreement Template

- Sign Georgia Independent Contractor Agreement Template Fast

- Help Me With Sign Nevada Termination Letter Template

- How Can I Sign Michigan Independent Contractor Agreement Template

- Sign Montana Independent Contractor Agreement Template Simple

- Sign Vermont Independent Contractor Agreement Template Free

- Sign Wisconsin Termination Letter Template Free

- How To Sign Rhode Island Emergency Contact Form

- Can I Sign Utah Executive Summary Template

- Sign Washington Executive Summary Template Free

- Sign Connecticut New Hire Onboarding Mobile

- Help Me With Sign Wyoming CV Form Template

- Sign Mississippi New Hire Onboarding Simple

- Sign Indiana Software Development Proposal Template Easy

- Sign South Dakota Working Time Control Form Now