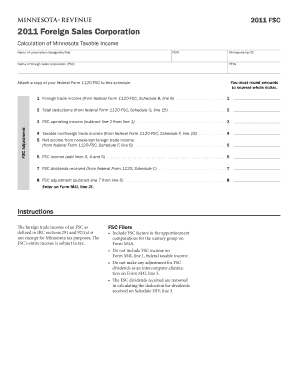

FSC Foreign Sales Corporation Calculation of Minnesota Taxable Income Name of Corporationdesignated Filer FEIN Name of Foreign S Form

Understanding the FSC Foreign Sales Corporation Calculation

The FSC Foreign Sales Corporation Calculation of Minnesota Taxable Income is a crucial document for corporations engaged in foreign sales. This form helps determine the taxable income of a foreign sales corporation (FSC) operating in Minnesota. It requires specific information about the corporation, including the name of the designated filer, the federal employer identification number (FEIN), and the Minnesota tax identification number. Accurate completion of this form is essential for compliance with state tax regulations.

Steps to Complete the FSC Calculation Form

To complete the FSC Foreign Sales Corporation Calculation of Minnesota Taxable Income, follow these steps:

- Gather necessary documents, including your Federal Form 1120 FSC.

- Enter the name of the corporation and the designated filer’s FEIN accurately.

- Provide the Minnesota tax ID and ensure all numbers are correct.

- Calculate the taxable income based on the guidelines provided for FSCs.

- Attach a copy of your Federal Form 1120 FSC as required.

Required Documents for Submission

When submitting the FSC Foreign Sales Corporation Calculation, it is vital to include the following documents:

- A completed FSC Calculation form.

- A copy of your Federal Form 1120 FSC.

- Any additional documentation that supports the calculations made.

State-Specific Rules for Minnesota

Each state has specific rules governing the taxation of foreign sales corporations. In Minnesota, it is important to adhere to the state’s tax laws, which may include unique deductions or credits applicable to FSCs. Familiarizing yourself with these rules can help ensure compliance and optimize potential tax benefits.

IRS Guidelines for Foreign Sales Corporations

The IRS provides guidelines that govern the operations and reporting requirements for foreign sales corporations. Understanding these guidelines is essential for accurately completing the FSC Foreign Sales Corporation Calculation. This includes knowing how to report income, expenses, and any relevant deductions that may apply to your corporation.

Penalties for Non-Compliance

Failure to comply with the requirements of the FSC Foreign Sales Corporation Calculation can result in penalties. These may include fines or additional tax liabilities. It is crucial to ensure that all forms are completed accurately and submitted on time to avoid these consequences.

Quick guide on how to complete fsc foreign sales corporation calculation of minnesota taxable income name of corporationdesignated filer fein name of foreign

Complete [SKS] effortlessly on any device

Digital document management has gained traction with businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the required form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Handle [SKS] on any device using airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to alter and eSign [SKS] without hassle

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Put aside concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow caters to your document management requirements in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure seamless communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to FSC Foreign Sales Corporation Calculation Of Minnesota Taxable Income Name Of Corporationdesignated Filer FEIN Name Of Foreign S

Create this form in 5 minutes!

How to create an eSignature for the fsc foreign sales corporation calculation of minnesota taxable income name of corporationdesignated filer fein name of foreign

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the FSC Foreign Sales Corporation Calculation Of Minnesota Taxable Income?

The FSC Foreign Sales Corporation Calculation Of Minnesota Taxable Income involves determining the taxable income of a foreign sales corporation operating in Minnesota. This calculation is essential for compliance with state tax regulations and requires specific information, including the Name Of Corporation, designated Filer FEIN, and the Name Of Foreign Sales Corporation. Additionally, you must A Ttach A Copy Of Your Federal Form 1120 FSC To This for accurate reporting.

-

How can airSlate SignNow assist with the FSC Foreign Sales Corporation documentation?

airSlate SignNow provides a streamlined platform for managing the documentation required for the FSC Foreign Sales Corporation Calculation Of Minnesota Taxable Income. With our eSigning capabilities, you can easily prepare and send documents, ensuring that all necessary forms, including the Federal Form 1120 FSC, are completed and submitted efficiently. This simplifies the process for businesses needing to comply with Minnesota tax regulations.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow offers a variety of features designed to enhance document management, including customizable templates, secure eSigning, and real-time collaboration. These features are particularly beneficial for businesses dealing with complex forms like the FSC Foreign Sales Corporation Calculation Of Minnesota Taxable Income. By utilizing these tools, you can ensure accuracy and compliance while saving time.

-

Is airSlate SignNow cost-effective for small businesses?

Yes, airSlate SignNow is a cost-effective solution for small businesses looking to manage their documentation needs, including the FSC Foreign Sales Corporation Calculation Of Minnesota Taxable Income. Our pricing plans are designed to accommodate various budgets, ensuring that even small enterprises can access essential features without breaking the bank. This affordability makes it easier for businesses to stay compliant with tax regulations.

-

What integrations does airSlate SignNow support?

airSlate SignNow supports a wide range of integrations with popular business applications, enhancing its functionality for users. These integrations allow for seamless workflows, especially when dealing with the FSC Foreign Sales Corporation Calculation Of Minnesota Taxable Income. By connecting with tools you already use, you can streamline your processes and improve overall efficiency.

-

How secure is the information shared through airSlate SignNow?

Security is a top priority at airSlate SignNow. We implement advanced encryption and security protocols to protect all information shared through our platform, including sensitive data related to the FSC Foreign Sales Corporation Calculation Of Minnesota Taxable Income. This ensures that your documents and personal information remain confidential and secure throughout the signing process.

-

Can I track the status of my documents in airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking for all documents sent for eSignature. This feature is particularly useful when managing important forms like the FSC Foreign Sales Corporation Calculation Of Minnesota Taxable Income, as it allows you to monitor the progress and ensure timely completion. You will receive notifications when documents are viewed and signed.

Get more for FSC Foreign Sales Corporation Calculation Of Minnesota Taxable Income Name Of Corporationdesignated Filer FEIN Name Of Foreign S

Find out other FSC Foreign Sales Corporation Calculation Of Minnesota Taxable Income Name Of Corporationdesignated Filer FEIN Name Of Foreign S

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF