M15C Additional Charge for Underpayment of Estimated Tax Beginning with Tax Year , C Corporations Must Use Schedule M15C to Dete Form

Understanding the M15C Additional Charge for Underpayment of Estimated Tax

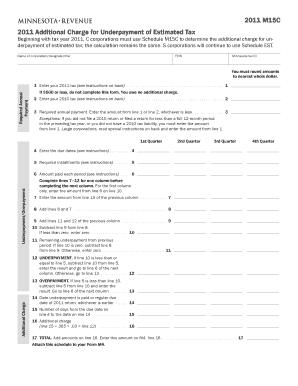

The M15C Additional Charge for Underpayment of Estimated Tax is a critical component for C Corporations in the United States. This charge applies to businesses that have not met their estimated tax payment obligations. The M15C form is used to calculate the additional charge, ensuring compliance with federal tax regulations. C Corporations must be aware of this charge to avoid penalties and maintain good standing with the IRS.

How to Use Schedule M15C

To utilize the M15C form effectively, C Corporations need to follow a structured approach. First, gather all relevant financial documents, including income statements and previous tax returns. Next, complete the M15C form by inputting the required figures, such as total income and estimated tax payments made throughout the year. It is essential to calculate any underpayment accurately, as this will directly affect the additional charge assessed. Finally, review the completed form for accuracy before submission.

Steps to Complete the M15C Form

Completing the M15C form involves several key steps:

- Collect necessary financial data, including income and tax payment records.

- Fill out the M15C form, ensuring all fields are completed accurately.

- Calculate the total estimated tax due and compare it to the payments made.

- Determine the additional charge based on the underpayment amount.

- Review the form for any errors before filing.

Legal Considerations for Using the M15C

When using the M15C form, C Corporations must adhere to specific legal requirements. This includes understanding the IRS guidelines regarding estimated tax payments and the consequences of underpayment. Failure to comply can result in penalties and interest charges. It is advisable for corporations to consult with a tax professional to ensure all legal obligations are met and to minimize potential liabilities.

Key Elements of the M15C Form

The M15C form contains several key elements that are crucial for accurate completion. These include:

- Identification of the corporation, including name and tax identification number.

- Details of estimated tax payments made during the tax year.

- Calculation of total tax liability and any underpayment amounts.

- The resulting additional charge for underpayment, which must be reported.

Filing Deadlines for the M15C Form

Timely filing of the M15C form is essential to avoid penalties. C Corporations should be aware of the specific deadlines set by the IRS for estimated tax payments. Generally, these payments are due quarterly, and the M15C form must be submitted in accordance with these deadlines to ensure compliance and avoid additional charges.

Quick guide on how to complete m15c additional charge for underpayment of estimated tax beginning with tax year c corporations must use schedule m15c to

Complete [SKS] effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed forms, as you can easily find the necessary template and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents quickly without delays. Handle [SKS] on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to adjust and eSign [SKS] with ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Select important sections of your documents or redact sensitive information using the tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature using the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the m15c additional charge for underpayment of estimated tax beginning with tax year c corporations must use schedule m15c to

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the M15C Additional Charge For Underpayment Of Estimated Tax?

The M15C Additional Charge For Underpayment Of Estimated Tax Beginning With Tax Year is a penalty imposed on C Corporations that fail to pay the required estimated tax. C Corporations Must Use Schedule M15C To Determine The Additional Charge For Underpayment Of Estimated Tax. Understanding this charge is crucial for compliance and avoiding unnecessary penalties.

-

How can airSlate SignNow help with tax document management?

airSlate SignNow provides an efficient platform for managing tax documents, including those related to the M15C Additional Charge For Underpayment Of Estimated Tax Beginning With Tax Year. With our eSigning capabilities, C Corporations can easily sign and send necessary documents securely. This streamlines the process and ensures timely submissions.

-

What features does airSlate SignNow offer for C Corporations?

airSlate SignNow offers features tailored for C Corporations, including customizable templates, secure eSigning, and document tracking. These features help businesses manage their tax-related documents, including those concerning the M15C Additional Charge For Underpayment Of Estimated Tax Beginning With Tax Year. This ensures compliance and reduces the risk of penalties.

-

Is airSlate SignNow cost-effective for small businesses?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses. By utilizing our platform, companies can save on printing and mailing costs associated with tax documents, such as those related to the M15C Additional Charge For Underpayment Of Estimated Tax Beginning With Tax Year. This makes it an ideal choice for budget-conscious organizations.

-

Can airSlate SignNow integrate with other accounting software?

Absolutely! airSlate SignNow seamlessly integrates with various accounting software, enhancing your workflow. This integration is particularly beneficial for managing tax documents related to the M15C Additional Charge For Underpayment Of Estimated Tax Beginning With Tax Year. It allows for easy access and management of all necessary documents in one place.

-

What are the benefits of using airSlate SignNow for tax compliance?

Using airSlate SignNow for tax compliance offers numerous benefits, including improved efficiency, enhanced security, and reduced risk of errors. By managing documents related to the M15C Additional Charge For Underpayment Of Estimated Tax Beginning With Tax Year through our platform, C Corporations can ensure they meet all compliance requirements effectively. This ultimately saves time and resources.

-

How does airSlate SignNow ensure document security?

airSlate SignNow prioritizes document security with advanced encryption and secure storage solutions. This is crucial for sensitive tax documents, including those related to the M15C Additional Charge For Underpayment Of Estimated Tax Beginning With Tax Year. Our platform ensures that your documents are protected from unauthorized access while remaining easily accessible to authorized users.

Get more for M15C Additional Charge For Underpayment Of Estimated Tax Beginning With Tax Year , C Corporations Must Use Schedule M15C To Dete

Find out other M15C Additional Charge For Underpayment Of Estimated Tax Beginning With Tax Year , C Corporations Must Use Schedule M15C To Dete

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter