CR SCD, Property Tax Deferral for Senior Citizens Minnesota Revenue State Mn Form

What is the CR SCD, Property Tax Deferral For Senior Citizens in Minnesota?

The CR SCD, or Property Tax Deferral for Senior Citizens, is a program designed to assist eligible senior citizens in Minnesota by deferring property taxes on their homes. This initiative allows seniors to postpone paying property taxes until they sell their home, move out, or pass away. The program aims to alleviate financial burdens on older homeowners, enabling them to maintain their residences without the immediate pressure of tax payments.

Eligibility Criteria for the CR SCD

To qualify for the CR SCD program, applicants must meet specific criteria. Generally, eligible participants are individuals aged sixty-five or older who own and occupy their home as their primary residence. Additionally, applicants must have a household income below a certain threshold, which is adjusted annually. It is essential to review the current income limits and other requirements set by the Minnesota Department of Revenue to ensure eligibility.

Steps to Complete the CR SCD Application

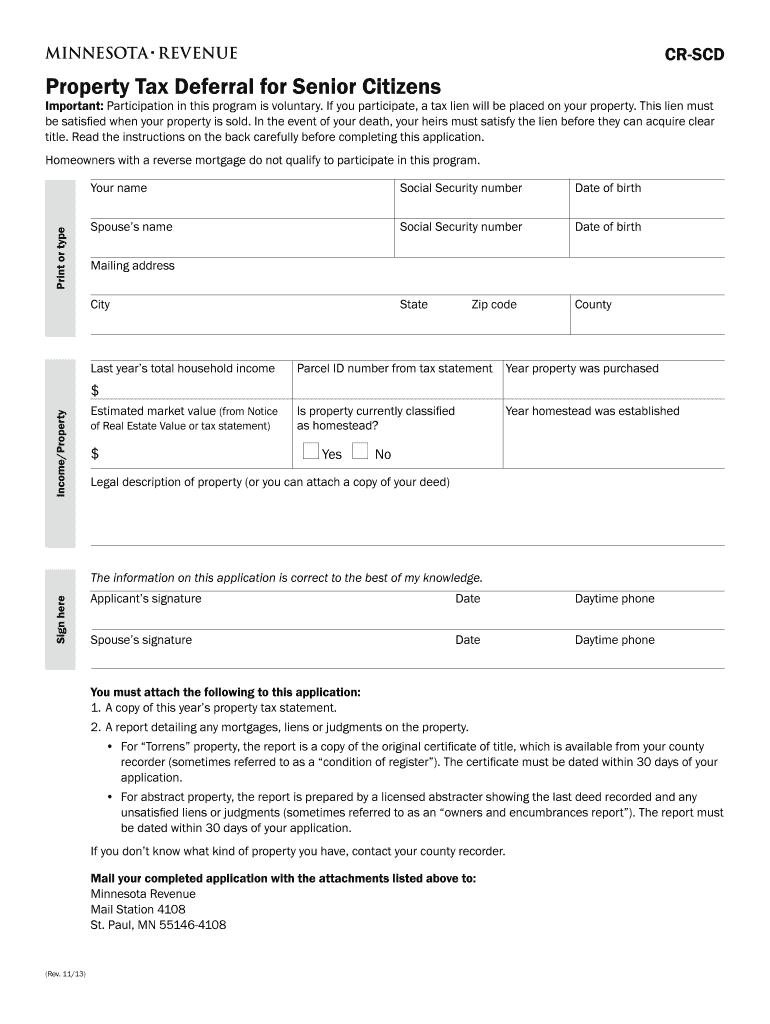

Completing the application for the CR SCD involves several straightforward steps. First, gather necessary documentation, including proof of age, income verification, and property details. Next, fill out the application form accurately, ensuring all information is complete. Once the form is filled, submit it to your local county assessor’s office. It is advisable to check for any specific submission requirements or deadlines that may apply.

Required Documents for the CR SCD Application

When applying for the CR SCD, certain documents are necessary to verify eligibility. Applicants typically need to provide:

- Proof of age, such as a birth certificate or driver’s license.

- Income documentation, including tax returns or pay stubs.

- Property information, such as the deed or property tax statement.

Having these documents ready can streamline the application process and help ensure a timely review by the appropriate authorities.

How to Use the CR SCD Once Approved

Once approved for the CR SCD, seniors can benefit from deferred property taxes. This means that while property taxes will not need to be paid immediately, they will accumulate over time. The deferred taxes will become due when the homeowner sells the property, moves out, or passes away. It is crucial for participants to keep track of the amount of deferred taxes and understand the implications for their estate and heirs.

Form Submission Methods for the CR SCD

Applicants can submit the CR SCD application through various methods. The most common ways include:

- Online submission via the Minnesota Department of Revenue website, if available.

- Mailing the completed form to the local county assessor’s office.

- In-person submission at designated county offices.

Choosing the most convenient method can help facilitate a smoother application process.

Quick guide on how to complete cr scd property tax deferral for senior citizens minnesota revenue state mn

Complete [SKS] seamlessly on any device

Online document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents efficiently without delays. Manage [SKS] across any platform using airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign [SKS] with ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or redact sensitive details using tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you would like to send your form, via email, SMS, invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choosing. Edit and eSign [SKS] and ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to CR SCD, Property Tax Deferral For Senior Citizens Minnesota Revenue State Mn

Create this form in 5 minutes!

How to create an eSignature for the cr scd property tax deferral for senior citizens minnesota revenue state mn

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the CR SCD, Property Tax Deferral For Senior Citizens Minnesota Revenue State Mn?

The CR SCD, Property Tax Deferral For Senior Citizens Minnesota Revenue State Mn is a program designed to help eligible senior citizens defer property taxes on their homes. This initiative allows seniors to manage their finances better by postponing tax payments until they sell their property or pass away.

-

Who qualifies for the CR SCD, Property Tax Deferral For Senior Citizens Minnesota Revenue State Mn?

To qualify for the CR SCD, Property Tax Deferral For Senior Citizens Minnesota Revenue State Mn, applicants must be at least 65 years old, meet income requirements, and own a homestead property. Additionally, the property must be their primary residence, and they should not have any delinquent property taxes.

-

How does the CR SCD, Property Tax Deferral For Senior Citizens Minnesota Revenue State Mn benefit seniors?

The CR SCD, Property Tax Deferral For Senior Citizens Minnesota Revenue State Mn provides financial relief by allowing seniors to defer property taxes, thus freeing up cash flow for other essential expenses. This program helps seniors maintain their homes without the immediate burden of tax payments.

-

What is the application process for the CR SCD, Property Tax Deferral For Senior Citizens Minnesota Revenue State Mn?

To apply for the CR SCD, Property Tax Deferral For Senior Citizens Minnesota Revenue State Mn, seniors must complete an application form available through the Minnesota Department of Revenue. The application typically requires proof of age, income documentation, and property ownership details.

-

Are there any fees associated with the CR SCD, Property Tax Deferral For Senior Citizens Minnesota Revenue State Mn?

There are no direct fees for applying to the CR SCD, Property Tax Deferral For Senior Citizens Minnesota Revenue State Mn program. However, seniors should be aware that deferred taxes will accumulate interest until paid, which may affect the total amount owed when the property is sold.

-

Can the CR SCD, Property Tax Deferral For Senior Citizens Minnesota Revenue State Mn be combined with other tax relief programs?

Yes, seniors can often combine the CR SCD, Property Tax Deferral For Senior Citizens Minnesota Revenue State Mn with other tax relief programs, such as the Homestead Credit. It is advisable to consult with a tax professional or the Minnesota Department of Revenue for specific eligibility and benefits.

-

How does airSlate SignNow assist with the CR SCD, Property Tax Deferral For Senior Citizens Minnesota Revenue State Mn?

airSlate SignNow provides an easy-to-use platform for seniors to eSign and manage documents related to the CR SCD, Property Tax Deferral For Senior Citizens Minnesota Revenue State Mn. This cost-effective solution simplifies the application process, ensuring that seniors can complete necessary paperwork efficiently.

Get more for CR SCD, Property Tax Deferral For Senior Citizens Minnesota Revenue State Mn

Find out other CR SCD, Property Tax Deferral For Senior Citizens Minnesota Revenue State Mn

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free