Mutual of Omaha Life Insurance Final Expense Whole Life Insurance Form

Understanding Mutual Of Omaha Life Insurance Final Expense Whole Life Insurance

Mutual Of Omaha Life Insurance Final Expense Whole Life Insurance is designed to cover end-of-life expenses, ensuring that your loved ones are not burdened with financial responsibilities after your passing. This type of insurance provides a guaranteed death benefit, which can be used to pay for funeral costs, medical bills, and other related expenses. The policy remains in force for the lifetime of the insured, as long as premiums are paid, and it typically accumulates cash value over time.

How to Utilize Mutual Of Omaha Life Insurance Final Expense Whole Life Insurance

Using Mutual Of Omaha Life Insurance Final Expense Whole Life Insurance involves understanding the policy's benefits and how to access them. Once the policyholder passes away, beneficiaries can file a claim to receive the death benefit. It is important to keep the insurance documents in a safe place and inform your beneficiaries about the policy details. Additionally, policyholders can borrow against the cash value of the policy if needed, providing financial flexibility during their lifetime.

Obtaining Mutual Of Omaha Life Insurance Final Expense Whole Life Insurance

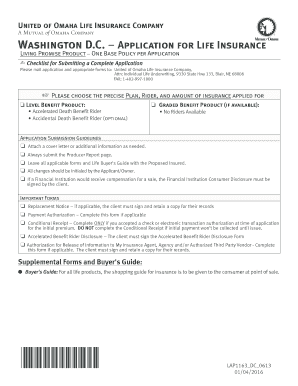

To obtain Mutual Of Omaha Life Insurance Final Expense Whole Life Insurance, individuals can start by researching the coverage options available. It is advisable to contact a licensed insurance agent who can provide personalized quotes based on individual needs and circumstances. The application process typically involves filling out a form that includes personal information and health history. After submission, the insurer may require a medical examination or additional documentation before finalizing the policy.

Steps to Complete the Mutual Of Omaha Life Insurance Final Expense Whole Life Insurance Application

Completing the application for Mutual Of Omaha Life Insurance Final Expense Whole Life Insurance generally involves several key steps:

- Gather necessary personal information, including Social Security number and health history.

- Contact a licensed insurance agent for guidance and to receive a quote.

- Fill out the application form accurately, ensuring all information is complete.

- Submit the application and any required documentation to the insurer.

- Await approval, which may involve a medical examination or further inquiries from the insurance company.

Key Features of Mutual Of Omaha Life Insurance Final Expense Whole Life Insurance

This insurance policy offers several key features that make it appealing to many individuals:

- Guaranteed Coverage: The policy provides lifelong coverage as long as premiums are paid.

- Fixed Premiums: Premiums typically remain level throughout the life of the policy.

- Cash Value Accumulation: The policy builds cash value over time, which can be accessed by the policyholder.

- Quick Payout: Beneficiaries often receive the death benefit quickly, providing immediate financial support.

Eligibility Criteria for Mutual Of Omaha Life Insurance Final Expense Whole Life Insurance

Eligibility for Mutual Of Omaha Life Insurance Final Expense Whole Life Insurance usually depends on several factors:

- Age: Applicants typically need to be within a certain age range, often between 45 and 85 years old.

- Health Status: The insurer may assess health conditions through medical history and examinations.

- Residency: Applicants must reside in the United States and meet state-specific regulations.

Quick guide on how to complete mutual of omaha life insurance final expense whole life insurance

Complete Mutual Of Omaha Life Insurance Final Expense Whole Life Insurance effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents quickly without delays. Manage Mutual Of Omaha Life Insurance Final Expense Whole Life Insurance on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Mutual Of Omaha Life Insurance Final Expense Whole Life Insurance with ease

- Find Mutual Of Omaha Life Insurance Final Expense Whole Life Insurance and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important parts of your documents or obscure sensitive details using tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred method of sharing your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your chosen device. Modify and eSign Mutual Of Omaha Life Insurance Final Expense Whole Life Insurance and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mutual of omaha life insurance final expense whole life insurance

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Mutual Of Omaha Life Insurance Final Expense Whole Life Insurance?

Mutual Of Omaha Life Insurance Final Expense Whole Life Insurance is a type of permanent life insurance designed to cover end-of-life expenses. This policy ensures that your loved ones are not burdened with funeral costs and other final expenses. It provides a guaranteed death benefit and can be a crucial part of your financial planning.

-

How much does Mutual Of Omaha Life Insurance Final Expense Whole Life Insurance cost?

The cost of Mutual Of Omaha Life Insurance Final Expense Whole Life Insurance varies based on factors such as age, health, and the amount of coverage you choose. Generally, premiums are affordable and can fit within most budgets. It's best to get a personalized quote to understand the specific costs associated with your policy.

-

What are the key benefits of Mutual Of Omaha Life Insurance Final Expense Whole Life Insurance?

One of the key benefits of Mutual Of Omaha Life Insurance Final Expense Whole Life Insurance is the peace of mind it provides, knowing that your final expenses will be covered. Additionally, this policy builds cash value over time, which can be accessed if needed. It also offers a fixed premium, ensuring that your payments remain stable throughout the life of the policy.

-

Are there any health requirements for Mutual Of Omaha Life Insurance Final Expense Whole Life Insurance?

Yes, there are health requirements for Mutual Of Omaha Life Insurance Final Expense Whole Life Insurance, but they are generally more lenient compared to traditional life insurance policies. Many applicants can qualify without undergoing a medical exam, making it accessible for those with health concerns. However, some basic health questions will still need to be answered during the application process.

-

Can I customize my Mutual Of Omaha Life Insurance Final Expense Whole Life Insurance policy?

Yes, you can customize your Mutual Of Omaha Life Insurance Final Expense Whole Life Insurance policy to fit your specific needs. Options may include choosing the coverage amount and adding riders for additional benefits. This flexibility allows you to tailor the policy to ensure it meets your financial goals and family needs.

-

How does Mutual Of Omaha Life Insurance Final Expense Whole Life Insurance compare to term life insurance?

Mutual Of Omaha Life Insurance Final Expense Whole Life Insurance differs from term life insurance in that it provides lifelong coverage and builds cash value. While term life insurance is typically less expensive, it only covers you for a specified period. Whole life insurance, like the Mutual Of Omaha policy, guarantees a death benefit regardless of when you pass away.

-

What happens if I miss a premium payment for my Mutual Of Omaha Life Insurance Final Expense Whole Life Insurance?

If you miss a premium payment for your Mutual Of Omaha Life Insurance Final Expense Whole Life Insurance, there is usually a grace period during which you can make the payment without losing coverage. If you fail to pay within this period, the policy may lapse, but you may have options to reinstate it. It's important to review your policy details and stay in contact with your insurance agent.

Get more for Mutual Of Omaha Life Insurance Final Expense Whole Life Insurance

- What we get from fruits in science form

- Caarng form 149 california national guard state of california calguard ca

- Construction work order form

- Royal caribbean gift card form

- Qb grading sheet form

- Opm calendar form

- Naples play n stay vacation rental agreement form

- Microsoft word vetappren201720170718 docx form

Find out other Mutual Of Omaha Life Insurance Final Expense Whole Life Insurance

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself